Bitcoin appears poised for fundamental upside motion following a solid delivery to 2025. Nonetheless, questions dwell about the market’s overall neatly being and whether the most fresh bullish momentum will even be sustained over the approaching weeks and months. Right here, we’ll rob an self reliant and data-pushed survey into the underlying numbers supporting our most up-to-date pattern.

For a more in-depth survey into this topic, inspect a most up-to-date YouTube video here: Bitcoin Data Pushed Diagnosis & On-Chain Roundup

Miner Recovery

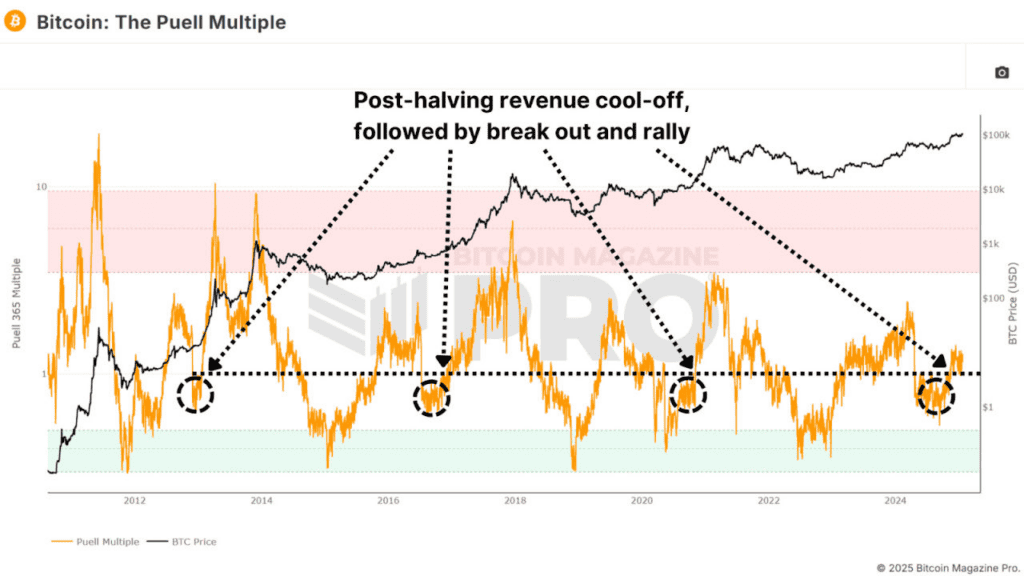

The Puell Extra than one, a measure comparing miners’ on daily basis USD revenue to its yearly practical, suggests that Bitcoin’s main community energy remains solid. Historically, after a halving tournament, miner revenue experiences a fundamental dip due to the 50% block reward bargain. Nonetheless, the Puell Extra than one now no longer too lengthy in the past climbed above the key ticket of 1, indicating a restoration and a presumably bullish phase.

Outdated cycles allege that crossing and retesting the price of 1 generally precedes main ticket rallies. This sample is repeating, signaling solid market again from mining exercise.

Enormous Upside Potential

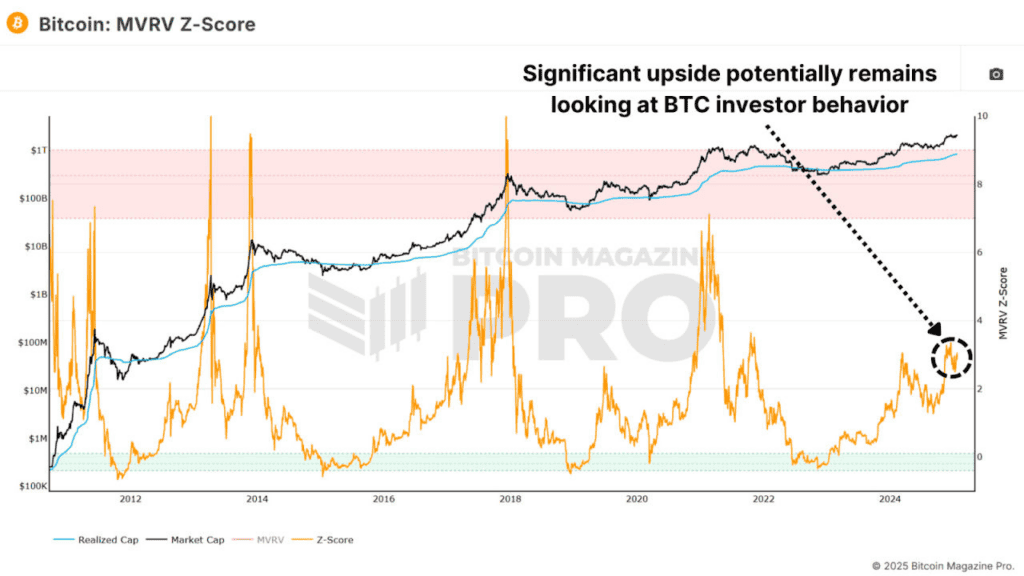

The MVRV Z-Rating, a metric inspecting Bitcoin’s market ticket relative to its realized ticket, or practical accumulation ticket for all BTC, suggests most up-to-date values dwell neatly beneath historical height regions, outlining mighty room for development.

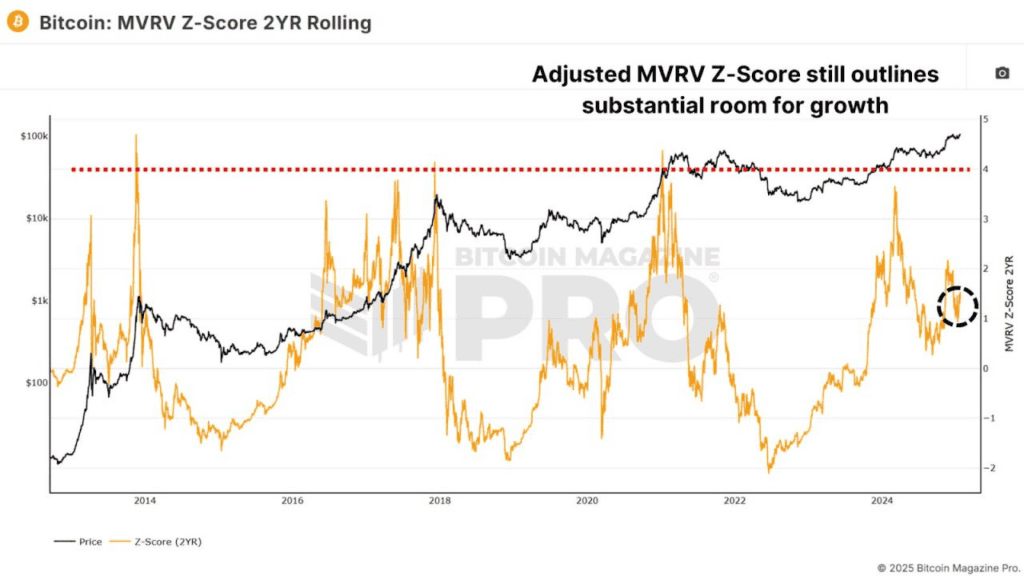

A two-year rolling version of the MVRV Z-Rating, which adjusts for evolving market dynamics, also shows bullish capacity. Even by this adjusted measure, Bitcoin is removed from outdated cycle height stages, leaving the door delivery for additional ticket appreciation.

Sustainable Sentiment

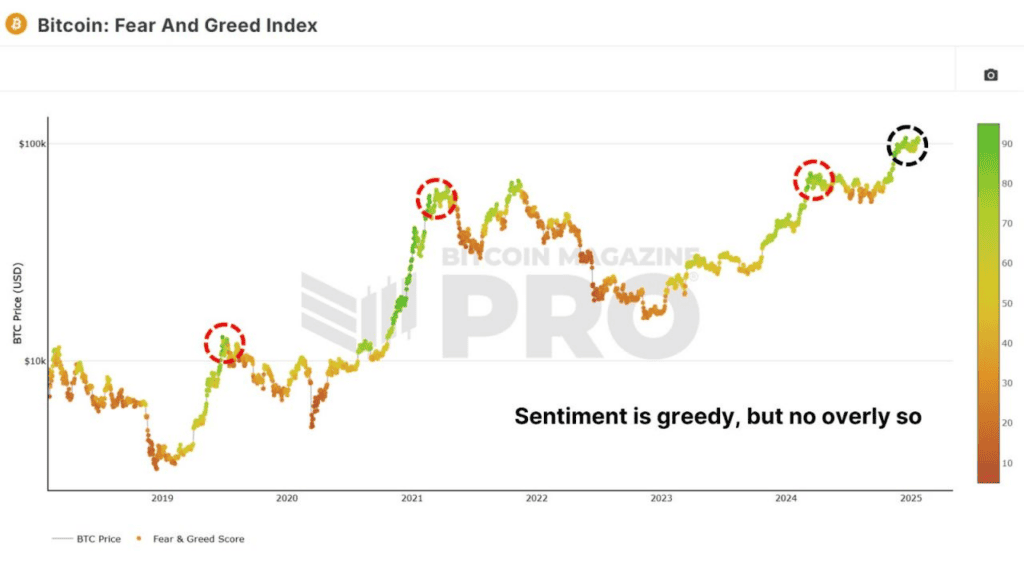

The Bitcoin Horror and Greed Index is presently at a healthy and sustainable amount of Greedy sentiment, indicating grasping however sustainable sentiment. Historical files from the 2020-2021 bull cycle shows that greed stages around 80-90 can persist for months, supporting prolonged bullish momentum. Supreme when values methodology outrageous stages (95+) does the market on the full face fundamental corrections.

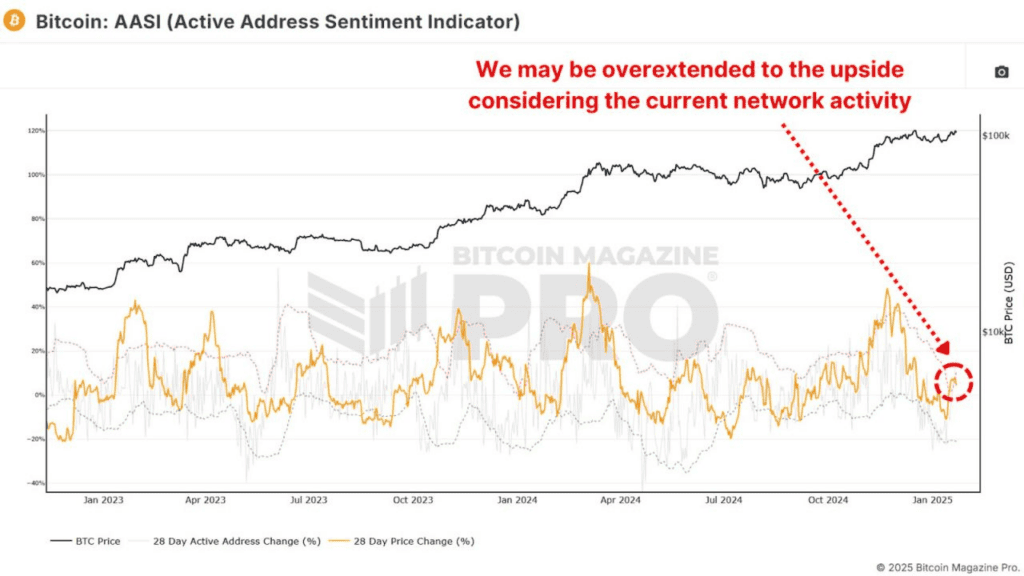

Community Process

The Active Take care of Sentiment Indicator finds a limited dip in community exercise, suggesting retail traders hold yet to fully re-enter the market. Nonetheless, that is also a particular impress, indicating untapped retail ask that can perchance perhaps also fair gasoline the following leg of the rally.

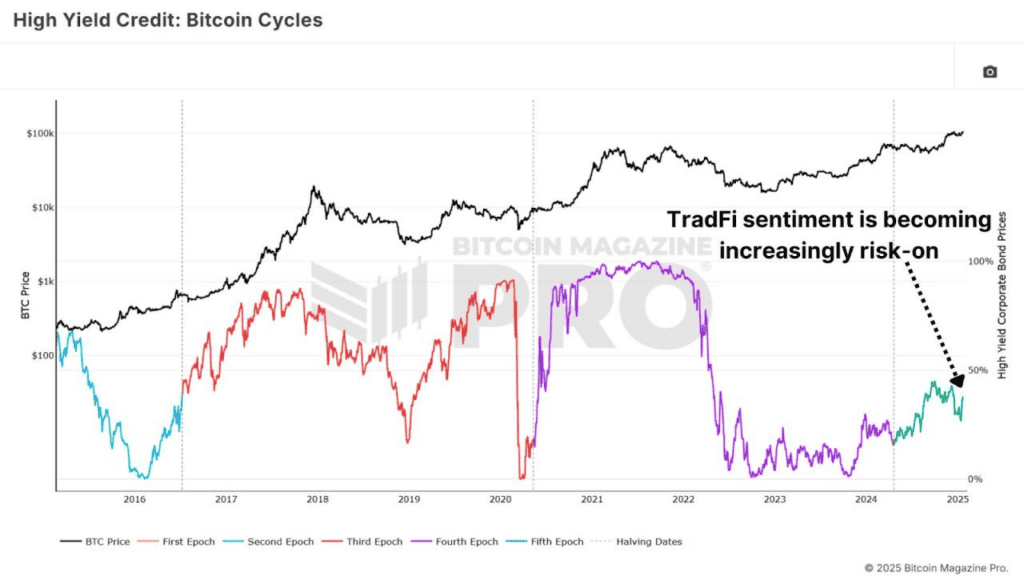

Possibility Appetite Shifts

Mature market sentiment is showing bettering indicators. Excessive Yield Credit rating appetite is increasing as the macro-financial atmosphere shifts to a more possibility-on outlook. Searching at company bonds that supply larger curiosity charges due to their decrease credit ratings compared to funding-grade bonds. Historically, there became a solid correlation between Bitcoin’s performance and periods of heightened global possibility appetite, which hold generally aligned with bullish phases in Bitcoin’s ticket.

Conclusion

Bitcoin’s on-chain metrics, market sentiment, and macro level of view all allege a continuation of the most fresh bull market. While brief-term volatility is step by step possible, the convergence of these indicators suggests that Bitcoin is neatly-positioned to construct and presumably surpass our most up-to-date all-time high in the reach future.

For more detailed Bitcoin evaluation and to fetch entry to developed aspects delight in are living charts, customized indicator alerts, and in-depth commerce experiences, inspect Bitcoin Journal Pro.

Disclaimer: This article is for informational solutions most efficient and also can fair now no longer be regarded as monetary recommendation. Always invent your have analysis sooner than making any funding choices.