The below is from a latest edition of the Deep Dive, Bitcoin Magazine’s top price markets e-newsletter. To be among the many first to safe these insights and quite a bit of on-chain bitcoin market prognosis straight to your inbox, subscribe now.

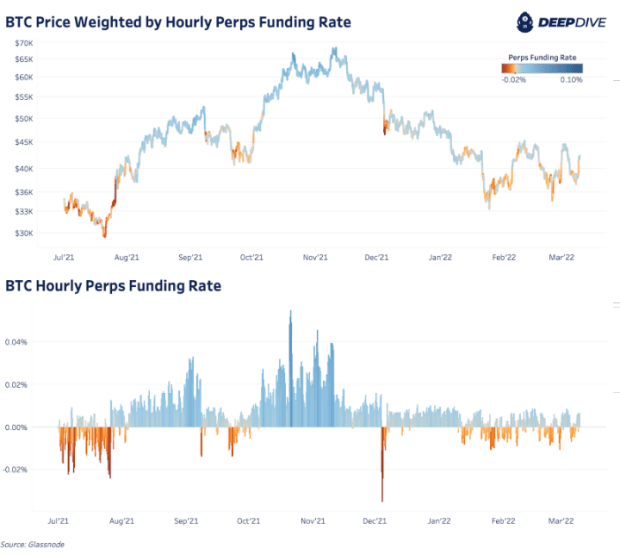

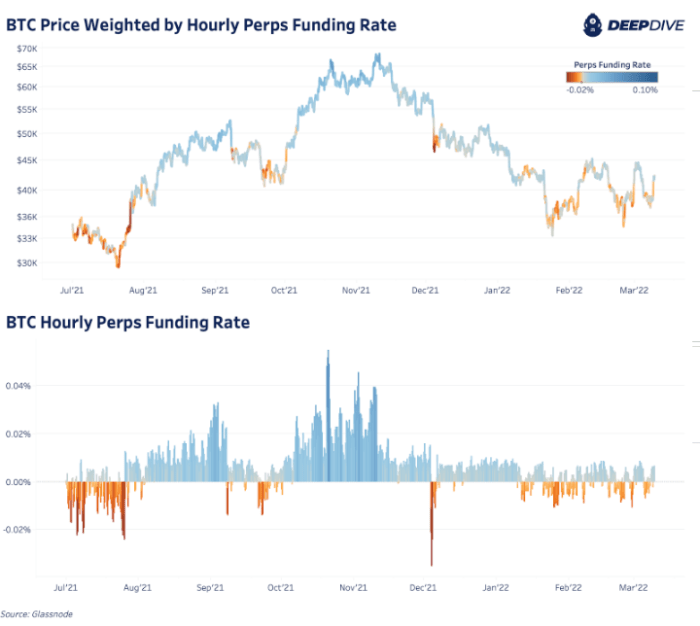

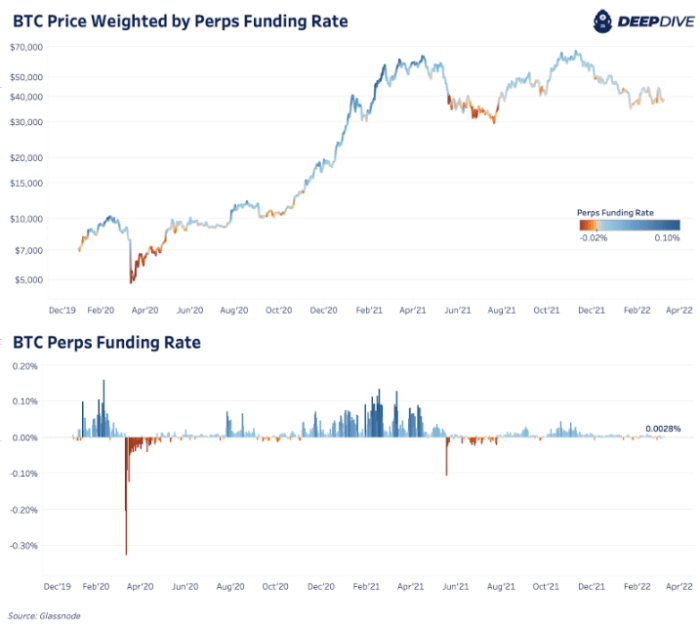

On the unusual time we’ll duvet the most up-to-date in the bitcoin derivatives market. On the time of writing, the value of bitcoin is up approximately 8% over the day earlier than this day’s time. When examining the derivatives data, the old two months procure brought on a regime of periodically unfavorable funding, exhibiting the caution shown by market contributors right thru a period of macroeconomic uncertainty.

The bitcoin set weighted by the hourly perpetual funding price demonstrates caution by market contributors.

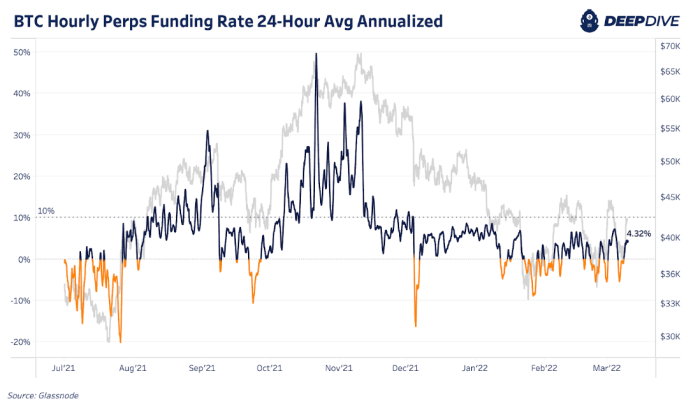

Confirmed below is the funding rates annualized, with approximately 10% annualized being the market fair price to crawl lengthy. As we stand this day, funding price sentiment emphasizes a skewed, below-fair sentiment to the design back since gradual January.

For added context, right here is the day by day moderate of perpetual swap funding rates since the birth of 2020:

The day by day moderate bitcoin set weighted by perpetual funding price affords extra context for market sentiment.

It’s grand that old regimes of spinoff bearishness saw funding rates crawl grand deeper into unfavorable territory, which can screech to the maturation and institutionalization of the asset class.

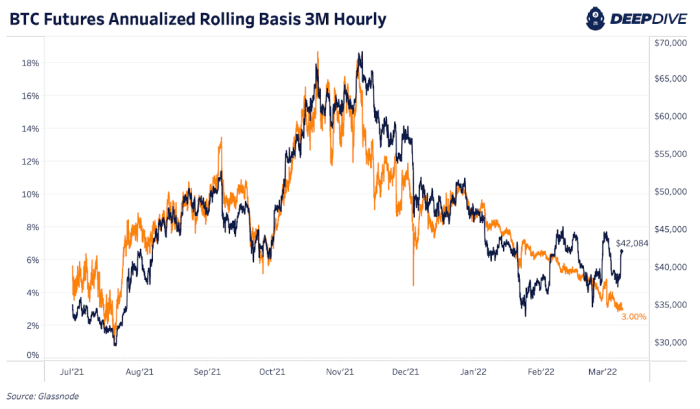

Equally, quarterly futures annualized foundation continues to tumble, whereas set severely caught a expose.

Equities indices are moreover purchasing and selling up by approximately 3% this day, which is probably to procure contributed to the streak set movement viewed in the bitcoin market.

As for the level of open passion in the derivatives market, it continues its downtrend since November in each and each BTC and USD phrases. Originate passion is down 14.76% and 44.34% respectively. With the falling annualized rolling foundation, this is one other manner to ogle the structural decline of the danger appetite ask of for bitcoin over the final 5 months.