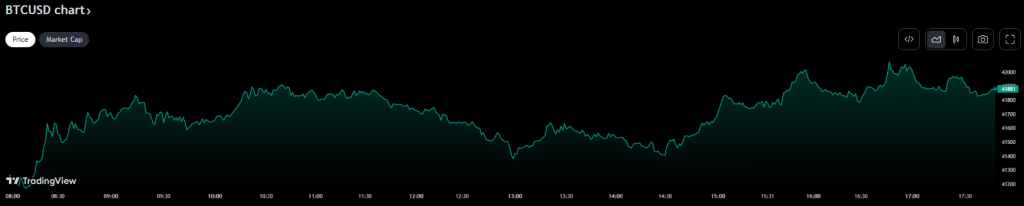

After hitting $43,000 final week, Bitcoin traded valid below it over the weekend. Nonetheless the price of the cryptocurrency dropped vastly on Tuesday, reaching $41,800. Following Bitcoin’s December surge, investors chose to take earnings, which led to this descend. There used to be a broad decline the night before, with Bitcoin momentarily falling as low as $40,300.

Because of the decline, the discontinue cryptocurrency within the sector had nearly a week’s price of features erased in simplest 20 minutes on Sunday night. Per statistics from TradingView, Bitcoin seen a dramatic 7% decline at approximately 9:00 p.m. Eastern Time, falling from above $43,200 to as low as $40,290.

Bitcoin Liquidations And Stock Fluctuations

Following months of stagnation in a itsy-bitsy procuring and selling fluctuate, Bitcoin has been frequently rising in recent weeks. The cryptocurrency has considered a principal change in temper and performance after previously experiencing market disinterest.

Coinglass data signifies a flurry of positions liquidated within the 12 hours initiating on Sunday night, with upwards of $335 million in liquidations across cryptocurrencies, and roughly $300 million of that in prolonged positions. The clarification for the abrupt swing down used to be no longer straight away evident. In precisely Bitcoin alone, liquidations totaled over $89 million.

Source: TradingView

Stocks comprise fluctuated this week as investors prepare for a busy match time table. Expectedly high volatility this week—the Federal Reserve’s most up-to-date monetary policy possibility is due on Wednesday, and well-known November inflation data is approaching Tuesday—is the clarification for this fright.

Related Learning: Retain Your Horses: Bitcoin May perhaps perhaps maybe Descend Inspire To Below $38,000, These Analysts Say

When assessing the blow their own horns rise in bitcoin, chart analysts all agree that a extra most principal dip within the cryptocurrency will most definitely be mandatory before they would reevaluate how solid the rally is.

The sharp decline forced the liquidation of long Bitcoin positions worth over $270 million. Source: CoinGlass.

Rob Ginsberg from Wolfe Evaluation agrees, declaring that there would possibly perhaps be loads of momentum within the persevering with rising growth. Per the consensus of industry mavens, there would possibly perhaps be a overall belief within the sturdiness and longevity of Bitcoin’s upward trajectory.

Easy A Luminous Road Ahead

A form of favorable catalysts for the cryptocurrency is considered within the upcoming year, with the first being the assorted of a bitcoin commerce-traded fund (ETF). Investors protect up for a label spike within the months that educate the predicted halving of Bitcoin within the spring of 2024.

BTCUSD trading at $41,877 on the daily chart: TradingView.com

Even supposing some investors are inflamed by the likelihood of an ETF, the market as a full is feeling certain and anticipating most principal changes to the cryptocurrency ambiance.

The label of Bitcoin has risen by about 150% on story of the originate up of the year, despite the hiccup. The most principal driver of the surge has been expectations that large monetary establishments will soon be in a problem to aquire most principal exposure to Bitcoin thru commerce-traded funds (ETFs).

The market’s overall expectation that the US Federal Reserve would originate up cutting pastime rates within the center of 2024 has added to the toughen for Bitcoin’s label climb.

Featured image from Adobe Stock

Disclaimer: The article is supplied for academic capabilities simplest. It doesn’t signify the opinions of NewsBTC on whether or no longer to aquire, promote or protect any investments and naturally investing carries risks. You is susceptible to be suggested to habits your comprise research before making any investment choices. Employ data supplied on this web residing entirely at your comprise threat.