Data exhibits Bitcoin has been stuck in a historically tight 14-day differ these days, something that has decompressed into tall strikes within the previous.

Bitcoin 14-Day Vary Has Been Extremely Slim Neutral these days

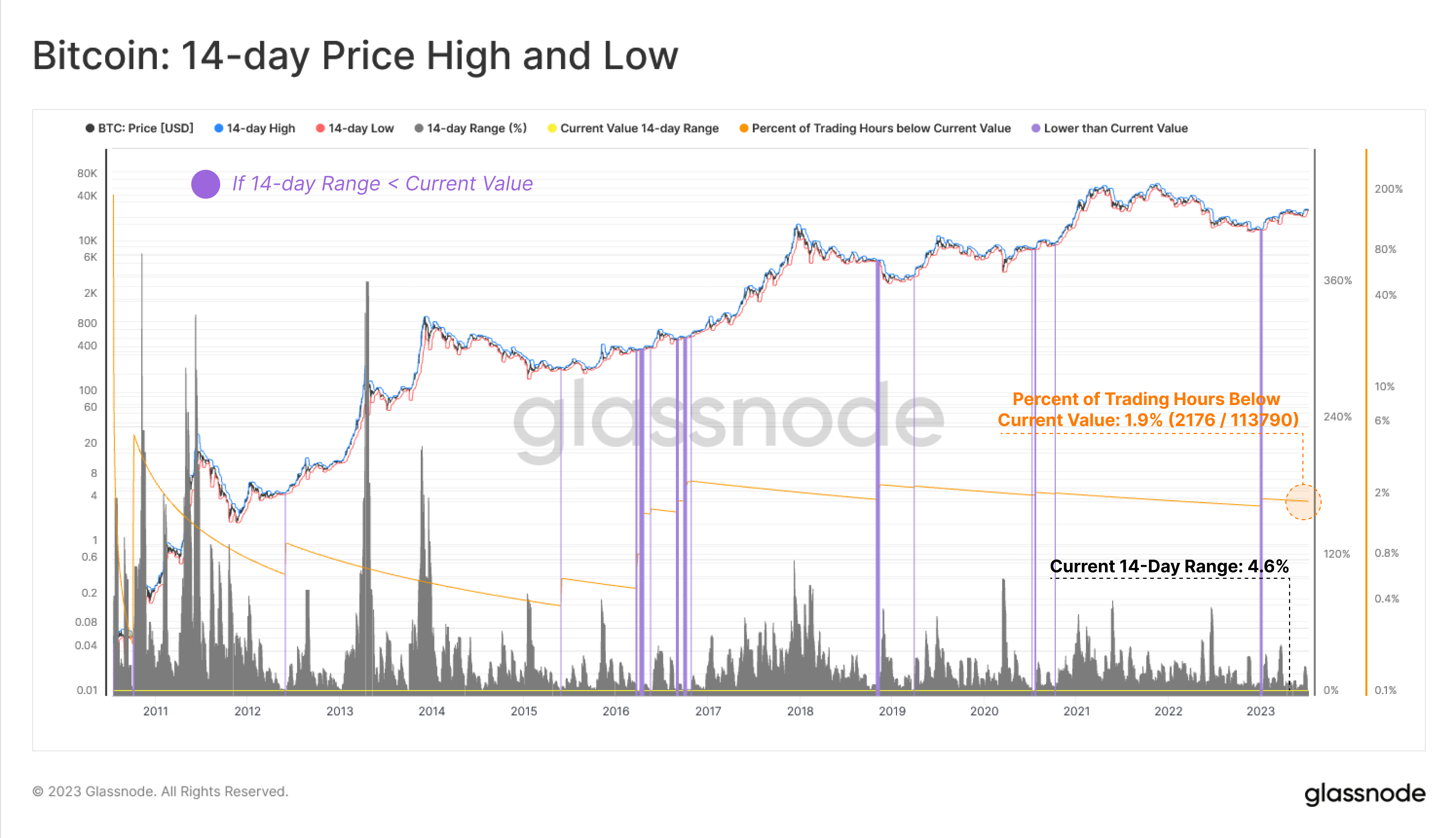

Consistent with data from the analytics company Glassnode, the 14-day differ has handiest been narrower than now at some level of lower than 2% of the cryptocurrency’s complete shopping and selling existence. The “14-day differ” right here refers back to the percentage distinction between the end and bottom recorded within the Bitcoin designate at some level of the previous two weeks.

This indicator can expose us about how unstable the asset’s designate has been these days. When its fee is high, it ability that the coin has noticed a orderly amount of fluctuation for the period of the last fourteen days, and thus, the designate has registered high volatility.

On the quite loads of hand, low values of the metric imply the cryptocurrency hasn’t been that unstable as its designate has moved by handiest a low percentage at some level of the previous couple of weeks.

Now, right here is a chart that exhibits the model within the Bitcoin 14-day differ over the total history of the asset:

Looks like the value of the metric has been quite low in recent days | Source: Glassnode on Twitter

As highlighted within the above graph, the Bitcoin 14-day differ is within the mean time at a fee of excellent 4.6%, meaning that the native high and low for the period of the previous two weeks like differed by excellent 4.6%.

Here’s an especially low fee when in contrast to what has most frequently been the norm for BTC. Within the chart, Glassnode has also marked the instances where the indicator has noticed even lower values than glorious now.

As will likely be seen from the purple bars, there like handiest been only about a occurrences where Bitcoin has traded within a narrower differ. By strategy of the numbers, handiest 2,176 hours within the lifetime of the asset like registered lower values of the metric, that are the same to about 1.9% of the total shopping and selling lifetime of the oldest cryptocurrency.

An spirited sample has historically followed at any time when the indicator has recorded such low values of the 14-day differ. From the graph, it’s seen that Bitcoin has on the total succeeded in these intervals of extremely low volatility with a violent pass.

This violent pass will likely be towards both route, as both crashes and rallies like followed a slim differ. Though, curiously, the majority of these strikes had been towards the upside.

Basically the most up to the moment incidence of this sample used to be ability befriend in January, glorious ahead of the most up to the moment rally on the foundation started. It will seem that befriend then as wisely, the tight differ exploded into a pointy upwards pass.

If history is anything else to saunter by, the most up to the moment low values of the 14-day differ would perchance well fair imply that but some other tantalizing Bitcoin pass would perchance well very wisely be more likely to take space within the shut to future. And naturally, if precedence is to take into legend, this form of pass would perchance well very wisely be extra doable to be towards the up route.

BTC Value

On the time of writing, Bitcoin is shopping and selling around $30,900, up 1% within the last week.

BTC appears to be surging | Source: BTCUSD on TradingView

Featured image from André François McKenzie on Unsplash.com, charts from TradingView.com, Glassnode.com