Reason to believe

Strict editorial policy that makes a speciality of accuracy, relevance, and impartiality

Created by enterprise experts and meticulously reviewed

The ideal standards in reporting and publishing

How Our News is Made

Strict editorial policy that makes a speciality of accuracy, relevance, and impartiality

Advert discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper ecu odio.

The tag of Bitcoin jumped by better than double digits over the final week, striking in a single of its finest performances so a ways in 2025. After struggling below $87,000 for the previous two months, the flagship cryptocurrency has ultimately returned above the $90,000 level.

It stays unclear whether or no longer the sizzling BTC tag surge is a continuation signal for the bull cycle. Nonetheless, the most modern on-chain data suggests that the investor sentiment may maybe maybe be turning obvious all over again, that arrangement that the Bitcoin bull scamper may maybe maybe also in the end be wait on on.

‘ETF Printer Goes Brrr’ – Crypto Analyst

In an April 25 put up on the X platform, a crypto analyst with the pseudonym Maartunn shared an on-chain perception into the sizzling tag rally experienced by the sphere’s largest cryptocurrency. Per the gain pundit, the rising scamper for meals of alternate-traded fund (ETF) investors within the previous few days may maybe maybe also need contributed to the Bitcoin bullish momentum.

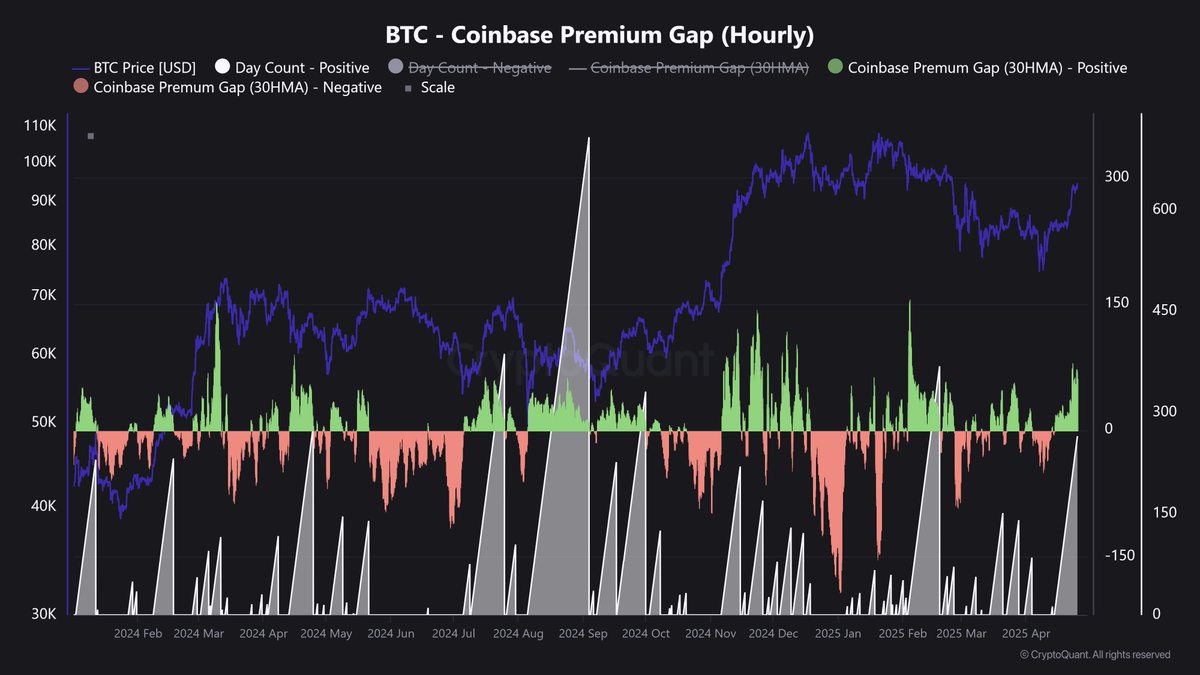

The relevant indicator here is the Coinbase Top class Gap, which tracks the adaptation between the Bitcoin tag on US-essentially essentially based Coinbase Pro (USD pair) and world Binance alternate (USDT pair). When this difference is understated, it implies BTC is shopping and selling at a elevated tag on Coinbase than on Binance.

Now and again, a obvious Coinbase Top class Gap indicates that US-essentially essentially based investors are shopping Bitcoin aggressively, particularly by ETF issuers that use Coinbase as a liquidity provider. Per data from CryptoQuant, this metric’s 30-hour transferring average has stayed obvious for better than 265 straight hours (approximately 11 days).

Maartunn infamous that here is the fifth-longest tear since the place aside Bitcoin alternate-traded funds began shopping and selling in January 2024. Now and again, a continuously obvious Coinbase Top class Gap suggests that US institutional gamers and gigantic investors are prepared to pay above-market prices for Bitcoin — particularly by regulated channels delight in ETFs or custodial platforms.

This prolonged obvious tear is historically correlated with obvious tag motion and accumulation phases for the flagship cryptocurrency. Therefore, the most modern spike within the Coinbase Top class Gap may maybe maybe also provide the ample condition to reduction Bitcoin’s newly-found bullish momentum and maybe catalyze the next significant breakout.

Bitcoin Ticket At A Be taught

The tag of Bitcoin has climbed above $95,000 for the predominant time since February, reflecting a 2% lift within the previous 24 hours. Per CoinGecko data, the premier cryptocurrency has surged by better than 13% within the previous seven days.

Featured image created by DALL.E, chart from TradingView

Disclaimer: The information found on NewsBTC is for educational purposes

only. It does no longer signify the opinions of NewsBTC on whether or no longer to buy, promote or hang any

investments and naturally investing carries risks. You are instructed to conduct your luxuriate in

study sooner than making any investment decisions. Expend data supplied on this web living

completely at your luxuriate in possibility.