Bitcoin and Ethereum surged the previous day, buoyed by the largest day-to-day outflow since February and an expand in the volume of whale wallets.

Bitcoin’s Lift the Dip Myth

On-chain recordsdata presentations that crypto investors fetch been gathering Bitcoin and Ethereum this week.

Even supposing both resources tumbled earlier this week, the crypto market’s “engage the dip” gallop change into on beefy expose. BTC instant recovered after an 8% tumble Tuesday to sweep lows of $31,000, closing that day at $33,400.

This certain pattern persisted on Wednesday with Bitcoin rising 12%. On-chain recordsdata presentations that the uptick change into backed by necessary pronounce procuring for on exchanges.

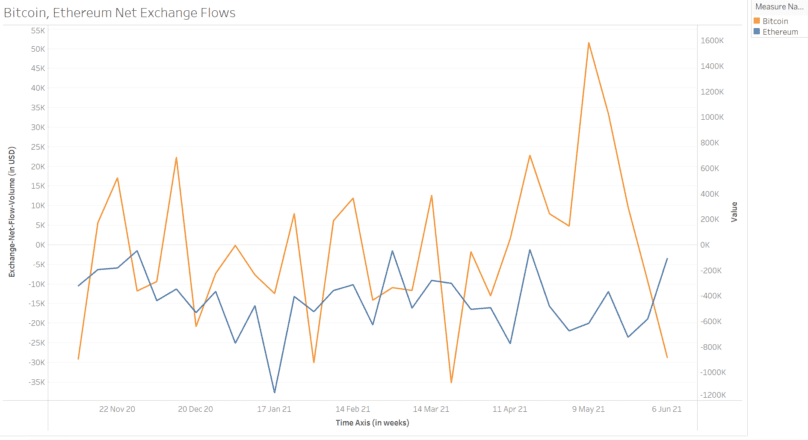

Bitcoin’s accumulate gallop from crypto exchanges change into harmful the previous day. Round 18,800 BTC worth $630 million primarily based fully on final day’s shopping and selling prices, stages no longer seen since February.

Bitcoin’s accumulate gallop change into certain from mid-April via Would possibly perchance possibly perchance also. Its tag also dropped during these sessions.

The return of harmful gallop means that investors moved more Bitcoin from exchanges to self-hosted wallets and utterly different capabilities.

Moreover, the weekly accumulate gallop for Ethereum has been harmful since November final year.

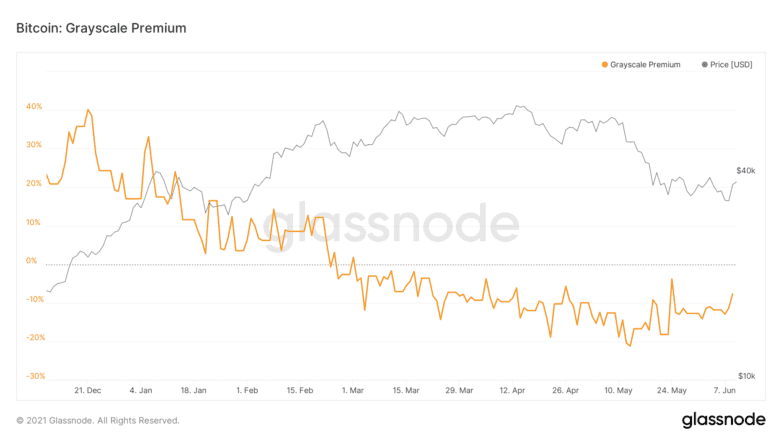

Moreover swap outflows, there change into also an expand in GBTC premiums, indicating procuring for request at institutional brokerages esteem Fidelity and Schwab. Nonetheless, the shares are collected promoting at a bargain. The gash tag diminished from 12% to 7% the previous day.

Source: Glassnode

Source: GlassnodeThe gash tag on Ethereum’s ETHE shares, in the period in-between, is 3%.

Ethereum Leads Among Whales

The volume of whale-sized Bitcoin and Ethereum wallets also spiked the previous day, which is a great signal for prolonged-term bullish gallop. The expand in the volume of Ethereum wallets change into higher than in Bitcoin.

The volume of addresses maintaining more than 10,000 ETH increased by 19, which equates to on the very least $4.7 billion worth of ETH added to whale wallets. The volume of Bitcoin wallets maintaining more than 1,000 BTC (worth around $350 million) fell the previous day however is up 16 attributable to the initiating of the week.

#Bitcoin been making an strive to trace whale accumulation on GN using two metrics:

– Addresses maintaining >1k $BTC

– Addresses maintaining >10k $ETH

Following the previous day’s tag acton, appears esteem mountainous accumulation of $ETH and fewer of $BTC. pic.twitter.com/qFJaEzbLnN

— Tempting Pork (@tempting_beef) June 10, 2021

The accurate on-chain recordsdata, along with the hot tag will increase, is a signal of accurate procuring for volume. It marks the first accumulation signal attributable to the wreck that hit the market in Would possibly perchance possibly perchance also.

BTC change into final altering fingers at $37,800 and ETH at $2,565.

The facts on or accessed via this net pronounce is obtained from honest sources we predict to be honest and knowledgeable, however Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any facts on or accessed via this net pronounce. Decentral Media, Inc. is no longer an funding advisor. We attain no longer give personalized funding advice or utterly different monetary advice. The facts on this net pronounce is self-discipline to swap without gape. Some or all of the facts on this net pronounce might presumably presumably also fair change into previous-normal, or it can presumably presumably also very effectively be or change into incomplete or unsuitable. We might presumably presumably also fair, however need to no longer obligated to, update any previous-normal, incomplete, or unsuitable facts.

You ought to by no way way an funding decision on an ICO, IEO, or utterly different funding primarily based fully on the facts on this net pronounce, and likewise you ought to by no way account for or otherwise depend on any of the facts on this net pronounce as funding advice. We strongly counsel that you just seek the advice of a certified funding advisor or utterly different certified monetary skilled as soon because it’s likely you’ll presumably presumably presumably also very effectively be seeking funding advice on an ICO, IEO, or utterly different funding. We attain no longer settle for compensation in any invent for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

Gaze beefy phrases and conditions.

$1.3 Billion Bitcoin Leaves Exchanges as Holders Put collectively for Bull Flee

In 2020, with regards to 500,000 Bitcoin fetch left crypto exchanges, suggesting a upward thrust in custody over profit-booking. This same dynamic change into no longer evident during the 2017 and 2019 tops. A Volatile…

Ben Lilly Discusses Bitcoin’s Market Dynamics

The shuffle in the crypto market continues. Bitcoin’s tag fell below $35,000 to lows of $32,150 this morning. It’s now down 7.6% this week and simplest 12.5% higher than its…

What’s Polygon (MATIC): Ethereum’s Internet of Blockchains

Via both decentralized app (DApp) pattern and adoption, no blockchain has been more a success than Ethereum (ETH). However no topic its relative success, the Ethereum network collected comprises a total lot of…

Over 1% of Bitcoin Now Lives as WBTC on Ethereum

The full quantity of wrapped Bitcoin on Ethereum has exceeded 1% of the full circulating Bitcoin provide, the group announced. Here’s being conception to be a necessary milestone for the tokenized…