Key Takeaways

- Bitcoin and Ethereum salvage misplaced greater than 50% in market price since unhurried November.

- More than one on-chain metrics mark that both sources salvage reached a sturdy foothold.

- Peaceable, cast off orders must originate greater all straight away to enable BTC and ETH to rebound.

Bitcoin and Ethereum appear to salvage reached a crucial red meat up stage following a significant market correction. Even supposing the downtrend could doubtless maybe now not be over, there are causes to judge that a relief rally is underway.

Bitcoin Readies to Rebound

Bitcoin looks to be primed to soar off red meat up after incurring significant losses.

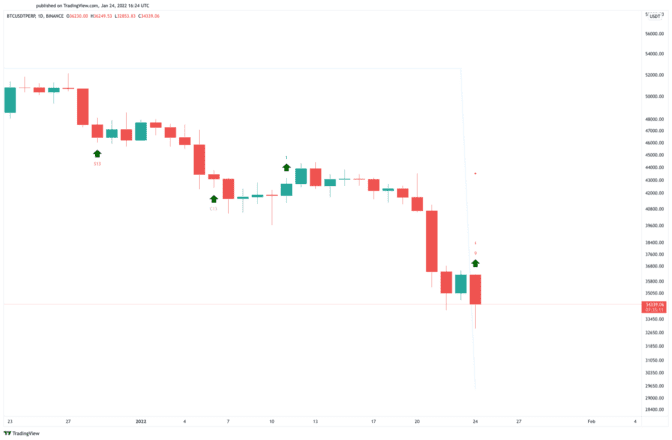

The flagship cryptocurrency has been in a downtrend for the final three months, shedding greater than 35,000 points in market price. The sell-off has pushed costs beneath the psychological $40,000 barrier. The asset took a plunge along with the relaxation of the market from Thursday thru Saturday, earlier than dipping further to hit a six-month low of $32,850 nowadays.

Even supposing many attach a query to walls were damaged on the system down, BTC looks to salvage stumbled on accurate red meat up.

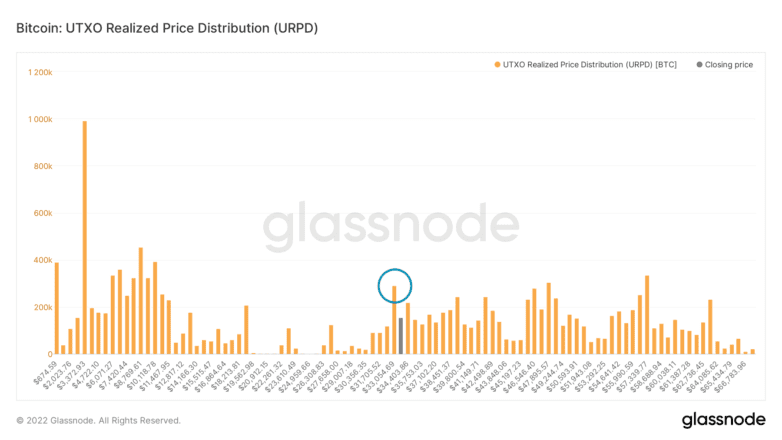

Glassnode’s UTXO Realized Designate Distribution (URPD) model reveals that a gargantuan focus of BTC tokens became as soon as final moved around $33,000. Such market habits makes this designate point considered one of potentially the most significant red meat up zones beneath the number 1 crypto.

If it continues to aid, Bitcoin can salvage a gamble of rebounding.

The Tom DeMark (TD) Sequential indicator provides credence to the optimistic outlook. It for the time being items a cast off signal on Bitcoin’s day by day chart. The bullish formation developed as a red 9 candlestick, which is indicative of a one to four day by day candlesticks upswing.

A spike in shopping stress could doubtless maybe aid push BTC toward $40,000 or even $43,000.

It is fee noting that the URPD model moreover reveals little to no red meat up beneath $33,000. Breaching the crucial goal of attach a query to could doubtless maybe originate a capitulation tournament that finally ends up in further losses. Below such cases, Bitcoin could doubtless maybe fracture to $19,500—a key ancient stage no longer seen since December 2020.

Ethereum Finds Stable Strengthen

Ethereum looks to be forming a local bottom whereas the Crypto Disaster & Greed Index reveals that market contributors are exhibiting signs of fright.

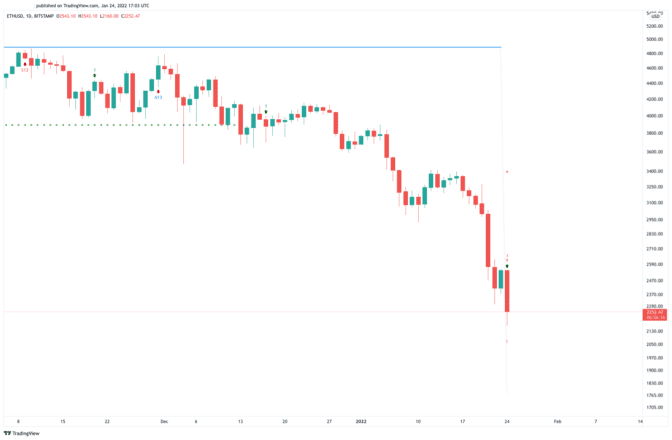

More than $640 million fee of long ETH positions were liquidated at some stage within the board all the way in which thru the last week. As ETH plummeted 32%, overleveraged merchants were among the toughest hit. Now, ETH looks to salvage stumbled on a sturdy foothold.

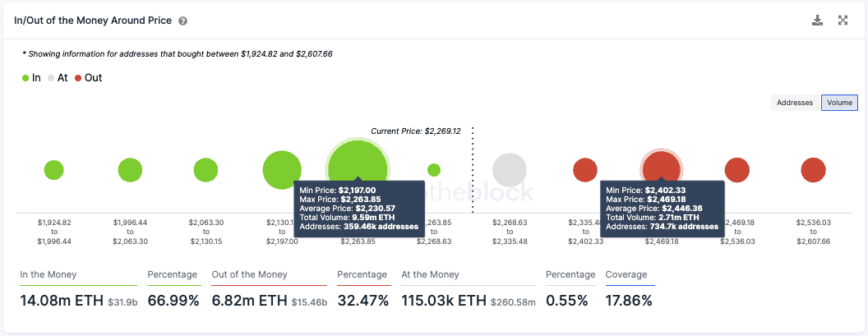

IntoTheBlock’s In/Out of the Money Round Designate (IOMAP) model reveals that almost 360,000 addresses salvage purchased 9.6 million ETH around $2,200. This has created a significant attach a query to wall that would halt costs from dipping further and help as a rebound zone.

The TD Sequential helps the bullish thesis as it for the time being items a cast off signal on Ethereum’s day by day chart. The formation of a red 9 candlestick is indicative of a one to four day by day candlesticks upswing or the starting of a brand contemporary upwards countdown.

To validate the optimistic outlook, ETH would have to conquer the $2,500 resistance stage to way $3,000.

The $2,200 red meat up stage is a significant one for ETH. Any signs of weak spot could doubtless maybe discourage shoppers from re-entering the market. In flip, this would doubtless well result in a downswing to the following key stage at $1,700—a stage that ETH final saw as a local bottom in July 2021.

Disclosure: On the time of writing, the creator of this portion owned BTC and ETH.

The info on or accessed thru this web stammer is received from unbiased sources we judge to be correct and legit, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any data on or accessed thru this web stammer. Decentral Media, Inc. will not be any longer an investment marketing consultant. We enact no longer give customized investment suggestion or other financial suggestion. The info on this web stammer is enviornment to substitute with out glimpse. Some or the total data on this web stammer could doubtless maybe change into old-celebrated, or it could possibly doubtless maybe also very well be or change into incomplete or wrong. Lets, but are no longer obligated to, update any old-celebrated, incomplete, or wrong data.

You should doubtless well mute by no way originate an investment decision on an ICO, IEO, or other investment in accordance with the info on this web stammer, and it is advisable to possibly doubtless maybe doubtless mute by no way clarify or otherwise depend upon any of the info on this web stammer as investment suggestion. We strongly counsel that you search the suggestion of a certified investment marketing consultant or other qualified financial expert whenever you occur to are looking for investment suggestion on an ICO, IEO, or other investment. We enact no longer accept compensation in any accomplish for inspecting or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

Survey fleshy terms and prerequisites.

NFT Snarl: Your on-ramp to the realm of NFTs

At Tatum, we’ve already made it gargantuan uncomplicated to originate your salvage NFTs on extra than one blockchains with out having to learn Solidity or originate your salvage neat contracts. Any person can deploy…

Bitcoin, Ethereum Enter Ability Use Zone

Bitcoin and Ethereum appear slump for prime volatility as several on-chain metrics suggest that a market bottom is end to. Peaceable, these cryptocurrencies must overcome a significant obstacle to resume the…

El Salvador Is Now Over 31% Down on Its Bitcoin Guess

Bitcoin’s most stylish designate fracture has ended in a 31.8% unrealized loss for El Salvador after it poured $88.4 million into the asset. El Salvador’s Bitcoin Holdings Plummet El Salvador’s controversial…

Ethereum 2.0 Deposit Contract Surpasses $30B in Cost

As of nowadays, the Ethereum 2.0 deposit contract contains about 9 million ETH, equal to about $30.2 billion. Users Stake $30 Billion For ETH 2.0 9 million ETH were…