The below is an excerpt from a fresh edition of Bitcoin Journal Expert, Bitcoin Journal’s top price markets newsletter. To be among the many first to procure these insights and other on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

Inflation Is Now not Over

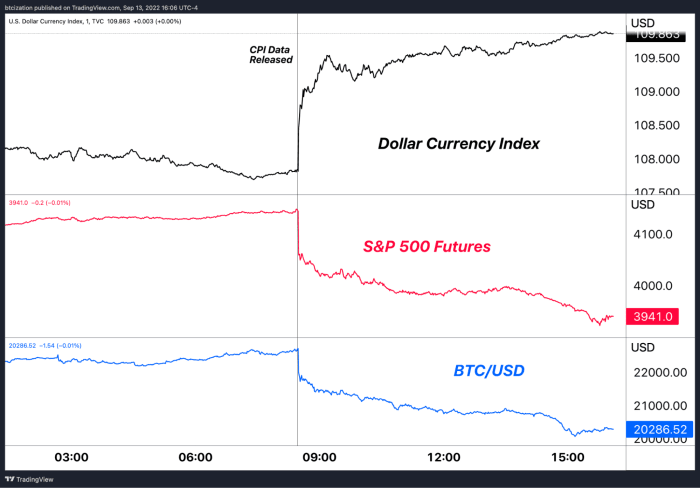

Despite the general consensus and sentiment for right inflation files this previous month, the upper-than-expected U.S. August User Tag Index (CPI) print has derailed any instant-timeframe bullish momentum for threat assets that’s been constructing over the final week. As a result, equities, bitcoin and credit score yields exploded with some volatility in the present day time. The S&P 500 Index closed down 4.3% with bitcoin following on a 10% plus down pass. The final time this came about for equities grow to be June 2020.

It’s a linked tournament to what we seen final month for July files, but in reverse and with more magnitude. Markets cheered on a loosely confirming fashion of peak inflation final month, most efficient to fetch in the present day time’s files teach in any other case. Now we see to the broader marketplace for threat and charges over the subsequent few days to verify this fresh rally downtrend or some reduction with the Merge expected to uncover put gradual the next day to come evening.

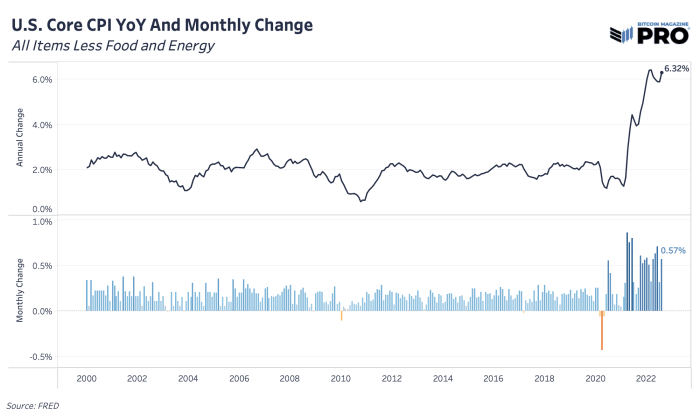

Both headline CPI and Core CPI beat expectations that had consensus positioning for month-over-month deceleration. As a change, we got both headline CPI and Core CPI rising month-over-month to 0.12% and 0.57% respectively. In extra effective terms, inflation has no longer been vanquished but and there’s more work to provide (or are trying and provide) on the monetary protection front. The Cleveland Fed Inflation Nowcast heavenly great nailed their August forecast.

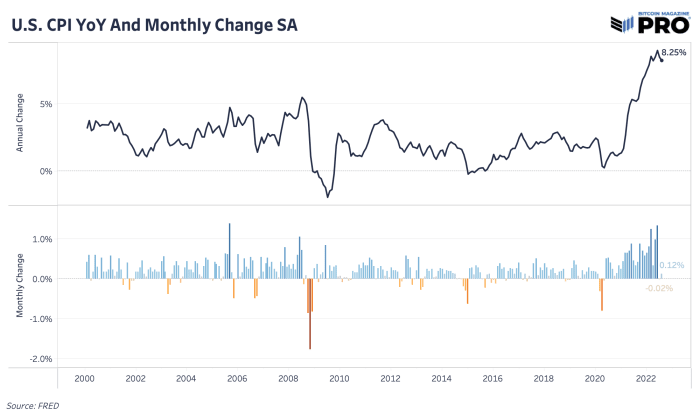

User designate index year-over-year and month-to-month exchange with out factoring in food and vitality

Though we did look some inflation throughout vitality commodities come down, it wasn’t adequate to offset the rising inflation in the companies and products sector. Bigger and elevated wage inflation stays a key, sticky half of inflation that’s but to come down. Housing inflation is additionally peaceable an draw back and has but to come down. Housing inflation and costs fetch in total been the final to fall into a pending deflationary and/or recessionary duration. Rent inflation (aka householders’ linked hire (OER)) is a well-known component that would possibly perchance more than doubtless more than doubtless sustain CPI prints for longer as it’s usually a six-to-nine-month jog.

Total, the inflation listing appears to be like to be sticky and broadening. Per the Federal Reserve’s statements over the final few months, it’s a transparent worth to retain aggressive monetary protection by means of price hikes going.

Genuine now following the liberate of the CPI files, equities and bitcoin began to promote and the dollar soared. The cost action of the asset classes grow to be less regarding the inflation itself and more regarding the market’s expectations for future monetary protection from the Federal Reserve.

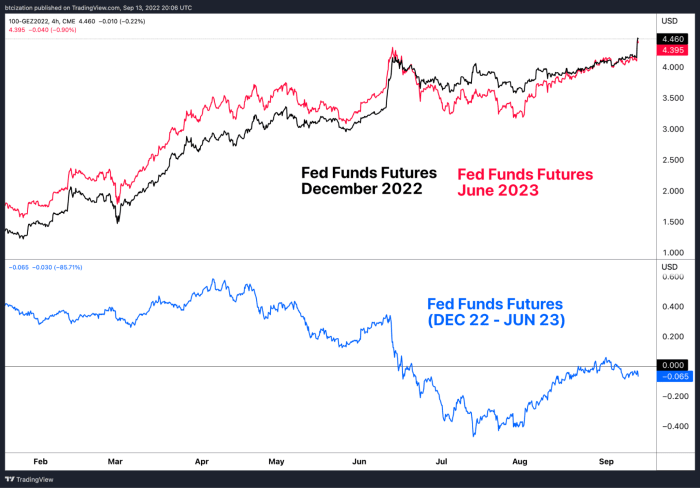

Expectations for charges in the present day jumped to fresh yearly highs, with the market now pricing in a Fed Funds price of 4.46% for December of this year, which is form of 200 foundation capabilities decrease than potentially the most modern price contrivance price vary of two.25-2.50%.

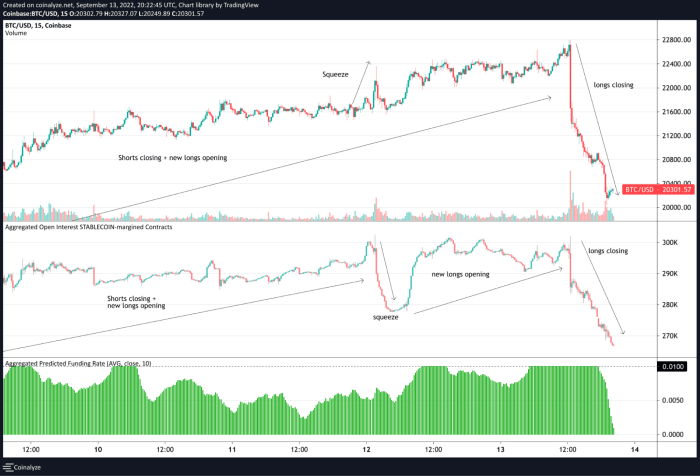

Bitcoin in explicit grow to be field to a gargantuan unwind in beginning curiosity as traders speculating on peak inflation by going prolonged futures now had been underwater en masse.

The decline in stablecoin margin beginning curiosity grow to be greater than 30,000 bitcoin from the liberate of CPI files to the shut of legacy markets. Assuming the bulk of the decline in beginning curiosity grow to be longs closing positions, the market confronted the same of roughly 25% of MicroStrategy’s bitcoin stash in selling stress in the guts of some hours.

With that acknowledged, we’re as convicted as ever in an closing capitulation moment having but to occur throughout world monetary markets. Long-timeframe investors shouldn’t awe draw back volatility, but quite embody it, working out the unique different it affords to clutch high quality assets at fire sale costs.