Key Takeaways

- Reuters has reported that Binance allowed Iranian customers to substitute on its platform no subject U.S. sanctions and a firm policy in opposition to working in the country.

- The newspaper cited interviews with seven traders who allegedly abused Binance’s lax compliance policies and traded on the platform till September 2021.

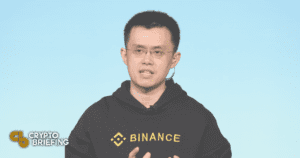

- Binance CEO Changpeng Zhao said that since 2018, Binance has been the use of Reuter’s own screening product, WorldCheck, as one of its KYC verification instruments.

In no longer at once responding to the allegations on Twitter, Binance CEO Changpeng Zhao highlighted that the unreal has been the use of Reuter’s own KYC verification product, WorldCheck, since 2018.

Binance Reportedly Operated in Iran Despite Sanctions

Binance’s lax compliance exams can accumulate allowed Iranian electorate to bypass U.S. sanctions.

Primarily primarily based fully on a Monday tale by Reuters, the enviornment’s largest crypto substitute, Binance, persisted to direction of trades by prospects primarily primarily based in Iran no subject U.S. sanctions and a firm-huge policy in opposition to working in the country. Reuters cited interviews with seven traders who reportedly urged the newspaper that they circumvented Binance’s lax compliance exams and persisted trading on the unreal till September closing 12 months. “There accumulate been some picks, but none of them accumulate been as factual as Binance,” one Iranian dealer allegedly urged Reuters, asserting that the unreal didn’t carry out any identity or background exams.

Binance banned traders in Iran from the use of its substitute in November 2018, after the Trump administration abandoned its predecessor’s nuclear deal and reimposed sanctions on the country. Despite the loyal ban, nonetheless, users from Iran might well well allegedly open Binance accounts with handiest an email contend with and proceed trading on the platform till the unreal tightened its anti-money laundering exams around August 2021.

Per the Reuters tale, traders from Iran might well well simply skirt Binance’s blockade by the use of VPNs to veil their IP addresses, which might well well inform the unreal of their verbalize. “All of the Iranians accumulate been the use of it,” one particular person allegedly urged the newspaper, claiming that they extinct a VPN to substitute around $4,000 rate of crypto on the unreal main as much as August 2021.

Primarily primarily based fully on lawyers contacted by the newspaper, Binance’s alleged failure to conform with U.S. sanctions might well well get it in nervousness with the global superpower. Particularly, the U.S. might well well doubtlessly cut again off the firm’s get entry to to its monetary system as punishment for helping Iranians evade its substitute embargo.

Binance has been the use of Reuters WorldCheck as one of many KYC verification instruments since 2018.

— CZ 🔶 Binance (@cz_binance) July 11, 2022

In no longer at once responding to the newspaper’s allegations on Twitter, Binance CEO Changpeng Zhao said that the unreal has been the use of Reuters’ own identity verification product, WorldCheck, since 2018. “It [WorldCheck] looks to suck, primarily primarily based on Reuters now,” Zhao said. “To be gorgeous, it’s the golden customary all banks use. But when we use it, they soundless write FUD [fear, uncertainty, doubt] about us,” he added.

Earlier in June, Reuters reported that Binance was a “hub for hackers, fraudsters and drug traffickers,” and that it allegedly processed extra than $2.35 billion in illicit funds between 2017 and 2021. Binance therefore denied Reuters’ claims, asserting that the newspapers labored beyond regular time to push a “false tale,” and printed 50 pages of email exchanges between firm executives and the newspaper.

Disclosure: At the time of writing, the author of this piece owned ETH and loads of diversified cryptocurrencies.

The knowledge on or accessed by this net page is obtained from objective sources we imagine to be factual and first price, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any knowledge on or accessed by this net page. Decentral Media, Inc. will not be any longer an investment handbook. We present out no longer give custom-made investment advice or diversified monetary advice. The knowledge on this net page is field to substitute with out note. Some or the total knowledge on this net page might well well become out of date, or it can well very correctly be or become incomplete or wrong. We might well well, but are no longer obligated to, update any out of date, incomplete, or wrong knowledge.

You ought to soundless by no formulation form an investment possibility on an ICO, IEO, or diversified investment primarily primarily based on the solutions on this net page, and also you need to always soundless by no formulation interpret or otherwise rely on any of the solutions on this net page as investment advice. We strongly suggest that you consult a certified investment handbook or diversified certified monetary first price in the event you can very correctly be seeking investment advice on an ICO, IEO, or diversified investment. We present out no longer settle for compensation in any form for inspecting or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

Reuters Blasts Binance for $2.35B Money Laundering Recount

A tale from Reuters claims that Binance can accumulate allowed the laundering of extra than $2.35 billion over a interval of 5 years. The story highlighted instances when North Korean…

Binance CEO Changpeng Zhao Criticizes Crypto Bailouts

Binance CEO Changpeng Zhao has issued a reward summarizing his thought on bailouts and leverage in the crypto industry. His feedback map handiest a couple of days after studies of the…

Binance.US Faces Class-Motion Swimsuit From Terra Traders

Plenty of Terra investors accumulate filed a class-motion suit in opposition to Binance.US, primarily primarily based on a factual tale filed Monday. Binance.US Centered in Lawsuit Terra investors are suing Binance.US, alleging that the unreal…

Binance Faces SEC Scrutiny Over 2017 BNB Coin Offering

BNB has fallen 8.5% since the news first surfaced. Binance Hit by SEC Investigation The Securities and Substitute Rate is investigating Binance over its BNB initial coin offering. Per a…