On-chain files reveals Bitcoin exchange reserves hang now reached novel 4-year lows, a signal that would possibly perchance reward to be bullish for the crypto’s worth.

Bitcoin Swap Reserve Has Sunk Down Extra Only within the near past

As pointed out by an analyst in a CryptoQuant put up, the BTC exchange reserve has been occurring, suggesting buying has been going within the market.

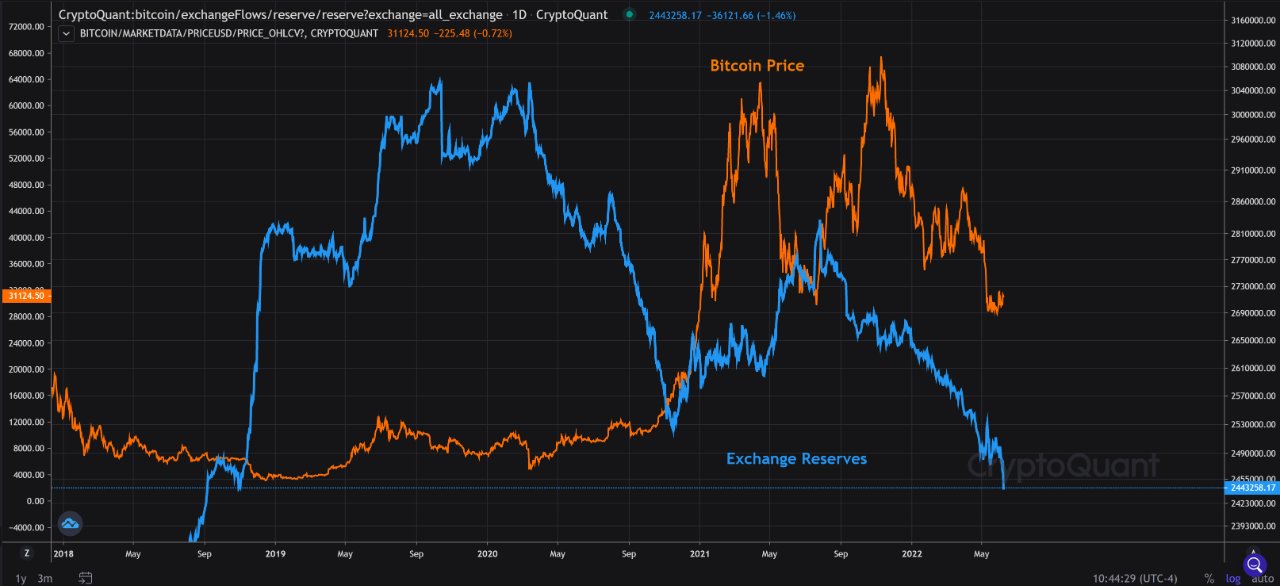

The “all exchanges reserve” is an indicator that measures the total amount of Bitcoin for the time being saved in wallets of all centralized exchanges.

When the cost of this metric goes up, it intention merchants are depositing a uncover amount of coins to exchanges simply now.

Such a trend, when prolonged, can even be bearish for the cost of the crypto as holders most frequently transfer their crypto to exchanges for selling applications.

Related Learning | When Greed? Bitcoin Market Beaten Below One Plump Month Of Grief

On the varied hand, a downtrend within the reserve suggests merchants are withdrawing their BTC from exchanges for the time being. This produce of trend can even be bullish for the cost of the crypto.

Now, here’s a chart that reveals the trend within the Bitcoin exchange reserve over the last few years:

The worth of the metric appears to be like to hang skilled downwards motion over the closing year | Source: CryptoQuant

As you’d look within the above graph, the Bitcoin exchange reserve has noticed some entertaining motion down not too long within the past, taking its rate to novel 4-year lows.

Right here’s a continuation of the total downtrend within the indicator that has been going on for nearly a stout 12 months now.

Related Learning | U.S. Macro Rigidity To blame For Whole Bitcoin Downtrend

This is able to moreover simply suggest that the market has been in a explain of constant accumulation, which would mean a provide shock would possibly be deepening within the BTC market.

As a consequence of accomplish-ask dynamics, the kind of shock can even be optimistic for the cost of the cryptocurrency within the long term.

On the opposite hand, some files from December 2021 suggests that the growth of as a lot as the moment funding instruments hang ETFs are doubtless one amongst the causes on the serve of the exchange reserve’s decline.

The coins are simply transferring from one offer of promoting stress into one more. Such a shift would mean that a provide shock wouldn’t occur correct by declining exchange reserves.

Nonetheless, a pair of of the decline would possibly moreover simply restful restful be from buying within the market so a reducing reserve can restful be bullish for the cost of Bitcoin.

BTC Establish

On the time of writing, Bitcoin’s worth floats around $30.1k, up 1% within the past week. Over the closing month, the crypto has lost 12% in rate.

Appears hang the cost of the crypto has moved sideways over the final couple of days | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com