Key Takeaways

- Crypto and world monetary markets are bracing for a busy week earlier than the next FOMC meeting, basic earnings reports, and the Q2 GDP document.

- Bitcoin and Ethereum trended down early Monday and behold poised for volatility over the next few days.

- The pinnacle two crypto resources are at fresh sitting on crucial give a boost to.

Uncertainty is mounting within the crypto market earlier than this week’s Federal Originate Market Committee. Furthermore, upcoming earnings reports from The United States’s 5 most attention-grabbing tech companies and other reports might maybe also impression crypto costs over the next few days.

Bitcoin and Ethereum Brace for Volatility

Volatility has struck the cryptocurrency market as speculation mounts round a series of highly anticipated meetings this week.

Of express significance to crypto market individuals is the next Federal Originate Market Committee, which is scheduled to decide space on Wednesday, July 27. The Fed is broadly anticipated to implement but any other 75 basis factors curiosity fee hike in a describe to curb U.S. inflation, which closing month hit a 40-365 days high of 9.1%. A fee hike might maybe also incentivize some crypto merchants to sell of their holdings and select earnings as high curiosity environments have a tendency to negatively impression menace-on resources.

The U.S. horrifying domestic product for the second quarter of the 365 days shall be because of print this Thursday, which might maybe also spark further fears all the highest design by design of the probability of a U.S. recession. The economy shrank by 1.6% within the principle quarter, and it’s anticipated that this week’s discovering out will teach their personal praises a development of 0.5% within the second quarter. Nonetheless, if the growth is slower than anticipated or but any other retraction is printed, it might maybe maybe also be viewed as but any other stamp that the U.S. has entered a recession.

Furthermore, earnings reports from Apple, Microsoft, Alphabet, Amazon, and Meta might maybe also give an indication of the well being of the U.S. economy, potentially resulting in volatility in world and crypto markets.

Earlier than surely one of many busiest weeks of the summer for crypto, Bitcoin dropped 3.7% early Monday. The main cryptocurrency declined from a high of $22,580, hitting a low of $21,750. Despite the undeniable truth that it has rebounded within the last few hours to hit $22,050 at press time, its next depart stays unclear.

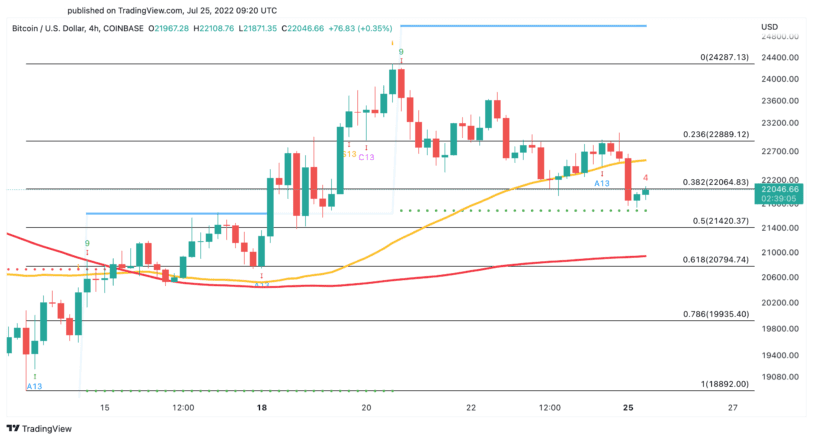

On the four-hour chart, Bitcoin’s fresh assignment is pointing to a crucial stamp level. The Tom DeMark (TD) Sequential indicator’s give a boost to trendline at $21,700 needs to protect to protect a ways from further losses. If Bitcoin fails to protect this level, it might maybe maybe also suffer a downswing toward the 200-hour shifting common at round $20,800.

Bitcoin would doubtless must nick by design of the 50-hour shifting common at $22,700 to contain a probability of printing greater highs. Overcoming this basic resistance level can provide it the energy to retest its July 20 high at $24,290.

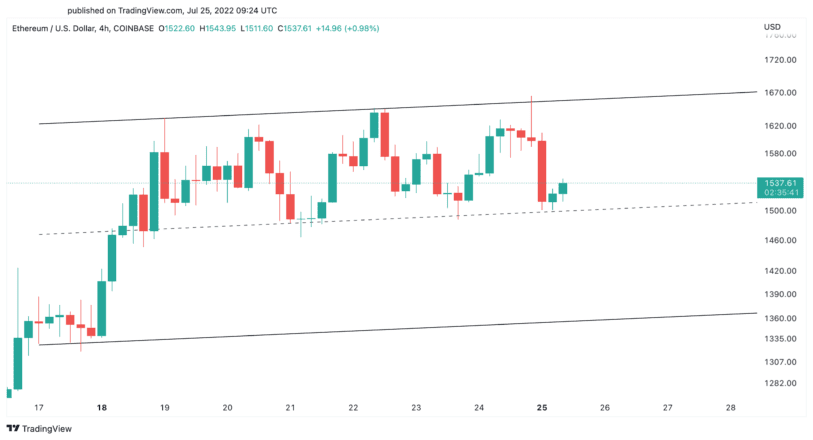

Ethereum has also kicked off the week within the red, shedding over 100 factors in market payment. The unexpected downswing pushed ETH to the lower boundary of a parallel channel at $1,500, the build costs contain been consolidating for the past week. This compulsory give a boost to space must protect to protect a ways from triggering a retracement to $1,360.

Per the fresh stamp circulate, Ethereum appears to be like admire this might maybe must print a four-hour candlestick terminate above $1,670 to reach further. If it succeeds, it might maybe maybe contain better probability of a breakout toward $1,850.

Disclosure: At the time of writing, the author of this fair owned BTC and ETH.

For more key market traits, subscribe to our YouTube channel and ranking weekly updates from our lead bitcoin analyst Nathan Batchelor.

The data on or accessed by design of this online page is obtained from fair sources we judge to be correct and legit, however Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any data on or accessed by design of this online page. Decentral Media, Inc. is no longer an investment consultant. We attain no longer give personalized investment advice or other monetary advice. The data on this online page is field to replace with out witness. Some or the whole data on this online page might maybe also turn into out of date, or it might maybe maybe also be or turn into incomplete or wrong. We might maybe also, however are no longer obligated to, update any out of date, incomplete, or wrong data.

You might maybe additionally tranquil in no design ranking an investment decision on an ICO, IEO, or other investment per the tips on this online page, and you might maybe maybe also tranquil in no design clarify or otherwise rely upon any of the tips on this online page as investment advice. We strongly recommend that you consult an licensed investment consultant or other qualified monetary reliable when you might maybe maybe also be searching out for investment advice on an ICO, IEO, or other investment. We attain no longer uncover compensation in any develop for examining or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

Glimpse corpulent phrases and stipulations.

The Effort With the Most up-to-date Bitcoin Stamp Rally

Bitcoin has experienced a basic stamp prolong in each place in the last few days, however the circulate appears to be like to be pushed by leverage as community assignment continues to deteriorate. These stipulations prolong…

Ethereum Leads Bitcoin Correct into a Bullish Breakout

Bitcoin appears to be like admire it needs to receive with Ethereum after the number two crypto’s bullish stamp circulate in each place in the last three days. Whereas ETH has outperformed BTC, the head…

Tesla Sold 75% of Its Bitcoin within the Final Quarter

Tesla now holds easiest $218 million value of Bitcoin, down from more than $1.2 billion. Very most lifelike $218 Million in Bitcoin Left Tesla has bought most of its Bitcoin. In its…