Info reveals Bitcoin and Ethereum contain formed a divergence within the Funding Rate indicator, with traders going prolonged on BTC, short on ETH.

Bitcoin & Ethereum Funding Charges Are Showing Opposite Values

In a brand recent publish on X, on-chain analytics firm Santiment has talked about how the Funding Rate has developed for Bitcoin and Ethereum amid essentially the most up to the moment market volatility.

Bitcoin and varied cryptocurrencies noticed some surprising mark swings within the course of the day before at the moment, with BTC’s mark first rallying to $90,300 in a blink, but then crashing back toward $86,000 apt as rapidly. The coin’s decline later extended to $85,300.

Whereas BTC returned to about the same levels as earlier than the flash surge, the same wasn’t apt about Ethereum. After its rally to $3,000, ETH plummeted to $2,830, earlier than one other leg all of the manner down to about $2,790. Sooner than the volatility storm, the cryptocurrency turned into trading around $2,920.

The adaptation in mark action would be a ability element within the back of the divergence that has formed within the derivatives market sentiment as gauged by the Funding Rate.

The Funding Rate retains song of the periodic quantity of funds that derivatives traders are paying on all centralized exchanges. A favorable payment on the indicator is a signal that prolonged traders are paying the short ones, whereas a detrimental one implies bearish positions outweigh the bullish ones.

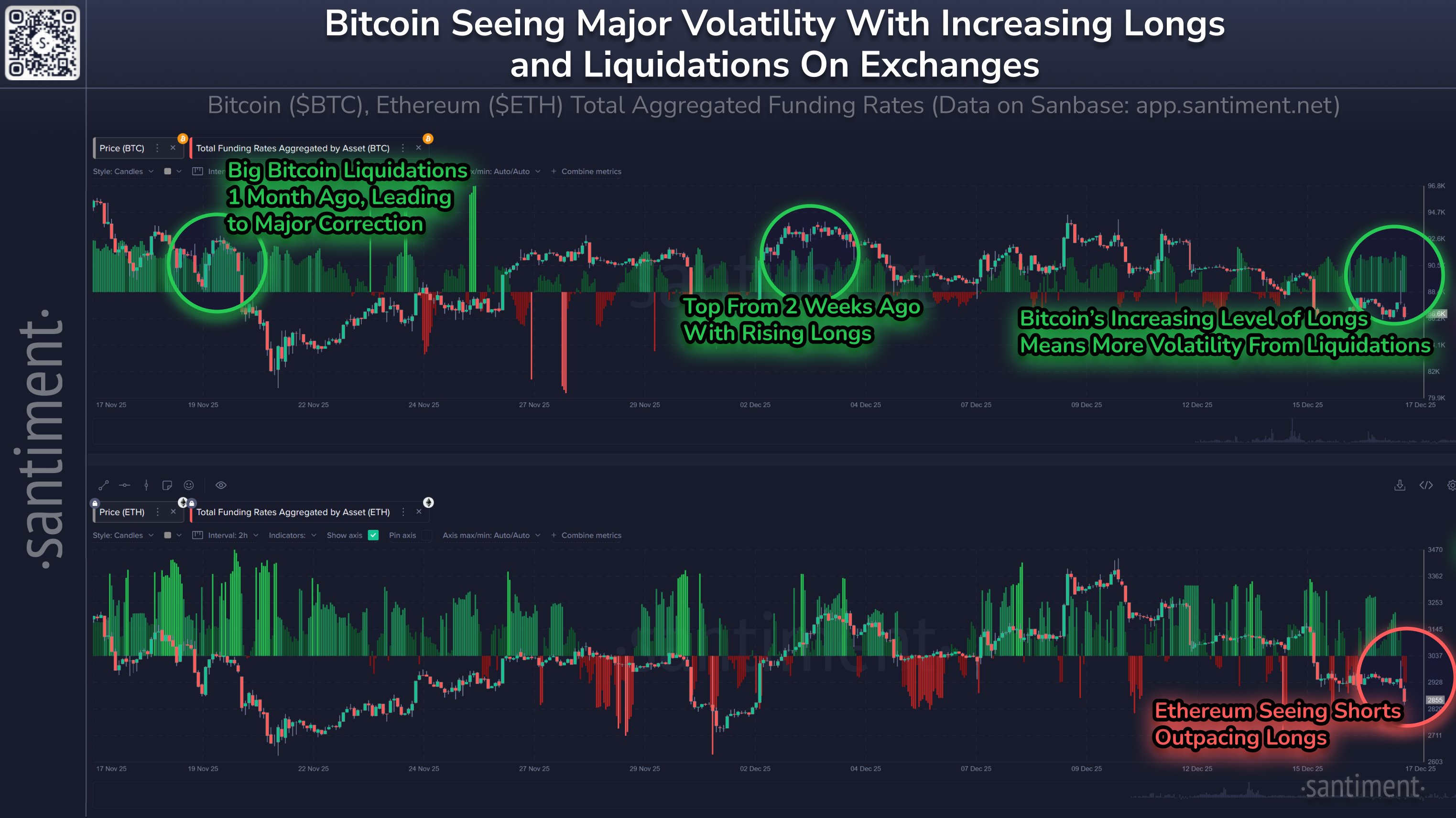

Now, right here is the chart shared by Santiment that reveals how the Funding Rate has modified for Bitcoin and Ethereum over the previous month:

As displayed within the above graph, the Bitcoin Funding Rate has been sure for the previous couple of days, indicating that a bullish mentality has been dominant amongst the traders. This sentiment has been maintained even after the price volatility.

Ethereum turned into additionally staring at a favorable payment on the Funding Rate prior to the volatility, but unlike for BTC, the sort didn’t final. Since ETH has gone via its quick surge and flash fracture, the indicator has grew to alter into crimson, a signal that shorts contain started outpacing longs.

The indisputable truth that bullish sentiment around ETH has weakened, alternatively, can also merely not essentially be detrimental. In response to Santiment, highly leveraged prolonged positions contain traditionally ended in racy liquidation events and volatility. This kind turned into additionally seen within the course of some recent tops and pullbacks.

Thus, excited about that the Funding Rate is detrimental for Ethereum now, the likelihood of volatility can also merely be lower. That said, Bitcoin’s prolonged-heavy market can also amassed be related for the cryptocurrency.

As Santiment explains, “all resources will amassed switch with Bitcoin, which contrivance Bitcoin’s funding charges need to discontinuance objective or chase detrimental in present to account for a clear path back to $100K and for altcoins to rebound.”

BTC Tag

Bitcoin has recovered back to $87,100 following its descend on Wednesday.

Featured image from Dall-E, Santiment.earn, chart from TradingView.com