Key Takeaways

- Bitcoin has dropped by in relation to 13% since Mar. 28.

- Likewise, Ethereum has incurred bigger than 12% in losses.

- Both tokens are in actuality drawing near key toughen areas that would possibly possibly merely possess the bleeding.

Bitcoin and Ethereum are struggling to search out toughen, whereas merchants within the futures markets are exhibiting indicators of optimism. Such market behavior would possibly possibly result in a fast upswing before one other retrace.

Bitcoin Prepares to Bounce

Bitcoin appears to be like to be gaining momentum for a rebound after the steep correction it has endured at some level of the last two weeks.

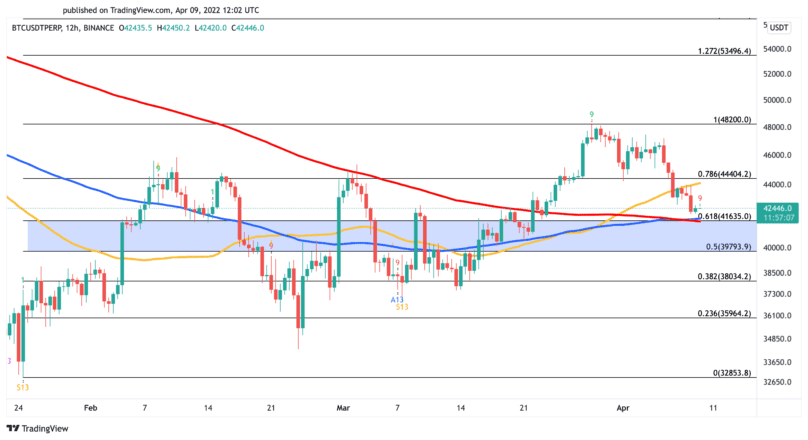

The tip crypto suffered a necessary downturn after reaching a high of $48,000 on Mar. 28. Its impress dropped by in relation to 13%, shedding bigger than 6,000 aspects in market price. Despite the plenty of losses incurred, it appears to be like that market persons are composed optimistic.

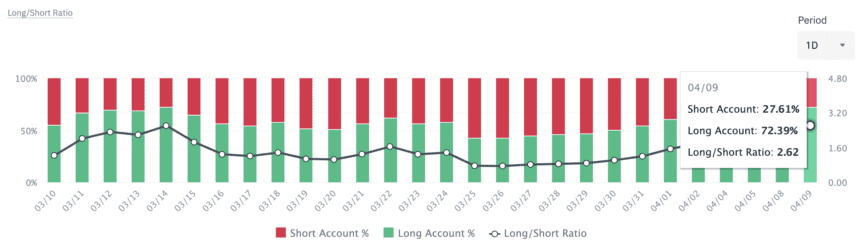

On Binance Futures, the BTCUSDT Prolonged/Fast Ratio has continued to surge, hitting a 2.62 ratio on Apr. 9. Roughly 72.4% of all accounts on the realm’s biggest crypto derivatives exchange by buying and selling volume are obtain-prolonged on Bitcoin.

Even if Bitcoin does not are inclined to appear at the herd, the bulls would possibly possibly very successfully be proven merely this time round.

The Tom DeMark (TD) Sequential within the within the meantime items a remove signal on Bitcoin’s 12-hour chart. The bullish formation developed within the maintain of a purple 9 candlestick, which is indicative of a one to four candlesticks upswing.

A spike in attempting to acquire stress would possibly possibly serve validate the optimistic outlook and push Bitcoin toward the $44,400 resistance stage. A decisive 12-hour candlestick shut above this hurdle would possibly possibly result in a more necessary upswing to retest the most up-to-date high of $48,200.

On the opposite hand, whereas the percentages appear to favor the bulls, Bitcoin would possibly possibly composed prolong its losses before it rebounds. A truly unprecedented foothold below Bitcoin lies between $41,600 and $40,000. If this toughen diagram is breached, it would possibly possibly merely put off a liquidations cascade, sending costs to $38,000 or even $36,000.

Ethereum at a Crossroads

Ethereum is consolidating inner a $140 impress range without offering a transparent signal of its subsequent hump.

The second-biggest cryptocurrency by market cap has been caught between $3,300 and $3,160 over the final three days after suffering a 12.27% correction. This impress pocket does not seem like attracting sidelined merchants no topic the significance of Ethereum’s upcoming plans. Even though the launch date is composed unknown, Ethereum is within the within the meantime making ready to full “the Merge” from a Proof-of-Work to a Proof-of-Stake consensus mechanism, one thing the blockchain’s followers had been waiting for for several years. It’s expected to ship sometime in 2022.

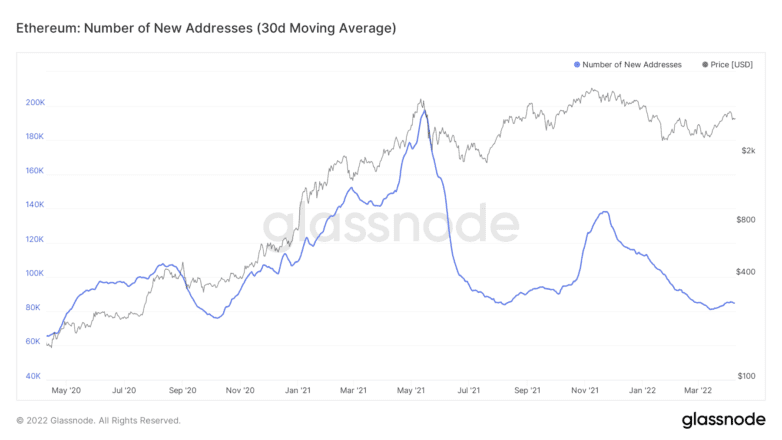

The community’s most up-to-date expansion rate displays the shortcoming of hobby. The need of most up-to-date each day addresses created on the Ethereum blockchain has remained stagnant at a mean of 85,000 addresses at some level of the last month. A sustained uptrend on this on-chain metric would possibly possibly result in further upward impress stream as it would signal the doorway of retail merchants.

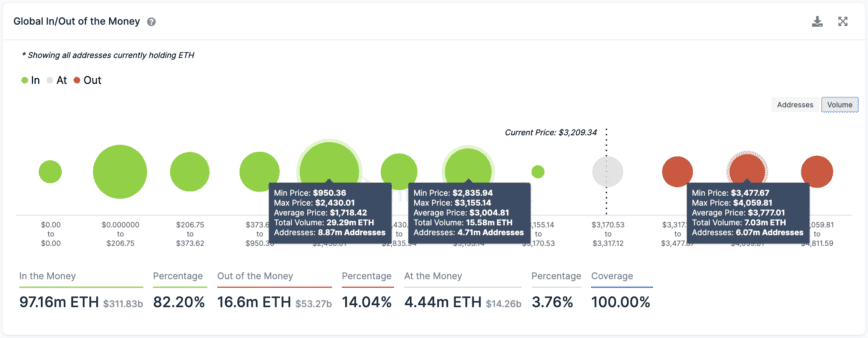

Except that occurs, transaction history presentations serious provide and seek data from areas to envision out out for.

IntoTheBlock’s Global In/Out of the Money (GIOM) mannequin finds that the biggest toughen stage for Ethereum sits at a mean impress of $3,000, the build 4.71 million addresses are retaining 15.58 million ETH. Meanwhile, the biggest resistance zone is $3,780, the build 6.07 million addresses beget beforehand purchased over 7 million ETH.

Ethereum needs to interrupt by toughen or resistance to solve its ambiguity. Decreasing by the $3,000 seek data from zone would possibly possibly opinion ETH fall toward $2,400. On the opposite hand, if the bulls spoil past the $3,780 provide wall, costs would possibly possibly advance toward $4,600.

Disclosure: On the time of writing, the creator of this fragment owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and acquire weekly updates from our lead bitcoin analyst Nathan Batchelor.

The records on or accessed by this web diagram is obtained from impartial sources we deem to be real and legit, nonetheless Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any data on or accessed by this web diagram. Decentral Media, Inc. just isn’t an funding advisor. We create not give custom-made funding suggestion or varied monetary suggestion. The records on this web diagram is enviornment to swap without ogle. Some or the total data on this web diagram would possibly possibly merely turn into outdated, or it shall be or turn into incomplete or unsuitable. We would possibly possibly merely, nonetheless are not obligated to, update any outdated, incomplete, or unsuitable data.

It’s essential to composed under no cases create an funding choice on an ICO, IEO, or varied funding based mostly mostly on the data on this web diagram, and you need to composed under no cases clarify or otherwise depend on any of the data on this web diagram as funding suggestion. We strongly indicate that you seek the suggestion of a licensed funding advisor or varied qualified monetary official whenever you happen to would possibly possibly very successfully be looking out for funding suggestion on an ICO, IEO, or varied funding. We create not salvage compensation in any maintain for analyzing or reporting on any ICO, IEO, cryptocurrency, forex, tokenized gross sales, securities, or commodities.

Glance fleshy terms and prerequisites.

Unique Bitcoin Political Advocacy Groups Offered at Bitcoin 2022

The Bitcoin Advocacy Project announced two unique official-Bitcoin political advocacy organizations at the novel time: the Bitcoin Protection Institute, and Monetary Freedom PAC. Collectively, these groups will behold to impact legislation, law, and…

“Don’t Sell Your Bitcoin”: Wood and Saylor Evangeliz…

ARK Make investments CEO Cathie Wood and MicroStrategy CEO Michael Saylor appeared collectively for a fireside chat at Bitcoin 2022 at the novel time. The duo talked about the transferring regulatory panorama, projections for…

What Is ETH? Defining Ethereum’s Scarce Asset

From a “triple-level asset” to “extremely sound money,” Crypto Briefing explores how Ethereum’s native asset has been conceptualized and whether viewing it as a perpetual bond would possibly possibly very successfully be the subsequent…