Bitcoin has failed to take the $30,000 level on Monday after scoring its eighth consecutive week in the crimson for the first time ever.

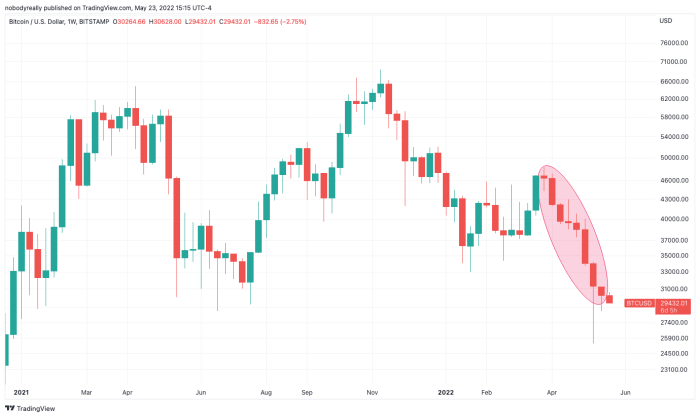

At some level of those eight weeks, which started in dreary March and ended on Sunday, bitcoin has lost over 35% of its U.S. buck price basically basically based fully on TradingView recordsdata. Sooner than the origin of the losing recede, BTC used to be trading at around $46,800.

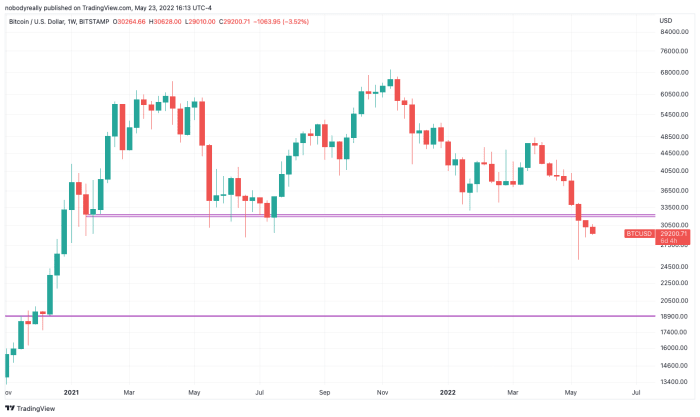

Bitcoin has scored losses for eight consecutive weeks for the first time in its historical past and it’s starting up the ninth with yet one other crimson candle. Image source: TradingView.

Bitcoin is altering fingers simply under $30,000 on the time of writing. The seek-to-seek currency climbed as high as $30,600 earlier on Monday to switch at around $29,400 as the trading in equity markets nears its result in Original York.

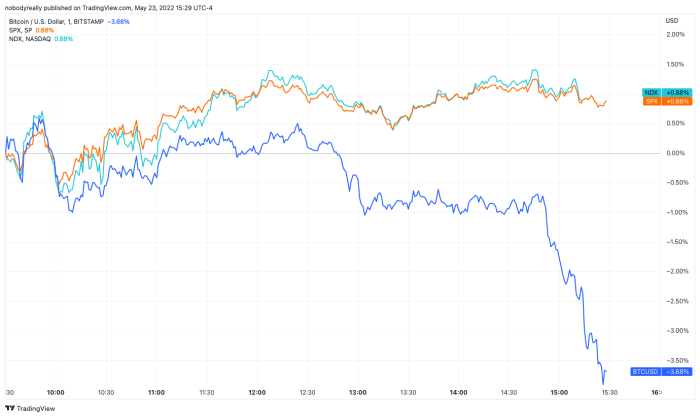

Whereas bitcoin turns south, main U.S. stock indices had been in the fairway. The Nasdaq, which is alleged to be extremely correlated with bitcoin, decoupled from the digital cash along side the S&P 500 to denote modest beneficial properties advance market end on Monday, per TradingView recordsdata.

Whereas bitcoin, Nasdaq and S&P 500 had been trading in tandem for a while on Monday, the P2P currency observed a spicy promote-off decouple it from the 2 indices and put it to a higher than 3% loss for the day. Image source: TradingView.

A Stressful One year For Bitcoin

Despite making two new all-time highs in 2021, bitcoin already erased nearly about all of those beneficial properties in 2022.

Bitcoin’s choppy trading One year to this point might per chance per chance moreover moreover be partly attributed to a broader sentiment of commercial uncertainty as the Federal Reserve tightens the U.S. financial system, withdrawing liquidity from the market after nearly two years of quantitative easing.

The central financial institution has already raised its real ardour rates two events this One year, the closing of which used to be double the magnitude of the old one and represented the main hike in two many years: Whereas the Fed elevated ardour rates by 0.25% in March, it raised them by 0.50% earlier this month.

When the Fed raises or lowers ardour rates by its Federal Commence Markets Committee (FOMC), what it’s truly doing is atmosphere a goal differ. The graph above depicts the lower and greater bounds of that heart of attention on differ in crimson and blue, respectively.

Whereas the U.S. central financial institution system items the goal, it cannot mandate that commercial banks put it to use — rather, it serves as a guideline. For that reason of this truth, what banks terminate up the utilize of for lending and borrowing excess cash between them in a single day is named the effective rate. Right here’s shown by the fairway line in the graph above.

The Fed beforehand hiked ardour rates persistently from 2016 to 2019, except plunging it advance zero in the aftermath of the COVID-19 pandemic outbreak, as smartly-known in the graph.

Bitcoin’s elevated sensitivity to liquidity and therefore ardour rates might per chance per chance moreover moreover be defined by a elevated participation of institutional merchants in the market, whose allocations are basically basically based fully on the provision of capital and broader financial prerequisites, Morgan Stanley reportedly mentioned.

For that reason of this truth, while Bitcoin used to be ready to place a bull market in the midst of the Fed rising ardour rates in 2017, raising nearly about 2,000% from January to December that One year, the percentages aren’t on the aspect of the bulls this One year.