Bitcoin is in an uptrend and could well well likely breach the all-predominant liquidation line at $72,000. At the space price, the coin is up approximately 25% from Might possibly fair lows and could well well rally, even breaking all-time highs of $73,800.

Retail Hobby In Bitcoin Falling Even As Costs Methodology All-Time Highs

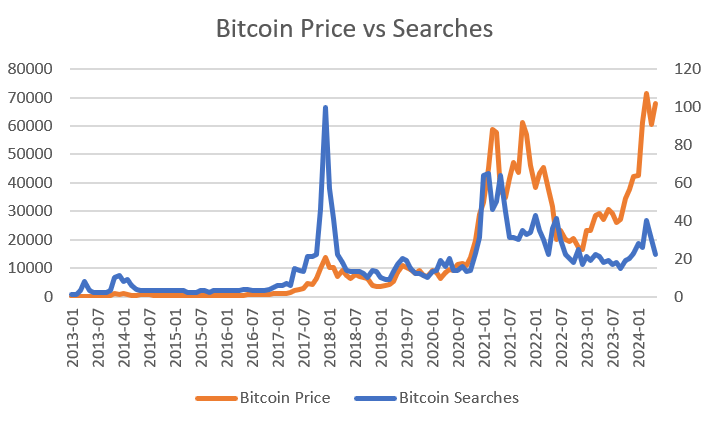

Even as Bitcoin prints spectacular bigger highs, Mike Alfred, a “value investor” and an stuffed with life crypto commentator, has identified a surprising disconnect: natural search engine traffic on Google is losing. Apart from the spike in search from Q4 2023 except early January 2024, the vogue has been southwards since then.

The upswing in natural searches on Google at some level of this period is basically as a result of United States Securities and Exchange Price (SEC) on the brink of approve the commence of space Bitcoin exchange-traded funds (ETFs).

The joy sooner than this milestone and the multi-year wait no longer simplest saw BTC prices rally but also improved sentiment. Subsequently, extra of us, mostly new to the industry, were interested to be taught extra regarding the digital asset.

The rally from Q4 2023 has no longer fizzled and continues to space rates. Bitcoin dipped in February sooner than bouncing sharply, breaking $70,000 and printing new all-time highs at $73,800. Despite the incontrovertible truth that prices fell weeks later, dipping to as shrimp as $56,500 in Might possibly fair, bulls are on the brink of rob bigger prices.

Alternatively, not just like the hobby viewed from Q4 2023 by early January 2024, natural searches, as talked about, are surprisingly falling. Alfred argues that this divergence components in direction of an “institutionally driven bull market” and still “early.”

In the past, and sooner than the approval of space Bitcoin ETFs, shops performed a super role in utilizing impress and sentiment. Alternatively, institutions are in play with the products readily accessible in the United States.

One observer notes that these market contributors are at possibility of present “committed ownership,” negating the necessity for constant online searches.

Encouragingly, the absence of retailers on this cycle–extending from the search in natural searches–signifies a drop in speculative procuring for. Subsequently, in the present relate, the Bitcoin market is extra liquid and genuine than sooner than.

Rising Awareness, Affordability A Reason?

There are several explanations in the support of the drop in natural searches on Google and diversified search engines. Despite the incontrovertible truth that institutions could well well very properly be in the support of the rally, the decline is since the humble consciousness of Bitcoin has grown over the years.

Of display mask, the availability of space Bitcoin ETFs and frequent media protection hold boosted the coin’s recognition.

Besides this, there could be one other facet of affordability. With the price hovering round $71,200, procuring a total Bitcoin is out of reach for many. In return, this dampens retail investor enthusiasm, leading them to hold in solutions more inexpensive altcoins admire Dogecoin or Solana.

Feature represent from Shutterstock, chart from TradingView

Disclaimer: The files chanced on on NewsBTC is for tutorial capabilities

simplest. It does no longer signify the opinions of NewsBTC on whether to buy, promote or attend any

investments and naturally investing carries risks. You are told to habits your hold

study sooner than making any funding choices. Employ files provided on this web site

entirely at your hold possibility.