Key Takeaways

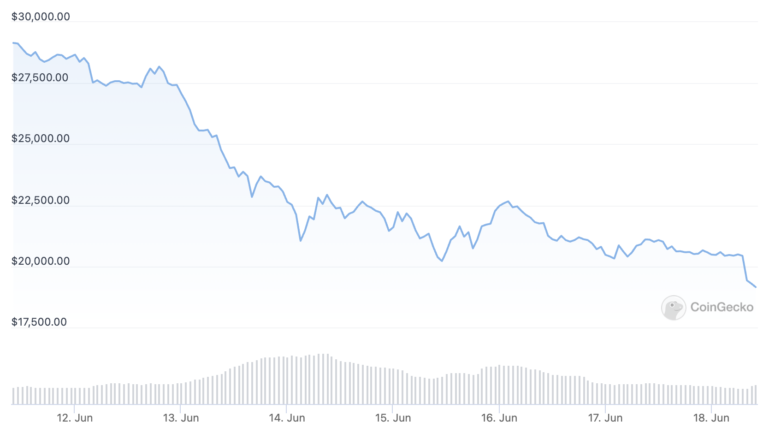

- Bitcoin has broken below $20,000 for the important thing time since December 2020, while Ethereum has dipped below $1,000.

- Or not it is miles the important thing time Bitcoin has fallen below its old cycle’s high. Bitcoin topped $19,600 in December 2017 and is now trading decrease.

- Several components are contributing to the most up-to-date crypto selloff, with a couple of of crypto’s most attention-grabbing companies plagued by the rocky market circumstances.

Ethereum crashed below $1,000 as Bitcoin tumbled.

Bitcoin and Ethereum Lengthen Losses

Bitcoin and Ethereum carry on falling as the crypto downturn continues.

The dwell crypto asset broke below $20,000 for the important thing time since December 2020 early Saturday, trading as low as $19,052 on Coinbase. It’s since posted a dinky recovery to $19,272 per CoinGecko files.

Bitcoin’s failure to set $20,000 is vital on epic of it has historically been a truly well-known make stronger stage. Bitcoin held above $20,000 for the entirety of the 2021 bull trot, topping out at $69,000 in November 2021. It’s now over 70% down from its high.

In old downtrends, Bitcoin has constantly held above its old bull cycle’s high. Let’s inform, it topped $1,000 in 2013 and traded at four digits for the total of the 2017 bull trot and subsequent iciness. In December 2017, it hit a blow-off high at around $19,600. After nowadays’s mark action, Bitcoin has broken a key pattern by falling below its old cycle’s high.

The quantity two crypto, Ethereum, has also assign in a unfortunate efficiency on the market of late. Ethereum fell below $1,000, one other well-known psychological trading stage, early Saturday as Bitcoin crashed, within the purpose out time trading at $995. It’s within the purpose out time heading within the right direction to discontinuance its 11th consecutive week within the red.

Several components savor contributed to the waning momentum within the cryptocurrency market. This week saw Celsius freeze buyer withdrawals as it contended with insolvency points, sooner than Three Arrows Capital, some of the well-known revered hedge funds within the residence, came into its hang liquidity disaster. The hedge fund co-trot by Su Zhu and Kyle Davies previously held over $10 billion in sources under administration and is now rumored to be getting ready to insolvency after a series of margin calls due to trading with vulgar leverage for the length of the market downturn. Babel Finance, an institutional-centered lending platform, also halted withdrawals due to low liquidity.

Primarily the most up-to-date dip comes against the backdrop of a precarious macroeconomic ambiance that’s viewed the Federal Reserve commit to hiking hobby rates for the length of this twelve months as it battles hovering inflation. Fed chair Jerome Powell announced one other 75 basis level hike this week, presenting but one other threat to effort-on sources esteem cryptocurrencies. Economists worldwide are forecasting a world recession, which can potentially trigger further concerns for investors.

After nowadays’s dip, the world cryptocurrency market cap is sitting at around $866 billion. That’s a 71% decline from the peak of correct eight months within the past.

Disclosure: At the time of writing, the creator of this piece owned ETH and several various cryptocurrencies.

The tips on or accessed through this internet region is obtained from honest sources we deem to be correct and legitimate, nonetheless Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any files on or accessed through this internet region. Decentral Media, Inc. is not an investment advisor. We pause not give customized investment advice or various monetary advice. The tips on this internet region is self-discipline to modify with out witness. Some or all the tips on this internet region would possibly maybe presumably become out of date, or it’d be or become incomplete or wrong. We would possibly maybe presumably, nonetheless are not obligated to, update any out of date, incomplete, or wrong files.

It’s best to silent never abolish an investment decision on an ICO, IEO, or various investment in step with the tips on this internet region, and you could always silent never clarify or in another case depend on any of the tips on this internet region as investment advice. We strongly counsel that you just search the advice of a licensed investment advisor or various licensed monetary legitimate once you occur to’re in search of investment advice on an ICO, IEO, or various investment. We pause not accept compensation in any accomplish for inspecting or reporting on any ICO, IEO, cryptocurrency, forex, tokenized gross sales, securities, or commodities.

Alarmed Crypto Wide 3AC Weighing Asset Gross sales, Bailout Alternatives: WSJ

Three Arrows Capital has reportedly hired approved and monetary advisors to relieve it set up a thought to pay support investors and lenders. Zhu and Davies Mulling Bailout Three Arrows Capital…

Celsius Has Paused Buyer Withdrawals

The reach follows weeks of rumors that the crypto lender would possibly maybe presumably face insolvency points because of the decline within the crypto market. Celsius Customers Blocked From Accessing Funds Celsius looks…

Bitcoin “Is Failing as an Digital Money Gadget”: Edward Snowden

The American whistleblower has expressed his concerns regarding the financialization of the crypto residence, nonetheless added that he sees mountainous promise within the expertise. Edward Snowden Talks Bitcoin Edward Snowden…