The cost performance of Bitcoin over the past week has been a source of yell for the huge majority of the crypto community. This has rather mighty been the case for diversified cryptocurrencies on the market, with several immense-cap tokens reversing their fair these days-collected profits.

Alternatively, some merchants are treating the brand new tag decline as a rare alternative within the bull market as they proceed to load their bags with sources of their preference. Namely, the most up-to-date on-chain knowledge exhibits predominant procuring exercise amongst a determined class of merchants.

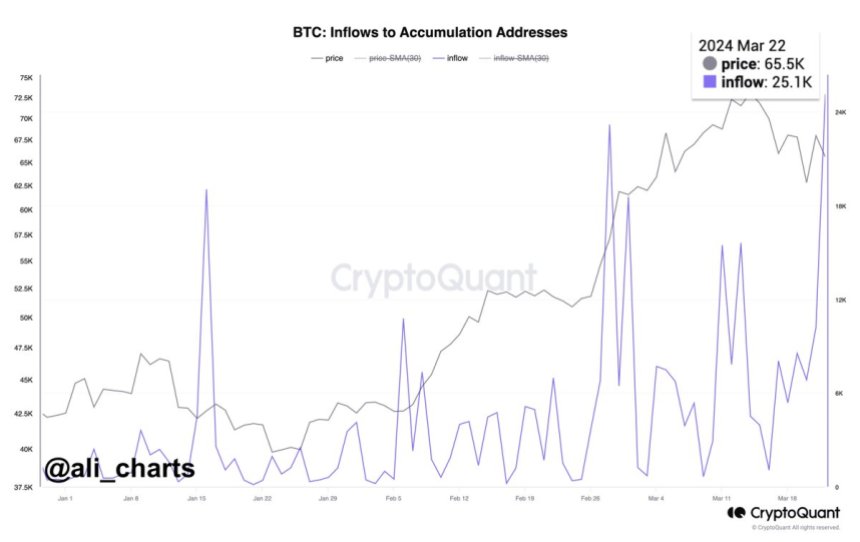

25,000 BTC Tear Into Accumulation Addresses In One Day

Prominent crypto pundit Ali Martinez printed, by a put up on X, that more than 25,000 BTC (valued at roughly $1.6 billion) modified into once moved to accumulation addresses on Friday, March 22. This figure represents the splendid amount transferred to these wallets in a single day to this level in 2023.

The metric of hobby here is the Inflow to Accumulation Addresses on the Bitcoin blockchain. For context, a Bitcoin accumulation take care of refers to an take care of that has zero outgoing transactions and maintains a balance of not not up to 10 BTC.

A chart showing the inflows to Bitcoin accumulation addresses | Source: Ali_charts/X

This classification, on the choice hand, excludes digital wallets linked to centralized exchanges and miners and has not up to 2 non-mud incoming transfers. Additionally, it doesn’t encompass addresses which absorb not seen any exercise in additional than seven years.

The increased lunge of coins into this class of pockets addresses is proof of huge BTC accumulation by entities who scrutinize the crypto as a prolonged-length of time investment. It indicators that determined mountainous-money gamers are gathering Bitcoin in anticipation of skill price appreciation.

What’s more, this predominant acquisition by prolonged-length of time merchants emphasizes the rising adoption of Bitcoin as a retailer of price. Meanwhile, it would also very smartly be an indicator of bullish tag lunge within the short length of time.

Bitcoin Brand Overview

As of this writing, Bitcoin is valued at $64,636, reflecting a mere 1% tag acquire bigger within the past 24 hours. This tag change is somewhat negligible, pondering the deep retracement of the premier cryptocurrency earlier within the week.

In response to knowledge from CoinGecko, the associated price of BTC is down by 2.4% over the past week. Meanwhile, the market leader is currently about 13% from its file high of $73,798.

Alternatively, it has been an overall positive performance for the Bitcoin tag in March, having surpassed this outdated all-time high of $69,000 somewhat over every week ago. And, with a market cap of $1.26 trillion, BTC retains its situation as the largest cryptocurrency within the sphere.

The price of Bitcoin struggles to hold above $64,000 on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured record from iStock, chart from TradingView

Disclaimer: The working out chanced on on NewsBTC is for academic applications

splendid. It doesn’t represent the opinions of NewsBTC on whether to buy, promote or take care of any

investments and naturally investing carries dangers. You might maybe also very smartly be suggested to behavior your private

evaluate before making any investment choices. Expend knowledge equipped on this websites

thoroughly at your private threat.