In a tumultuous flip of events, the cryptocurrency market has been rattled by a moving decline in Bitcoin prices. After a sustained interval of outstanding gains and file highs, Bitcoin has plunged to a weekly low of $65,000, marking a considerable setback for merchants.

At the time of writing, Bitcoin numbers had been all painted in crimson, and trading at $65,710, losing price within the 24-hour and weekly timeframes by 5.6% and 4.5%, respectively, in accordance with files from Coingecko.

A couple of days after its earlier low of $68,000, Bitcoin plummeted to its current stage, a figure now not considered in per week, as bears persevered of their downward stress.

Bitcoin plunging in the last 24 hours. Source: Coingecko.

Altcoins Also Take hold of A Beating

While Bitcoin bears the brunt of the downturn, altcoins are now not spared from the fallout. Ethereum (ETH) and Binance Coin (BNB) own also witnessed huge losses, shedding 10% of their price or more.

Dogecoin and Shiba Inu, two standard meme coins, own experienced even steeper declines, plunging by 20% and with reference to 30%, respectively. The broader altcoin market mirrors Bitcoin’s downward trajectory, amplifying the sense of unease among merchants.

BTC market cap currently at $1.29 trillion. Chart: TradingView.com

Bitcoin: Affect On Market Dynamics

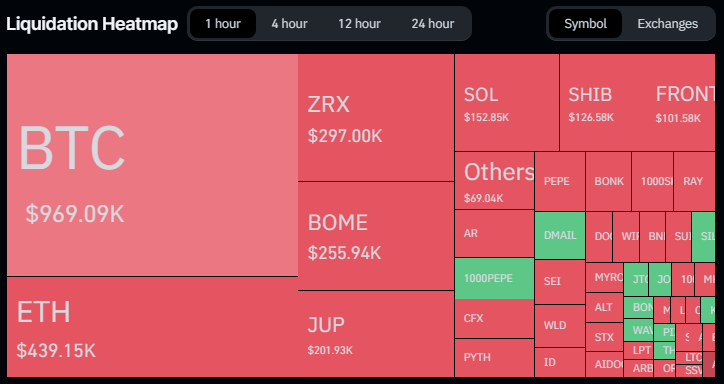

Basically the most unique assign correction in Bitcoin has reverberated across the cryptocurrency landscape, reshaping market dynamics and investor sentiment. The surge in liquidations, with over 151,000 merchants facing margin calls within the previous 24 hours, underscores the magnitude of the market upheaval. Bitcoin’s dominance on the market might perchance be evident as it accounts for the lion’s part of the full liquidations, highlighting its pivotal characteristic in shaping overall market trends.

Since the decline in price, the full market liquidations own reached $426 million, with Bitcoin taking the worst hit.

Liquidation Spree

The amount that the assign of Bitcoin has liquidated over the final 24 hours has exceeded $104 million, with long merchants losing the most money—they lost $86 million when put next with $18 million for short sellers. Ethereum observed a $48 million overall liquidation, with $33 million going to long merchants and $15 million going to short merchants, on legend of the losing bustle.

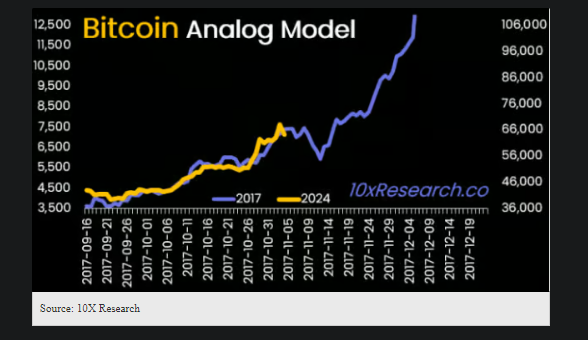

Analyst Sounds Awe Siren

Within the period in-between, market analysts equivalent to Markus Thielen, CEO of 10x Evaluation, own sounded the apprehension bells, warning of additional downside risks for Bitcoin. Thielen’s prediction of a doable plunge to $63,000 sends a sobering message to merchants, urging warning and prudence in navigating the current market ambiance.

His insights shed light on underlying concerns about Bitcoin’s market constructing, at the side of low trading volumes and liquidity, which exacerbate the agonize of moving assign corrections.

Amidst the market turbulence, merchants are grappling with the implications of Thielen’s diagnosis and adjusting their suggestions accordingly. The generation of meme coin mania appears to be to be waning, prompting merchants to reassess their positions and secure profits whereas they peaceable can.

Featured image from Kinesis Money, chart from TradingView

Disclaimer: The article is supplied for academic functions finest. It does now not relate the opinions of NewsBTC on whether or now not to aquire, sell or build any investments and naturally investing carries risks. You’re instructed to habits your hold analysis sooner than making any funding selections. Utilize files supplied on this web arena completely at your hold agonize.