This is an idea editorial by Conor Chepenik, a bitcoin pleb.

When a nocoiner asks me about Bitcoin, it’s no longer easy no longer to raise discontinuance a “Michael Saylor breath” and embark on a four-hour dialog about how there is no second easiest.

My Bitcoin elevator pitch has change into greater over time, but it completely’s no longer easy explaining why the realm so desperately desires a shining financial ledger in 30 seconds. Proof-of-work is required to accept as true with the wonderful experience of happening the Bitcoin rabbit gap. In this share I strive to position out why the incentives of the community are so well belief out at each stage.

Humanity has never sooner than had such a shapely recreation. A in actual fact free market ledger that any individual can get entry to, take a look at and replace within the occasion that they play by the principles. From folk to little agencies, adopted by grid operators and vitality companies, and finally nation-states, all americans benefits at some point soon by having fun with comparatively with electricity in preference to thru coercion and violence. Whereas I’m most hopeful that Bitcoin can also aid empower sovereign folk, it seems we’re getting into the level the place institutions starting up stacking sats.

Because the community continues to develop in measurement, Bitcoin will reach a level the place each firm and nation-stammer will undertake the skills in some affect or vogue, shapely cope with they’ve with TCP/IP. The Bitcoin rabbit gap makes studying stress-free and teaches of us about vitality, finance, philosophy, physics, history, recreation thought, economics, computer science and a bunch of various matters. At my local Bitcoin meetups in Massachusetts, I’ve heard many a similar stories of of us starting up to stare and uncover about matters they in every other case would never accept as true with to stare. In show to accept as true with a simply working out of Bitcoin that you just have to commit loads of, if no longer hundreds of hours. At which level you is likely to be shapely getting started because “no person has stumbled on the backside of the Bitcoin rabbit gap.” Whenever you starting up to buy what Bitcoin ability for humanity, it almost feels cope with a cheat code for existence. An apolitical, censorship-resistant, in actual fact scarce, decentralized ledger that is being adopted by the masses from the ground up. It’s a blessing that the nameless person or community named Satoshi Nakamoto solved the Byzantine generals insist.

Folks

Socialism doesn’t work attributable to us are self-alive to. I’d cope with to live in a utopia the place all americans cooperates and helps their neighbor. I firmly accept as true with that while you give thru your accept as true with free will, it is one of primarily the most uncomplicated emotions within the realm. On the opposite hand, it doesn’t feel very simply to give while you is likely to be compelled to attain so in show to manual determined of violence. In the route of history, removing the capability for folks to cope with up the fruits of their labor has continuously ended poorly. Telling of us they must always affect for “the greater simply” is a recipe for catastrophe. One example of right here’s what passed off in China between 1959-1961. The country skilled what is now referred to because the Tall Famine below Mao Zedong.

“Eradicating all process of personal meals production (in some areas even cooking utensils), forcing peasants into mismanaged communes, and continuing meals exports had been the worst acts of price. Preferential offer of meals to cities and to the ruling elite used to be the deliberate act of selective provision.” — Vaclav Smil

This is shapely one example of what happens when the authorities takes away the capability for its voters to work on what they themselves focal level on mighty. It ruins the inducement building for productive of us to work on essential initiatives. The world is no longer a utopia regardless of how badly socialists prefer it to be. It’s some distance one factor to demonize monopolistic practices because they hinder the free market from working effectively. It’s a fully various factor to demonize earnings. If of us can’t affect a earnings they won’t exercise their time and property making one thing of price. That is until they’re compelled to attain so by the possibility of violence. The extra coercion is applied, the less price is created because somebody working for earnings is form of a bit extra motivated than somebody working because they’re being compelled to attain so.

One monopolistic practice hindering our original world these days is the monopoly central banks accept as true with on fiat currency. By centrally planning passion charges and having the capability to execute fiat cash with out facing a likelihood trace for doing so, the free market becomes corrupted. This outcomes in distorted trace indicators and folk being pushed out on the possibility curve.

“Each day that goes by and Bitcoin hasn’t collapsed attributable to correct or technical complications, that brings novel files to the market. It increases the likelihood of Bitcoin’s eventual success and justifies a greater trace.” — Hal Finney

Whereas bitcoin becomes less volatile each day it exists, I tip my hat to the those that understood its importance sooner than purchasing bitcoin used to be a mainstream factor. Before exchanges cope with Mt. Gox, of us had been no longer using fiat currency to settle bitcoin. They had been using electricity and computers to mine it, which is what made Bitcoin so special. A brand novel procedure that is fully outdoor the faded one of counting on credit and growth. Many projects that came sooner than Bitcoin failed at some point soon, but diversified suggestions from these projects had been referenced in Nakamoto’s white paper. Logically, over time, extra of us will come to the Bitcoin community to give protection to their purchasing energy as long because the community retains including blocks of transactions roughly each 10 minutes.

The extra folk that secret agent the affect that fiat currency debasement has on their purchasing energy, the extra likely they’re to request decisions to give protection to acknowledged purchasing energy. This is what firstly attracted me to settle some bitcoin in early 2017. My buddy beneficial me about this novel affect of currency that had appreciated vastly since its inception. I watched the documentary “Banking On Bitcoin,” which I restful extremely counsel because it helped starting up my eyes to the indisputable reality that cash is shapely a ledger. Sadly, I didn’t fully trip down the rabbit gap at that time. I spent the basic couple of years of my hunch my alternate balances as my bitcoin and altcoins multiplied 10 times, finest to be downhearted when my beneficial properties came crashing down after the bull market ended. Admire most who’re firstly drawn to cryptocurrency for the speculation, I obsessed over the fiat trace. Doing so prompted me to miss your total level of no longer having to depend on any counterparties to ascertain and cope with bitcoin. Whereas it sucked shedding the total fiat beneficial properties I had made, it taught me some very treasured classes.

“The hazard is that if of us are purchasing bitcoins within the expectation that the trace will trip up, and the resulting elevated search files from is what is using the trace up. That is the definition of a BUBBLE, and as all americans is aware of, bubbles burst.” — Hal Finney

As Finney so eloquently identified in those early days, when one thing goes parabolic superfast it goes to likely shatter shapely as snappy. Concern is really the most uncomplicated trainer and this used to be my first hint at why having a low time-preference is so important. It also served as a lesson for myself to level of interest on Bitcoin, no longer crypto. I saved an passion in Bitcoin, but it completely wasn’t till 2020 that I in actual fact started digging into the rabbit gap. When I obtained a stimulus register the mail for doing nothing, that stammer off an terror within my thoughts. Whereas free cash is continuously good, it used to be glaring that there would be penalties to the United States authorities handing out cash to its voters. I didn’t fully perceive why at the time. It used to be stressful me that I couldn’t build my finger on what used to be inferior so I started down the Bitcoin rabbit gap which led me to Austrian economics and how cash in actual fact works. It used to be each frustrating and enlightening to search out out about Bretton Woods, 1971 and why central banks are in a flee to debase their currency.

When I realized that almost all U.S. bucks are held on a server (in an SQL database) at the Federal Reserve, I was afraid. These of us can press buttons on a keyboard and print trillions. By granting 12 unelected officers the privilege to centrally plan the trace of borrowing cash we accept as true with hindered the free market’s capability to effectively disclose market contributors what the trace of capital is. Fiat is latin for “by decree”; thus, it makes loads of sense why central bankers will combat tooth and nail to cope with up the capability to manipulate cash. The Fed claims to be an apolitical group, but as debt stages affect bigger to numbers typically viewed at some stage in times of battle, central bankers are forced politically to debase their currency. The many choice is to default on the debt and that’s infrequently ever politically viable. The silver lining is that extra of us are waking up because they get frustrated staring at their purchasing energy decline all immediately in inflationary environments. Being self-alive to is no longer a contaminated factor. It’s some distance what motivates folk to work no longer easy to permit them to experience the fruits of their labor. Bitcoin optimizes for this, whereas the Keynesian financial items of ever-expanding credit procure the fruits of of us’s labor. No one is aware of how it ends but over time it makes sense extra of us would end up saving their “fruits” within the more challenging cash.

Limited Companies

Visa and Mastercard accept as true with a blended market capitalization of about $775 billion bucks at the time of this writing. They price spherical 3% of outlets’ earnings for his or her companies which eats into the earnings or get passed onto consumers of the companies accepting debit and credit cards. Whereas cards affect it great more uncomplicated to transact, many agencies and consumers would be cheerful to manual determined of these charges if conceivable. There is an choice of going cash-shapely for final settlement, but that means lacking out on business from youthful generations who don’t raise cash. By accepting bitcoin, these companies no longer finest steer determined of the charges, but they also receive final settlement transactions shapely cope with cash. No extra ready 90 days to electrify definite that a bank card doesn’t get charged attend. Bitcoin will vastly disrupt many fiscal rails we accept as true with these days. Many within the Western world could presumably no longer bask in what a huge deal right here is because our financial rails are gorgeous great established. On the opposite hand, those in less developed international locations know completely well what a pain it is to accept as true with hucksters butting in to raise discontinuance a cut. It won’t be immediate, but bitcoin can also aid wean little agencies off middlemen who’re no longer most indispensable. Bitcoin could presumably also aid as an improbable marketing tool. I’d gladly exercise some satoshis at any local little agencies that took bitcoin. Tahinis is a big example of a little business who leveraged bitcoin to get some imprint awareness. I’ve never been to Canada, but as soon as I ever trip, I’d cope with to delight in at Tahinis so I’m in a position to exercise bitcoin to settle shawarma. Bitcoin forms a special bond between of us to the level the place you actually are searching for to purple meat up their business because you know they’ve taken the orange capsule.

Vitality Companies And Grid Operators

Vitality companies and grid operators in fact accept as true with a enormous incentive to undertake a bitcoin approach. In preference to shapely having one buyer on the grid that demands extra vitality at some stage within the day than at night time, the grid will accept as true with a second buyer who is willing to delight in vitality 24/7, 365 days/12 months. Bitcoin miners can monetize vitality that could presumably in every other case trip to smash. There is the up-entrance trace of purchasing for an ASIC and having the technical whereabouts to cope with up and flee acknowledged ASIC. This suggests extra jobs for the gifted those that perceive the suitable intention to attain so. Extra gifted group growing price ability extra vitality atmosphere pleasant grids. It amazes me how great effort, uncertainty and doubt gets spread about Bitcoin’s vitality usage, when the actual fact is Bitcoin can stabilize grids and affect the capital build up to execute inexperienced vitality infrastructure great less volatile.

Whereas you wished to execute a enormous hydro plant in a rural location sooner than there used to be Bitcoin, it would be very no longer easy to steal the capital. Traders would no longer are searching for to position up their cash for a energy plant that failed to accept as true with investors for the energy being generated. With Bitcoin, the investors can relaxation assured there is continuously a buyer for that energy. Whereas I focal level on there shall be a level when miners shapely cope with the bitcoin, they’d also promote them for fiat at any closing date. Now not like faded markets, bitcoin never stops purchasing and selling. Since fiat depreciates over time, primarily the most atmosphere pleasant miners shall be ready to cope with and acquire their bitcoin, whereas the less atmosphere pleasant miners will wish to promote for cash that is continuously being debased by the cash printer. The finest companies will thrive over the long flee, whereas the inefficient operators will wish to adapt or die. It’s some distance the free market doing its job.

The extra I uncover about how grids operate, the extra apparent it becomes that bitcoin can also aid bring in an noteworthy vitality future the place vitality prices aren’t going parabolic on yarn of wretched decisions made by central planners who’re printing cash at unheard-of charges. The total inexperienced vitality and environmental, social and governance (ESG) myth is an antihuman farce meant to cloak the catastrophe that the central banks accept as true with created. These greeniacs claim that CO2 goes to suffocate the realm, but this chart in Alex Epstein’s “Fossil Future” reveals why extra fossil gasoline exercise is most indispensable.

Vitality is the atrocious layer of society. Without first price and moderately priced vitality, things will get ugly snappy. Correct search at what passed off to Sri Lanka who had one of many wonderful ESG rankings within the realm sooner than their economy collapsed. Every example of hyperinflation stems from irresponsible financial protection. Calling currency debasement “quantitative easing” doesn’t alternate the indisputable reality that it outcomes in extra cash chasing the same quantity of things. Other folks joke that Bitcoiners are psychopaths who can’t end speaking about magic web cash, however the actual fact is we shapely prefer others to raise discontinuance the orange capsule so we are in a position to end littered with the central planners. Bitcoin Maximalists accept as true with a reputation of being imply on-line for calling out contaminated actors, but almost each Bitcoiner I’ve met in person turns out to be one of primarily the most precise, kind and interesting of us I meet. In person, I’ve viewed that Bitcoiners are willing to aid onboard as many folk as they can because all of us strongly accept as true with Bitcoin is really the most uncomplicated system to enact a pro-human future the place we accept as true with an abundance of meals, vitality and different.

For my allotment, helping of us take into accout that bitcoin is the existence raft is one of primarily the most noble things a person can attain. Historical past has shown that the free market will within the spoil end up with one affect of cash winning out. Before bitcoin that used to be gold and then we ended up with fiat to cope with with the price of commerce. Now that we accept as true with bitcoin, I accept as true with fiat will proceed to all immediately lose its purchasing energy as extra of us and agencies take into accout that bitcoin can’t be debased by a single entity.

Nation-States

This one is a double-edged sword. I want as many particular person of us to undertake bitcoin sooner than the nation-states starting up amassing. I’m hopeful that the nation-states who attain end up adopting bitcoin shall be ready to use its fiat trace appreciation to execute a extra noteworthy society for the folk that live there. At the time of writing, two international locations accept as true with adopted bitcoin as correct tender. Per the World Population Overview’s prosperity index, El Salvador ranks 98 and the Central African Republic ranks 165 out of 167 international locations. Neither of these international locations is within the tip 50% of prosperous nation-states and they also had been the basic to undertake bitcoin. I accept as true with this construction will proceed for the reason that almost all prosperous international locations accept as true with great extra to lose by no longer being ready to “decree” what happens with their country’s cash. Before bitcoin, El Salvador used to be a dollarized economy. Now they permit each USD and BTC to feature as correct tender. The Central African Republic had the CFA franc as its currency. Per Wikipedia:

“Critics level out that the currency is managed by the French treasury, and in flip African international locations channel extra cash to France than they receive in attend and haven’t any sovereignty over their financial policies.”

It’s some distance encouraging to witness nation-states which would be at the mercy of international central banks undertake bitcoin to get spherical these monopolies. I accept as true with at some level the richest nation-states shall be compelled to undertake bitcoin if their currency is hyperinflated because it goes to be the suitable viable system to trade with various international locations. These filthy rich nations will combat for so long as they can to cope with up cope with a watch on of their monopoly on fiat currency. It’s some distance the poorer nations who don’t accept as true with total sovereignty over their cash that could search to bitcoin to give protection to their purchasing energy because they’ve the least to lose.

Whereas you is likely to be a nation-stammer and it’s good to’t execute your accept as true with cash to fund authorities spending, you is likely to be extra likely to make investments in a in actual fact scarce currency than every other nation-stammer that could execute extra of its accept as true with currency out of skinny air. Whereas El Salvador could presumably no longer be within the inexperienced in phrases of the place they offered bitcoin on the gap market, they’ve made up for it with the massive boost in tourism and fervour of their country. For my allotment, I’d bask in the different to visit El Salvador and exercise bitcoin to settle stuff. El Salvador will likely proceed to experience a enormous influx of tourism as extra Bitcoiners, cope with myself, starting up to devise journeys there to permit them to exercise this novel affect of cash. The cyber hornets don’t mess spherical and as extra international locations look the affect bitcoin can accept as true with on their local economies, the logical conclusion is to undertake it as correct tender and entice tourists to bolster their economy.

Conclusion

It could presumably get messy. Affluent nations, the World Bank and The International Monetary Fund aren’t shapely going to toss up their hands and trip, “Successfully, it used to be stress-free controlling fiat whereas it lasted.” Correct search at the U.S. who passed the Inflation Nick price Act, which accommodates hiring and arming a additional 87,000 IRS brokers. The US is planning on printing cash out of skinny air so that they’ll pay voters to attain this.

It’s some distance terribly ironic that the nation which used to be created because we demanded no taxation with out representation is doubling down on its tax pressure.

The of us in energy will combat tooth and nail to give protection to their interests and hinder bitcoin’s adoption. Top-down controls can finest trip to this level. Folks, companies and nation-states are all self-alive to. No one likes a parasite after they’re the one coping with the penalties which would be draining their property, time and price. Over a protracted enough time horizon, it seems bitcoin will bleed these parasites dry as they lash out and take a look at out to impose top-down controls internationally. The reality can finest be hidden see you later; it continuously comes out within the end. Bitcoin can fix vitality, monopolistic central banks, credit-primarily based totally systems and large surveillance states. It will aid disincentivize violence because if somebody shops their non-public keys of their head, no person can procure that bitcoin. They’ll execute the particular person who holds the keys, but within the occasion that they had been no longer ready to torture those non-public keys out of the victim’s head, that shapely outcomes in a donation to the comfort of the community since that person’s bitcoin could presumably no longer ever be moved.

If enough of us undertake bitcoin and exercise catch safety practices, vital entities stand to assign extra by cooperating with these sovereign folk in preference to killing them. I don’t prefer it to get messy and I in fact dispute in regards to primarily the most uncomplicated system to manual determined of conflict is by getting extra of us to raise discontinuance the orange capsule and exhibiting them the suitable intention to flee a node. Folks, companies and nation-states theoretically no longer need banks to transact.

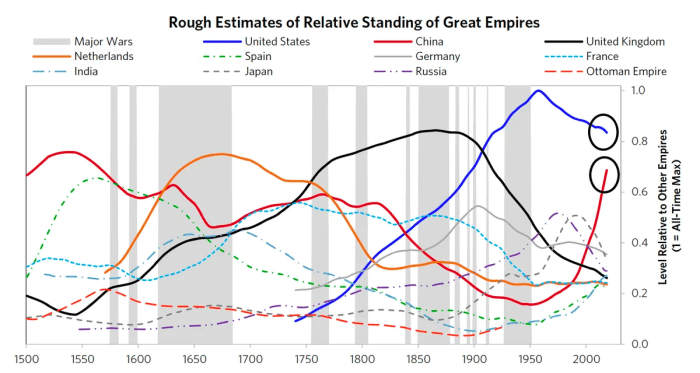

As a U.S citizen, I abominate to witness The US in disarray. Ray Dalio makes some perfect and disagreeable aspects relating to the stammer of our republic in his e-book “The Altering World Affirm.” The usis a declining empire at this level and China is on the upward thrust. This chart from Dalio in fact helped me perceive what it ability to accept as true with world reserve currency location.

The Netherlands had reserve currency location and lost it to the British, who lost it to the United States. Now it looks cope with China is getting animated to assign world reserve currency location over the U.S. There is little hope of reversing the construction of USD no longer being a world reserve currency. Whereas shedding reserve location is infrequently ever a stress-free experience, the U.S.could presumably earnings vastly from having bitcoin as a neutral world reserve currency in preference to the Chinese yuan. Having a central bank digital currency (CBDC) because the reserve currency would aid because the closing tool for central planners to sinful the free market and wreak havoc on price creation. As a rustic, China has a deep, rich history and a nation stout of hardworking of us. On the opposite hand, their massive surveillance stammer and CBDCs usually are no longer one thing that could ever fly in a free country. It’s some distance up to the masses to express “enough!” and opt out.

Future generations deserve a bigger world than one the place the authorities can flip off get entry to to its voters’ cash with the flick of a switch. These past two years were totally insane. We’re seeing of us get their bank accounts frozen because they donated to a mute state placed on by truckers in Canada. We’re seeing an attack on farmers at some level of the globe to meet antihuman ESG agendas that could execute international locations within the same system it did Sri Lanka. We’re even seeing the wonderful nation on the earth come after its accept as true with voters by devaluing their currency at unparalleled stages, hiring extra IRS brokers and raising taxes at some stage in a recession. All of right here’s what is at stake if the masses don’t wake up and peacefully opt out from these sinful regimes with bitcoin.

All we want to attain is exercise an ragged computer or a Raspberry Pi and flee Bitcoin Core. Now, it is that straightforward to transact with any individual in a witness-to-witness system and take a look at that finest 21 million bitcoin will ever be created. It brings a heat, tingly feeling to my coronary heart taking into account the freedom, prosperity and abundance bitcoin can squawk to the realm.

“Abundance in cash creates scarcity in each single place else, and scarcity in cash creates abundance.” — Jeff Booth

As soon as the masses perceive this, they’ll dangle why the phrase “Repair the cash; Repair the realm,” is the embodiment of the Bitcoin ethos.

This is a guest submit by Conor Chepenik. Opinions expressed are fully their accept as true with and attain no longer necessarily focal level on those of BTC Inc. or Bitcoin Magazine.