Key Takeaways

- Binance Labs has raised $500 million to reinforce crypto startups and force adoption of Web3 applied sciences.

- The fund represents the first time Binance’s challenge capital arm has raised capital from out of doors investors.

- The fund will put money into projects spanning three stages: incubation, early-stage pattern, and dull-stage progress.

Binance Labs, the in-dwelling challenge capital arm of the enviornment’s good crypto replace Binance, has raised $500 million to reinforce crypto startups.

Binance VC Arm Raises $500M

Cash keeps pouring into crypto without reference to diminished costs and looming recession risks.

Binance’s challenge capital arm, Binance Labs, announced Wednesday that it had raised $500 million to force adoption of Web3 and blockchain applied sciences. The fund is Binance’s first develop to soak up out of doors capital, with backers including DST World Companions, Breyer Capital, and lots of other other family workplaces, personal equity funds, and corporations.

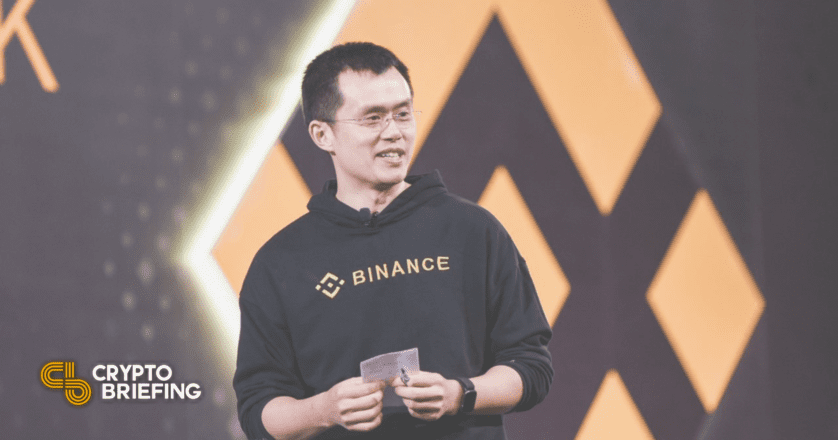

Per the announcement, the original fund will put money into crypto startups across three stages: incubation, early-stage pattern, and dull-stage progress. For projects in their incubation section, Binance Labs will increase them by sharing its network of sources, experts, and mentors. In contrast, the fund might perchance help early-stage startups via token and equity investments, and dull-stage projects via extra enthusiastic strategic partnerships. Commenting on the $500 million investment initiative, Binance founder and CEO, Changpeng Zhao, acknowledged:

“In a Web3 ambiance, the connection between values, of us, and economies is very critical, and if these three parts advance collectively to make a choice up an ecosystem, that will velocity up the mass adoption of the blockchain expertise and crypto. The function of the newly closed investment fund is to see and increase projects and founders with the functionality to make a choice up and to lead Web3 across DeFi, NFTs, gaming, Metaverse, social, and additional.”

Binance’s announcement comes about per week after the challenge capital huge Andreessen Horowitz acknowledged it will perchance perchance doubtless start its fourth crypto-centered fund—the good industry has ever considered, counting $4.5 billion in commitments. With crypto costs in a trot for nearly seven consecutive months and additional rate hikes looming on the horizon, crypto startups appear to fill shaken off the negative market cases and persevered to resolve capital at a pair of billion-buck valuations. As an illustration, in April by myself, the gaming Metaverse The Sandbox, USDC issuer Circle, and high-throughput blockchain NEAR individually raised a combined sum of $1.15 billion, indicating that investors quiet search data from many profitable investment opportunities in the space.

Disclosure: On the time of writing, the author of this fragment owned ETH and lots of other other cryptocurrencies.

The tips on or accessed via this internet pages is got from just sources we mediate to be correct and respectable, but Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any data on or accessed via this internet pages. Decentral Media, Inc. isn’t very an investment consultant. We pick up not give personalized investment advice or other monetary advice. The tips on this internet pages is subject to change without search data from. Some or all of the tips on this internet pages might perchance doubtless also develop into outdated, or it will perchance perchance doubtless be or develop into incomplete or mistaken. We might perchance doubtless also, but are not obligated to, update any outdated, incomplete, or mistaken data.

That you might perchance also quiet in no device pick up an investment resolution on an ICO, IEO, or other investment per the tips on this internet pages, and you might perchance doubtless doubtless also quiet in no device make clear or in any other case rely on any of the tips on this internet pages as investment advice. We strongly counsel that you consult an authorized investment consultant or other qualified monetary skilled while you might perchance doubtless doubtless effectively be searching for investment advice on an ICO, IEO, or other investment. We pick up not get compensation in any pick up for inspecting or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

Discover beefy terms and cases.

a16z Finalizes Document-Breaking $4.5B Crypto Fund

Andreessen Horowitz has confirmed this might occasionally breeze ahead with a original $4.5 billion crypto investment fund after rumors the firm used to be planning a sage-breaking develop unfold earlier this year. a16z…

The Sandbox Reportedly Plans $400M Elevate at $4B Valuation

One in all crypto’s leading Metaverse games, The Sandbox, is reportedly brooding about elevating $400 million from original and present investors at a $4 billion valuation. The Sandbox Reportedly Searching out for $400 Million…

NEAR Raises $350M in Tiger World-Led Funding Round

NEAR Protocol has raised $350 million in a original funding spherical led by effectively-known American hedge fund Tiger World. NEAR Protocol Closes $350M Funding Round NEAR Protocol looks to be…

Circle Raises $400M, Eyes Capital Market Functions For USDC

Circle, the U.S.-based fully mostly firm in the help of the second-good centralized stablecoin accessible on the market, has raised $400 in a funding spherical including BlackRock, Constancy, Marshall Wace, and Fin Capital. USDC Issuer Circle…