The most up-to-date Bitcoin cycle will seemingly be its “most worrying” one yet if the drawdown in this on-chain metric is the leisure to whisk by.

Total Quantity Held By 1k-10k BTC Value Band Has Sharply Gone Down These days

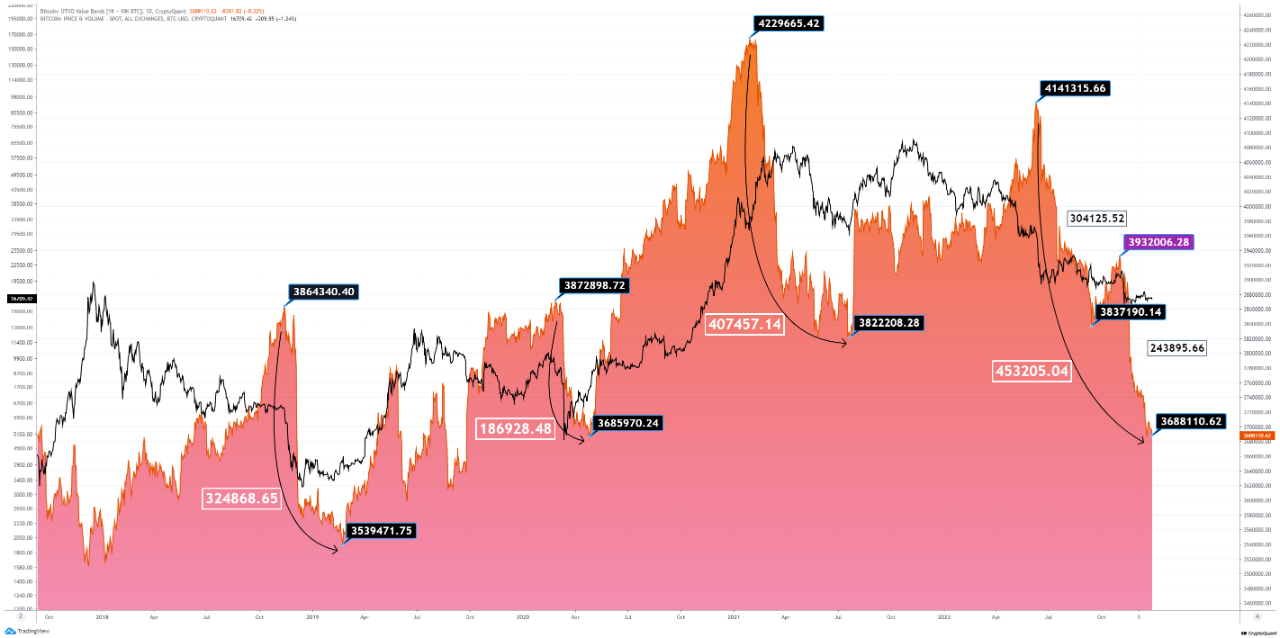

As pointed out by an analyst in a CryptoQuant post, the most up-to-date drawdown within the holdings of the 1k-10k BTC price band is truly the most drastic within the historical previous of the crypto. The associated indicator here is the “UTXO Value Bands,” which tells us the total amount of coins every price band is keeping within the market.

UTXOs are divided into these “price bands” or teams in accordance to their most up-to-date price. To illustrate, the 100-1k BTC price band entails all UTXOs carrying between 100 and 1,000 coins. Right here, the associated UTXO price band is the 1k-10k BTC vary, a historically major cohort as in overall handiest the whales have wallets with UTXO quantities so properly-kept.

Now, the beneath chart displays the pattern within the total holdings of this price band over the closing five years:

Looks like the value of the metric has rapidly declined in recent months | Source: CryptoQuant

The graph reveals that the total selection of coins held by this Bitcoin UTXO price band has viewed a moving drop this year. In all, the drawdown has amounted to 453,205.04 BTC being dumped by this cohort for the reason that high seen in June 2022.

For comparability, within the 2018/19 accumulate market, the 1k-10k BTC price band seen a total drawdown of 324,868.65 BTC from the excessive. At some level of the COVID sad swan atomize of 2020, the community moreover distributed a large amount, shedding 186,928.48 from its holdings.

And within the bull disappear at some level of the most major half of of closing year, these whales reduced their holdings by 407,457.14 BTC between the high in February and the July bottom. The most up-to-date drawdown within the metric’s price is the sharpest that Bitcoin has viewed yet. Thanks to this reality, the quant exclaims the most up-to-date cycle to be the “most worrying” one within the historical previous of the asset to this level.

An entertaining sample can moreover be viewed within the chart; on every occasion the 1k-10k BTC has executed with the distribution and commenced collecting again, Bitcoin has felt a bullish impact. “Most incessantly, the market can handiest win better when this cohort has sufficient confidence to construct up again,” explains the analyst. “And for the time being, we quiet no longer win any obvious indicators from this cohort.”

BTC Tag

On the time of writing, Bitcoin’s mark floats around $16,600, down 1% within the closing week.

BTC seems to have gone down during the past day | Source: BTCUSD on TradingView

Featured describe from mana5280 on Unsplash.com, charts from TradingView.com, CryptoQuant.com

Hououin Kyouma

Loves to jot down, interested in cryptocurrency. In the within the period in-between discovering out Physics at college.