Binance has seized over $450,000 price of crypto sources stolen within the Tuesday frontend attack on the decentralized cryptocurrency alternate Curve Finance.

Key Takeaways

- Binance has recovered $450,000, representing about 83% of the entire sum stolen within the Curve Finance frontend attack Tuesday.

- The crypto alternate Mounted Stride in conjunction with the waft also seized about 112 ETH, at this time price round $212,000, bringing the entire asset recovery to 100%.

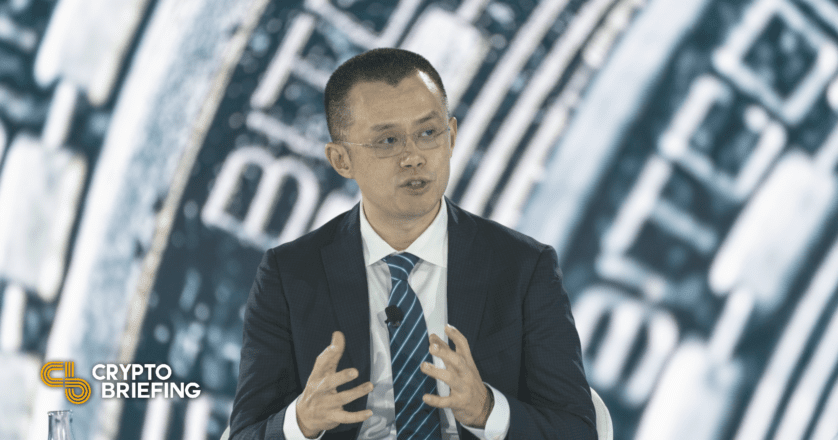

- Binance founder and CEO Changpeng Zhao talked about that the alternate is working with law enforcement to reach abet the funds to the victims.

The sources Binance recovered signify about 83% of the entire sum stolen within the exploit.

Binance Recovers Curve Hack Proceeds

Binance has traced and seized quite so much of the sources stolen on this week’s Curve Finance exploit.

Binance iced over/recovered $450k of the Curve stolen funds, representing 83%+ of the hack. We are working with LE to reach abet the funds to the customers. The hacker kept on sending the funds to Binance in diverse ways, thinking we can’t save it. 😂#SAFU https://t.co/Ekea9moeAw

— CZ 🔶 Binance (@cz_binance) August 12, 2022

The alternate’s ounder and CEO Changpeng Zhao launched on Twitter currently that the agency had recovered about $450,000 price of cryptocurrencies stolen on this week’s frontend exploit on decentralized alternate Curve Finance. Based on Zhao, the frozen proceeds signify about 83% of the entire sum stolen within the incident.

“The hacker kept on sending the funds to Binance in diverse ways, thinking we are in a position to’t save it,” he talked about, at the side of that the alternate was as soon as already working with law enforcement to reach abet the funds to customers.

Previously, the Lightning Network-essentially based entirely mostly cryptocurrency alternate Mounted Stride in conjunction with the waft iced over about 112 ETH, at this time price round $212,000. “Our security division has frozen section of the funds within the quantity of 112 ETH,” Mounted Stride in conjunction with the waft tweeted Tuesday. The two seizures, in mixture, bring the asset recovery as much as 100%, that manner all victims that misplaced cash within the front-discontinue attack on Curve would perchance per chance be fully compensated.

Curve was as soon as exploited for approximately $573,000 on August 9. The attacker spoofed the Area Title Carrier of Curve’s frontend, redirecting customers to a phishing dwelling that tricked them into approving a malicious spruce contract. After the unsuspecting victims authorised the transaction, the hacker was as soon as ready to catch crypto sources without prolong from their wallets. Following the incident, the attacker started sending batches of stolen ETH to multiple addresses in an strive to obfuscate the funds’ origin before transferring the cash to centralized exchanges to cash out.

Nonetheless, the attacker curiously did a uncomfortable job of hiding the provision of their stolen ETH, as successfully all of it has been seized by Binance and Mounted Stride in conjunction with the waft.

Disclosure: At the time of writing, the creator of this allotment owned ETH and quite so much of other other cryptocurrencies.

The info on or accessed by this online page is got from self sustaining sources we imagine to be staunch and reliable, nonetheless Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any data on or accessed by this online page. Decentral Media, Inc. shouldn’t be an investment advisor. We don’t give personalized investment advice or other financial advice. The info on this online page is enviornment to change without scrutinize. Some or the entire certainty on this online page would perchance per chance change into outdated, or it will also be or change into incomplete or wrong. We would perchance per chance, nonetheless are not obligated to, replace any outdated, incomplete, or wrong data.

It’s probably you’ll per chance restful by no manner gain an investment decision on an ICO, IEO, or other investment essentially based entirely totally on the certainty on this online page, and moreover you would perchance perchance doubtless also restful by no manner define or in another case rely on any of the certainty on this online page as investment advice. We strongly counsel that you just seek the advice of a licensed investment advisor or other licensed financial legitimate must you would perchance perchance doubtless also very neatly be looking for investment advice on an ICO, IEO, or other investment. We don’t ranking compensation in any accomplish for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

Stamp full phrases and conditions.

Curve Finance Exploited in Ongoing Attack

DeFi protocol Curve is at this time being exploited by its frontend. Over $573,000 has already been taken by the attacker. Curve Frontend Exploited Curve Finance is being exploited. Based on Paradigm…

SEC Investigating Binance, All U.S. Crypto Exchanges: Forbes

The financial regulator has stepped up its oversight of the digital sources home in contemporary weeks. U.S. Exchanges Below Investigation Coinbase shouldn’t be the declare cryptocurrency alternate the SEC is…

Binance Serviced Iranian Crypto Merchants Despite Sanctions: Story

In in some design responding to the allegations on Twitter, Binance CEO Changpeng Zhao highlighted that the alternate has been the utilization of Reuter’s hang KYC verification product, WorldCheck, since 2018. Binance Reportedly Operated…