The day earlier than this day, Bitcoin (BTC) spiked over 6% following Federal Reserve Chairman Jerome Powell’s announcement that they are adjusting its protection and hinting at a doable 25bps price slice at the following meeting on September 18. This unexpected files has fueled Bitcoin’s most in vogue volatility, with costs swinging unpredictably within the previous weeks.

Well-known on-chain files from CryptoQuant is providing a glimmer of optimism. In accordance with the records, traders are positioning for additional designate appreciation.

As the market digests the Fed’s fresh stance, all eyes are on Bitcoin to glimpse if this might perhaps perhaps impress the starting of a fresh bullish phase.

Bitcoin Details Exhibiting Market Optimism

Bitcoin is shopping and selling above $63,000 and gaining momentum as it prepares to rupture previous the serious $65,000 impress.

On-chain files from CryptoQuant unearths growing market optimism, highlighting a important style that would pressure costs better. Specifically, Bitcoin alternate reserves on centralized exchanges enjoy plummeted to an all-time low. Since the end of July, the provision of BTC on exchanges has lowered from over 2.75 million to approximately 2.67 million, representing a 3% drop in barely 30 days.

This decline means that much less BTC is readily available for shopping and selling on exchanges, which might perhaps perhaps place a offer shock, a scenario the assign ask of outstrips offer, main to a doable designate surge. As Bitcoin’s availability on exchanges diminishes, the probability of a designate amplify grows.

With Bitcoin starting to create strength, the market is carefully monitoring this style, potentially pushing Bitcoin into fresh bullish territory.

BTC Impress Circulation: $65,000 Next?

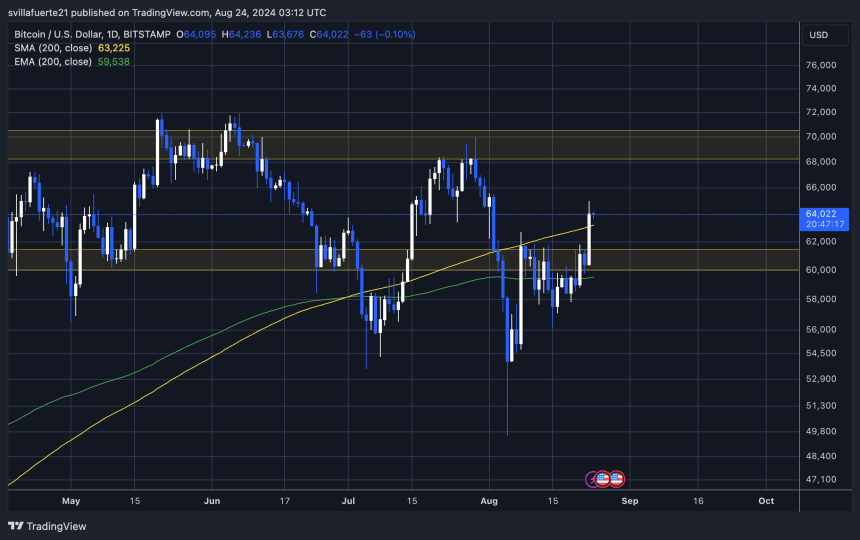

After two weeks of volatility and consolidation, Bitcoin is within the mean time shopping and selling at $64,100 at the time of writing, preserving above the indispensable day-to-day 200 Transferring Realistic (MA).

This stage is indispensable for bulls to defend the uptrend in a better time body. For the designate to rupture previous the $65,000 impress, it must verify its bullish structure by preserving above the $57,500 stage. Ideally, staying above the day-to-day 200 Exponential Transferring Realistic (EMA), which sits at $59,538, is preferable.

These ranges are indispensable for organising continued upward momentum. Holding above them would signal strength available within the market, reinforcing self assurance among traders and investors. The files of declining Bitcoin alternate reserves and the central financial institution’s protection announcement were met with optimism. Merchants are increasingly extra expecting a Bitcoin rally within the arriving months, fueled by these bullish indicators.

Disclaimer: The records came all over on NewsBTC is for tutorial applications

ultimate. It would not report the opinions of NewsBTC on whether or not to aquire, sell or defend any

investments and naturally investing carries risks. You is vulnerable to be suggested to habits your own

research sooner than making any investment decisions. Use records equipped on this web house

fully at your own pains.