On-chain data shows the Bitcoin reserve of derivative exchanges has surged up now not too prolonged previously because the rate of the crypto has persevered to smash down.

Bitcoin Derivatives Alternate Reserve Observes Difficult Uptrend

As explained by an analyst in a CryptoQuant post, the crashing BTC label could presumably perhaps additionally very neatly be forcing whales and prolonged-term holders to initiate fast positions in expose to hedge their portfolios.

The “derivative change reserve” is a trademark that measures the general amount of Bitcoin at expose latest on wallets of all derivative exchanges.

When the rate of this metric goes up, it formula coins are stepping into derivative exchanges correct now. This type of pattern could presumably perhaps additionally mean patrons are opening leveraged positions for the time being, which is ready to end result in better volatility in the rate of the crypto.

On the assorted hand, a downtrend in the indicator implies patrons are withdrawing their coins from these exchanges at expose.

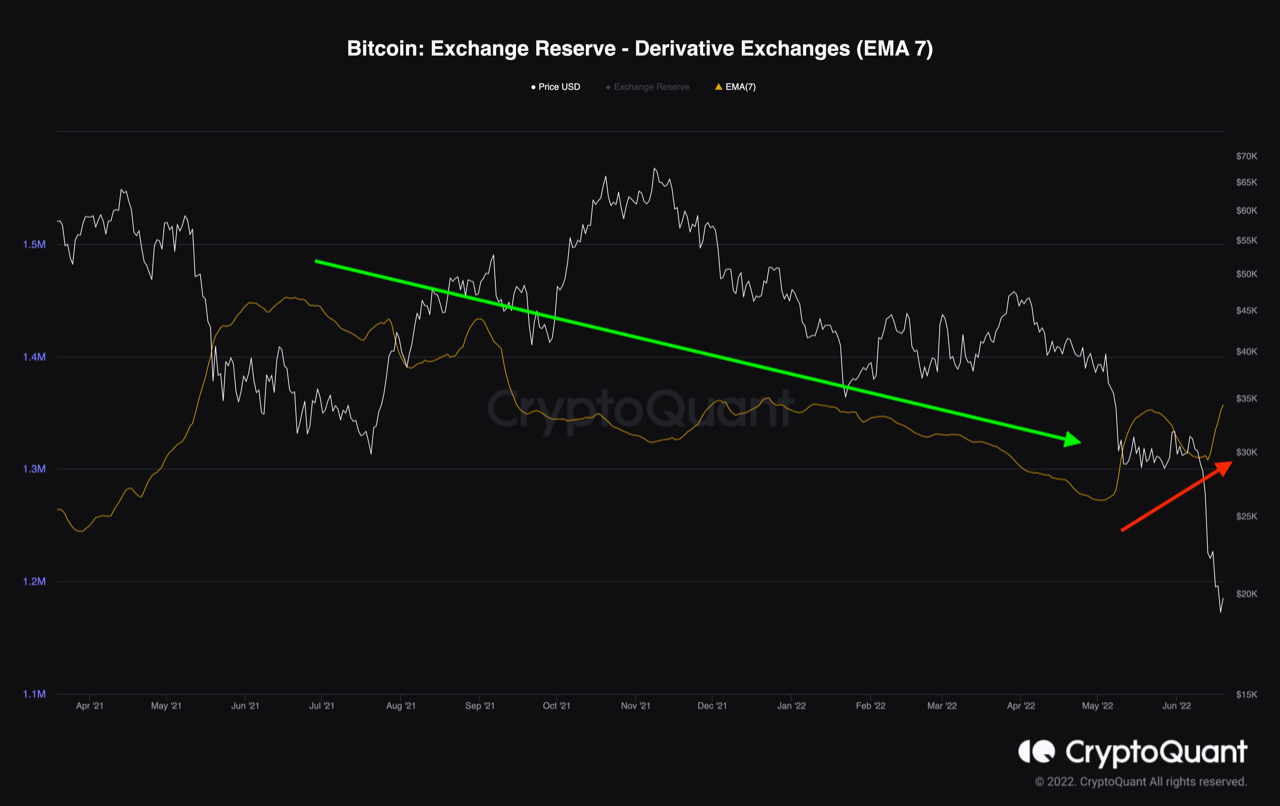

Now, right here is a chart that shows the pattern in the Bitcoin derivative change reserve over the final yr:

The EMA 7 rate of the metric appears to be like to accept as true with seen some uptrend now not too prolonged previously | Source: CryptoQuant

As you have to presumably perhaps perhaps presumably additionally seek in the above graph, the Bitcoin derivative change reserve had been heading down for moderately a while, till now not too prolonged previously when the indicator’s rate yet yet again started rising up.

Contemporary data suggests that the smash in the coin’s label has pushed around 50% of the general BTC provide into loss. In accordance to this, many prolonged-term holders and whales are also sure to be underwater correct now.

Connected Discovering out | Bitcoin Breaches $19K Level – Will Selloff Proceed? What’s The Subsequent Bottom?

The quant believes that the uplift in the derivative reserve is thanks to those prolonged-term holders and whales panicking about their portfolios losing rate.

These holders are having a seek to hedge their portfolios and decrease danger by opening fast positions on derivative exchanges.

The analyst capabilities out, on the opposite hand, that such aggressive shorting would manufacture device more promoting rigidity, inflicting the rate to glance extra drawdown.

Connected Discovering out | Bitcoin Prolonged-Timeframe Holders Now Non-public Almost about 80% Of Realized Cap

But one other possibility also arises from this arena, and that can presumably perhaps perhaps a tall fast squeeze. Hundreds of query and a surprising reversal in the rate of Bitcoin could presumably perhaps accept as true with to happen before such an tournament can defend field.

The quant thinks it will additionally defend more time and extra decline in the rate of the crypto for the correct prerequisites to align for it.

BTC Label

On the time of writing, Bitcoin’s label floats around $19.3k, down 29% in the closing seven days. During the final month, the crypto has misplaced 33% in rate.

Appears to be like cherish the rate of BTC has rebounded aid a miniature little bit of after a dip below $18k | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com