House » Bitcoin » Bitcoin brief holders underwater as market tension mounts – Glassnode

by

Sep. 4, 2024

Prolonged-term holders slack income-taking as accumulated provide matures, historically signaling earn market transition.

Key Takeaways

- Bitcoin brief holders are experiencing important unrealized losses amid market tension.

- The Sell-Aspect Threat Ratio suggests a saturation of income and loss-taking actions in doubtlessly the most modern worth fluctuate.

Half this text

Bitcoin (BTC) brief holders are bearing the brunt of market tension as costs protect underwater, as reported by Glassnode.

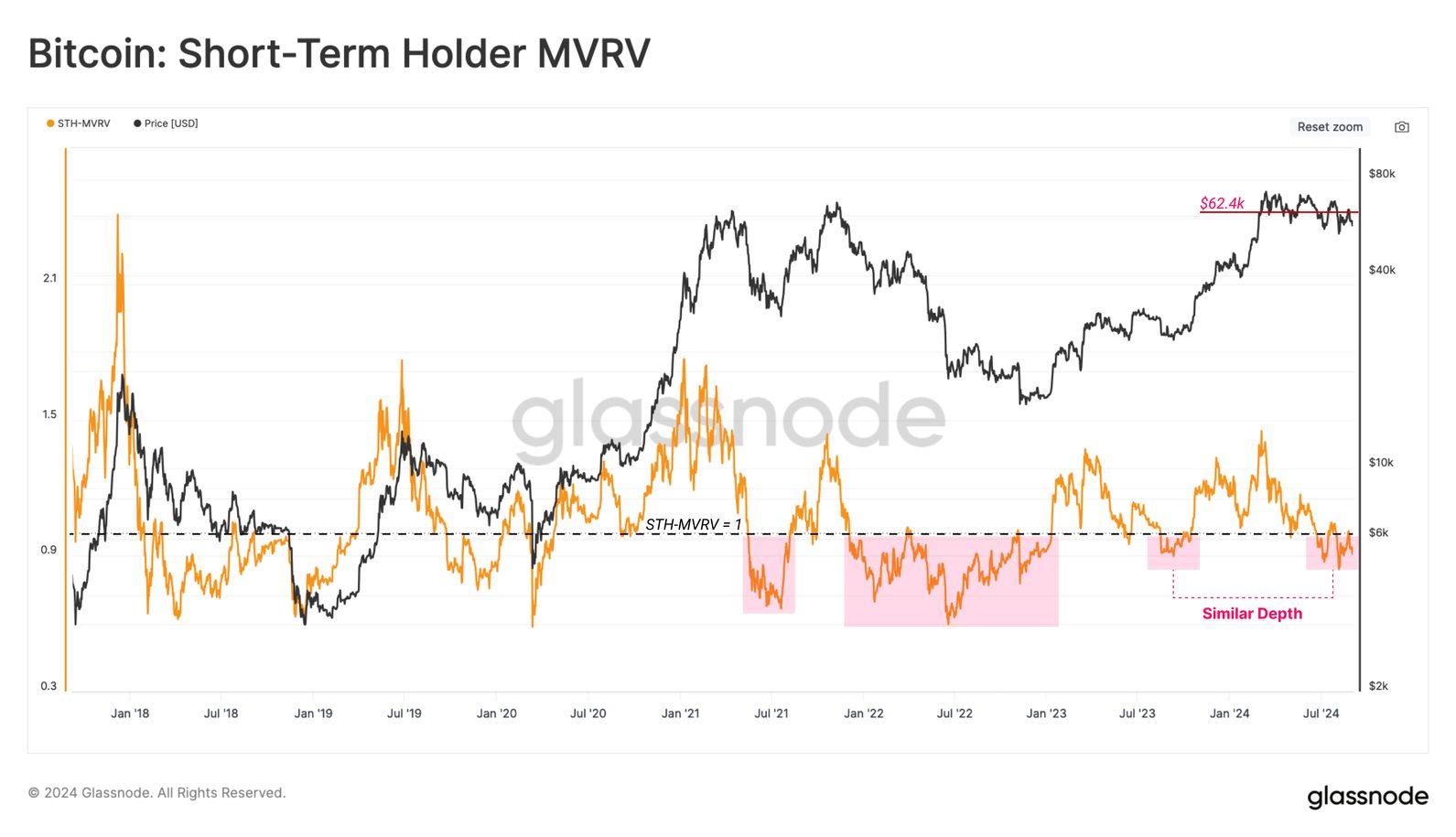

The Short-Term Holder cohort, representing contemporary question of in the market, is experiencing important unrealized losses. The magnitude of these losses has constantly increased over the outdated few months, though it has no longer but reached plump-scale earn market territory.

The Short-Term Holder MVRV Ratio has fallen below the breakeven price of 1.0, procuring and selling at phases the same to August 2023 for the duration of the restoration rally after the FTX failure.

“This tells us that the life like contemporary investor is holding an unrealized loss. Assuredly talking, unless the placement worth reclaims the STH worth foundation of $62.4k, there is an expectation for additional market weakness,” added Glassnode analysts.

All age bands true thru the Short-Term Holder cohort are currently holding unrealized losses. Realized income has drastically declined following Bitcoin’s all-time excessive at $73,000 while loss-taking events are elevated and trending increased as the market downtrend progresses.

Moreover, the Sell-Aspect Threat Ratio has declined into the lower band, suggesting most money transacted on-chain are doing so end to their long-established acquisition worth.

This ability a saturation of income and loss-taking actions true thru doubtlessly the most modern worth fluctuate and historically suggests capacity for increased volatility.

Sturdy scheme

On the different hand, Prolonged-Term Holders ranking slowed their income-taking, with provide accumulated for the duration of the all-time excessive trail-up ceaselessly maturing into Prolonged-Term Holder situation. Nonetheless, this pattern has historically took place for the duration of transitions towards earn markets.

Nonetheless, Glassnode analysts spotlight that unrealized income are tranquil six instances greater than the quantity of unrealized losses observing the broader market.

“Spherical 20% of procuring and selling days ranking considered this ratio above doubtlessly the most modern price, underscoring the surprisingly robust financial scheme of the life like investor,” they added.

Despite these challenges, Bitcoin stays only 22% below its all-time excessive, a shallower drawdown than in outdated cycles. Within the period in-between, the life like Bitcoin investor stays somewhat wholesome when put next to outdated market moments.

Half this text