Key Takeaways

- Bitcoin looks to be forming a market backside.

- Likewise, Ethereum has entered the “different zone.”

- BTC and ETH should always damage resistance to march to unique all-time highs.

Bitcoin and Ethereum seem sure for prime volatility as a few on-chain metrics counsel that a market backside is near. Mild, these cryptocurrencies should always overcome a fundamental obstacle to resume the uptrend.

Bitcoin in Accumulation Mode

Bitcoin looks to be trading in oversold territory whereas crypto lovers live afraid of further losses.

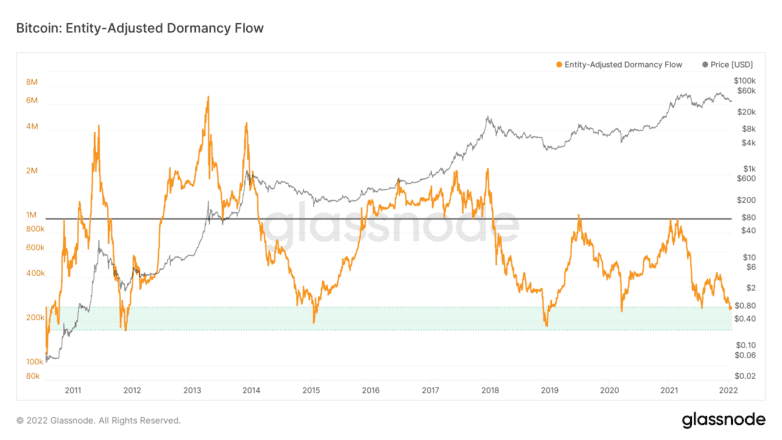

Bitcoin’s Entity-Adjusted Dormancy Circulation suggests that the flagship cryptocurrency will seemingly be forming a native backside. It considers the ratio of the sizzling market capitalization to the annualized dormancy cost to settle whether experienced market persons are spending their BTC.

Whenever there may perhaps be a substantial decrease in spending from the so-known as “outdated arms,” the Entity-Adjusted Dormancy Circulation drops below the 250,000 threshold, representing an most though-provoking historical desire zone. This on-chain metric has nearly perfectly timed every market backside since 2011, and a an analogous outlook may perhaps well perchance now play out as dormancy cost has overtaken market capitalization.

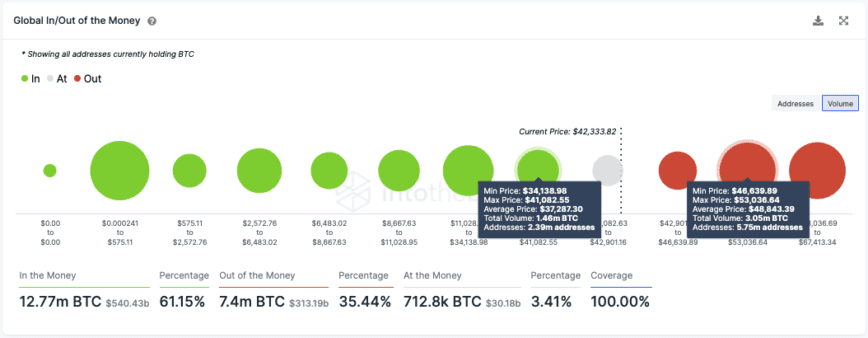

Mild, IntoTheBlock’s Worldwide In/Out of the Money mannequin finds that Bitcoin faces stiff resistance forward. Roughly 5.75 million addresses had bought bigger than 3 million BTC between $46,700 and $53,000.

Finest a substantial damage above this present barrier can insist that the pioneer cryptocurrency will resume its bull market.

It is price noting that Bitcoin in the meanwhile trades above a skinny layer of give a take to. Roughly 2.4 million addresses defend on the sphere of 1.5 million BTC between $34,000 and $41,000. This kind of fundamental search recordsdata from wall should always defend to forestall the bellwether cryptocurrency from capitulating to $30,000 or even $20,000.

Ethereum in Opportunity Zone

Ethereum looks to receive entered an accumulation zone, encouraging sidelined patrons to acquire reduction in the market.

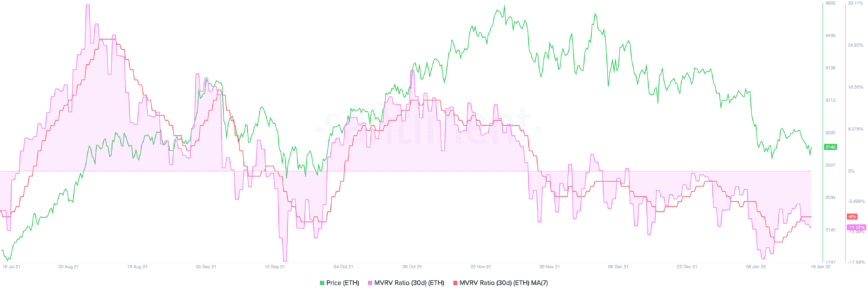

The Market Payment to Realized Payment (MVRV) index suggests that Ethereum is undervalued on the sizzling stamp ranges. This basic index measures the present earnings or loss of addresses that obtained ETH over the past month.

The 30-day MVRV ratio in the meanwhile hovers at -11.12%, indicating that Ethereum sits in the “different zone.” The decrease the MVRV ratio, the upper the chance of an upward stamp movement.

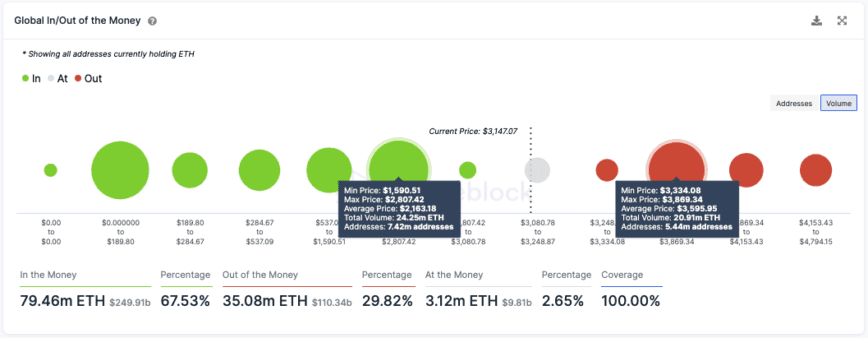

Although Ethereum is sitting on high of feeble give a take to, transaction historical past exhibits that it completely has one obstacle to beat to resume the uptrend.

More than 5.44 million addresses receive obtained roughly 21 million ETH between $3,300 and $3,900. A decisive candlestick end above this resistance barrier may perhaps well perchance propel ETH against unique all-time highs.

Regardless, patrons should always pay end consideration to the $2,800 give a take to level as any indicators of weak point around it can perchance perchance most certainly also reduction market individuals to sell. Below such circumstances, Ethereum may perhaps well perchance fall to $2,500 or even $2,000.

Disclosure: At the time of writing, the author of this portion owned BTC and ETH.

The records on or accessed through this website is obtained from fair sources we predict about to be correct and legit, however Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any recordsdata on or accessed through this website. Decentral Media, Inc. is no longer an funding advisor. We attain no longer give personalized funding advice or other monetary advice. The records on this website is field to replace without see. Some or the overall recordsdata on this website may perhaps well perchance became outdated, or it’d be or became incomplete or wrong. We may perhaps well perchance, however are no longer obligated to, update any outdated, incomplete, or wrong recordsdata.

It is advisable to always never carry out an funding decision on an ICO, IEO, or other funding in accordance with the guidelines on this website, and also it’s worthwhile to always never clarify or in every other case rely upon any of the guidelines on this website as funding advice. We strongly imply that you just consult a licensed funding advisor or other qualified monetary expert whenever you occur to may perhaps well perchance most certainly be searching for funding advice on an ICO, IEO, or other funding. We attain no longer rep compensation in any carry out for examining or reporting on any ICO, IEO, cryptocurrency, foreign money, tokenized sales, securities, or commodities.

NFT Inform: Your on-ramp to the sector of NFTs

At Tatum, we’ve already made it great easy to originate your have NFTs on a few blockchains without having to learn Solidity or originate your have dapper contracts. Somebody can deploy…

Bitcoin, Ethereum Dip Below Key Psychological Footholds

The two most dominant crypto property had been shedding formula for weeks since reaching all-time highs in November. As of late, on the opposite hand, they every dipped below key psychological ranges. Psychological Resistance Nearly…

Ethereum Hits Necessary Stage After Breaking Below $3,000

Ethereum has began the week in sluggish mode after its stamp suffered one other 7% dip. While many market persons are displaying indicators of disaster, the number two crypto looks to…

Bitcoin Struggling Towards Bearish Momentum

Bitcoin is struggling to receive a real give a take to flooring as bears appear to receive taken over. Historical stamp motion suggests that BTC should always defend above $37,300 to avoid capitulation. Bitcoin…