Visible Signs of a Bubble

In a bullish segment, the market runs hot and cools down in cycles. Altcoin prices rise and enter a bubble-love market. Merchants acknowledge tops and correction cycles, every time forming higher highs and lows.

One way or the opposite, the market runs out of steam, and the native top turns into a generational top. In some unspecified time in the future of this upthrust, liquidity flows in direction of altcoins, inflicting irregular gains with a shortage of fundamentals.

These are returning indicators of a bubble as altcoins display irrational exuberance. As an illustration, the day prior to this, the Stellar blockchain went down for a transient interval, however its native token XLM held onto the day outdated to this’s gains of 25%. Meanwhile, XRP has reached $1 despite its pending securities case filed by the SEC.

Serene, on-chain diagnosis of the tip two cryptocurrencies—Bitcoin and Ethereum—suggests that the market has no longer yet reached its top.

Ethereum Liquidity Disaster

Benjamin Lilly of on-chain be taught firm Jarvis Labs mapped the correlation between lowering change offer and ETH tag. Basically based entirely on Lilly, ETH “is gearing up for a historical speed.”

He discovered that in 2017 exchanges seen 44% lesser Ethereum balances, and customers withdrew ETH to private wallets. This time spherical, exchanges contain witnessed a 25% discount in offer. Furthermore, the full ETH offer is 38% greater than the closing time, representing elevated total offer-side liquidity.

Furthermore, exchanges aren’t the excellent entities maintaining ETH. Other illiquid ETH is locked in DeFi functions (11.5 million ETH), Grayscale’s reserves (3.17 million ETH), and Ethereum 2.0’s beacon chain (3.7 million ETH). A complete of 18 million ETH (15% of the full offer) is locked up altogether.

Lilly predicts that the keep a question to is having a secret agent to ramp up and gain explosive effects in tag. Right here’s as a consequence of “rising institutional keep a question to as a consequence of the unethical management of the buck, Grayscale Attain,” as properly because the mainstream acceptance of the crypto in NFTs, the sinful layer for stablecoins and various FinTech functions.

Bitcoin Continues Shopping Pattern

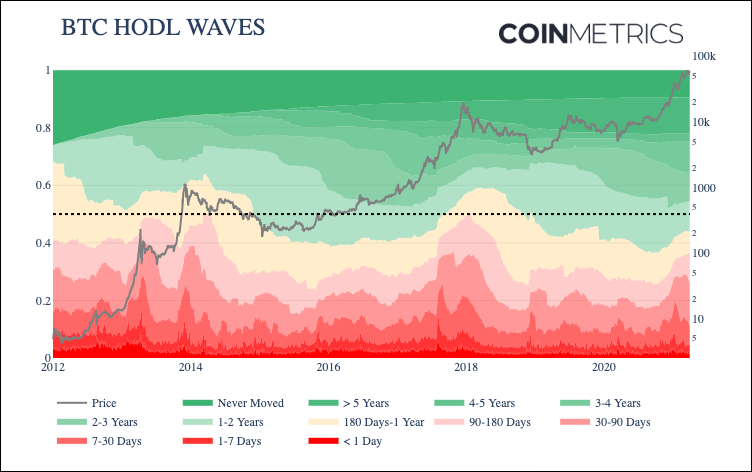

In an identical fashion, Bitcoin hasn’t exhibited indicators of a lengthy-time-frame cycle top. Bitcoin’s age distribution bands metric has been a sturdy indicator of market tops within the previous.

The metric, in general recognized as HODL waves, separates the Bitcoin addresses in step with the closing deposit and withdrawal time.

A big immediate-time-frame offer band means that patrons are hyperactive, which has occurred reach the market top twice sooner than. “36% of offer changed into as soon as active within the closing 180 days, aloof properly underneath the peak of about 50% within the heart of January 2018,” wrote Coinmetrics‘ Nate Maddrey.

Bitcoin HODL waves indicator. Source: Coinmetrics

Bitcoin HODL waves indicator. Source: CoinmetricsMaddrey drew a the same conclusion from two assorted metrics: Market Mark vs. Realized Mark (MVRV) and the Spent Output ratio (SOPR).

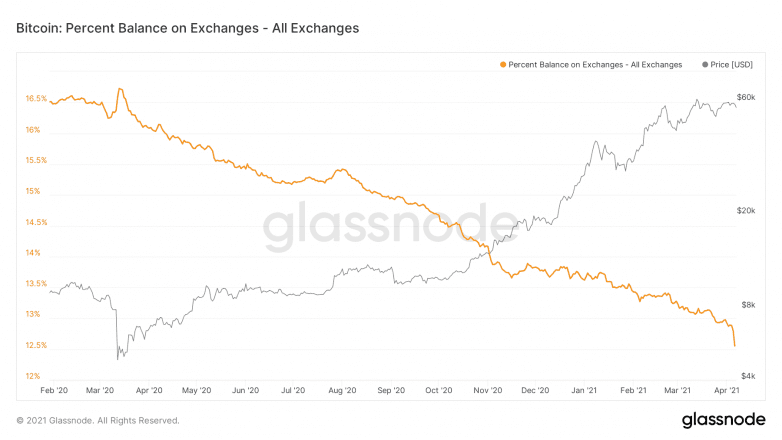

Besides this pattern, a properly-organized amount of Bitcoin left exchanges within the closing two days as BTC dropped underneath $59,000. The steep tumble within the yellow line represents the largest sweep since November 2020.

The compounding liquidity disaster pushed by solid keep a question to amplifies the upthrust after immediate-time-frame consolidation.