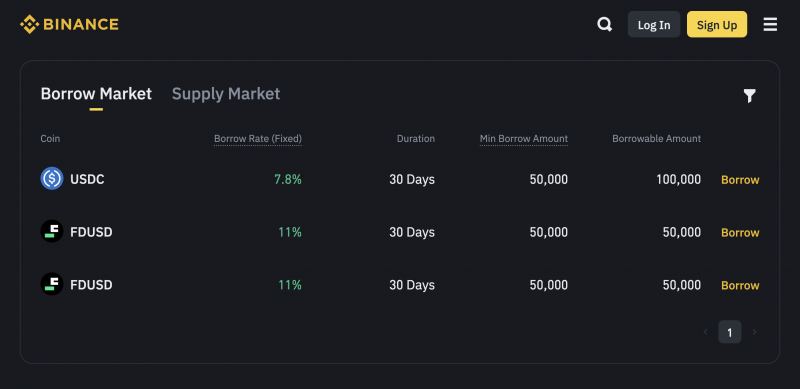

Dwelling » Ecosystem » Binance to initiate mounted rate loans in USDC and FSUSD stablecoins

Sep. 5, 2024

Mounted rate loans beef up monetary balance for Binance users.

Key Takeaways

- Binance’s mounted rate loans provide predictable monetary planning for users.

- The provider entails functions love auto-repay and major safety.

Half this text