On-chain info reveals exchanges maintain obtained a huge Bitcoin influx spike from prolonged-time length holders, a tag that might well perchance well perchance also very successfully be bearish for the worth of the crypto.

Investors Holding Bitcoin Since 12 Months To 18 Months Within the past Switch A Broad Amount To Exchanges

As identified by an analyst in a CryptoQuant post, some prolonged-time length patrons retaining on to their money since between a year to a year and a half only in the near past sent large inflows to exchanges.

The connected indicator right here is the “alternate influx,” which measures the total amount of Bitcoin arresting to centralized alternate wallets.

When the cost of this indicator reveals a trim spike, it methodology patrons maintain staunch deposited heaps of cash to exchanges. Such a building is regularly bearish for the worth of the crypto as holders most steadily transfer to exchanges for promoting functions.

Then again, minute values of the metric can also demonstrate fashioned market conduct and that there isn’t largescale dumping occurring for the time being.

Related Reading | Bitcoin Taker Carry/Promote Quantity Presentations “Carry” Signal As BTC Gears Up For Rally

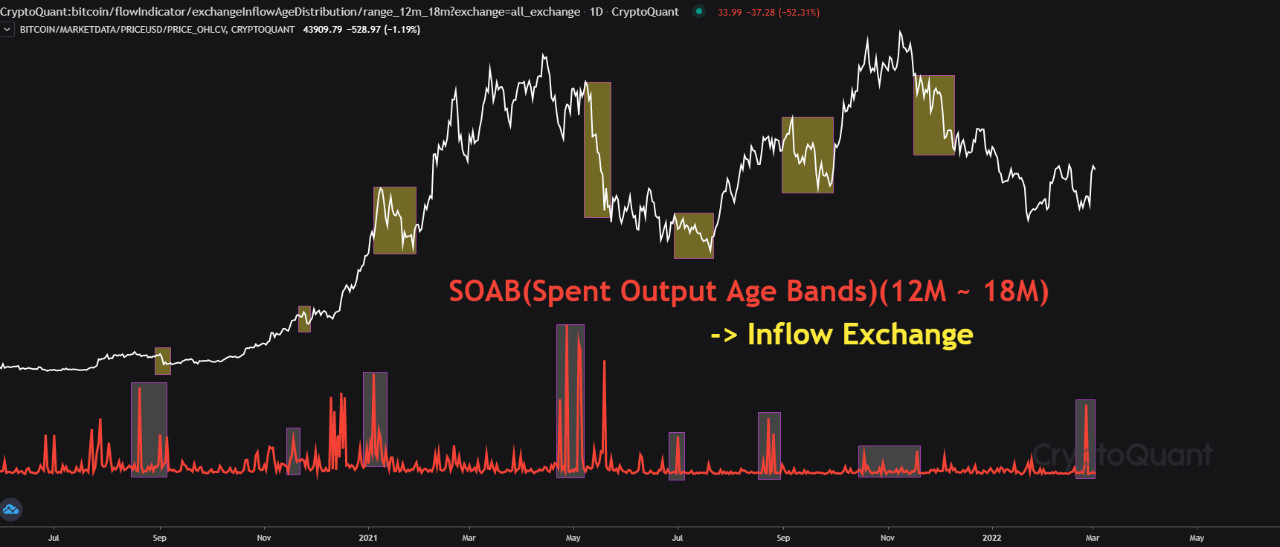

A modified model of the Bitcoin alternate influx reveals finest transfers from these patrons who had been retaining on their money since 12 months to 18 months previously. Here is the chart for it:

Appears worship a trim amount of cash maintain been deposited by these prolonged-time length holders only in the near past | Supply: CryptoQuant

As you’ll be in a position to see in the above graph, the cost of the indicator noticed a huge spike staunch only in the near past. This methodology that prolonged-time length holders contained in the age range of 12 to 18 months transferred a large quantity of cash to exchanges, perchance for promoting them.

Within the chart, the quant has furthermore marked the previous times this more or much less building took space. It seems worship rapidly following this kind of spike, the worth has always noticed a decline.

Related Reading |Bitcoin Closes 1st Green Month After 3 Reds, What Historical past Says Can also Happen

Since a spike has furthermore happened only in the near past, the worth of Bitcoin can be in for a identical drop soon, if the pattern continues to expend.

Then again, in definite circumstances, it’s furthermore that you’ll be in a position to think the cost of the coin doesn’t see any outcomes from this. An instance of this kind of inform might well perchance well well be if an outflow of identical or larger amount took space soon.

BTC Tag

On the time of writing, Bitcoin’s mark floats spherical $43.3k, up 23% in the closing seven days. Over the last month, the crypto has won 17% in cost.

The below chart reveals the building in the worth of the coin over the closing five days.

Following the arresting surge just a few days abet, the worth of Bitcoin appears to be like to maintain moved sideways | Supply: BTCUSD on TradingView

Featured relate from Unsplash.com, charts from TradingView.com, CryptoQuant.com