Files reveals Bitcoin has been extra stable than gold, DXY, Nasdaq, and S&P 500 currently, right here’s what historical past says may maybe furthermore apply subsequent.

Bitcoin 5-Day Volatility Has Fallen Below That Of Gold, DXY, Nasdaq, And S&P 500

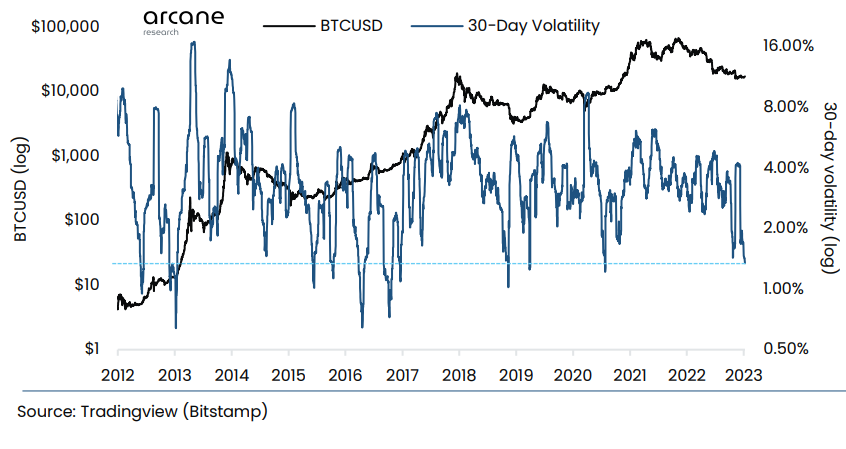

In accordance with the latest weekly file from Arcane Learn, BTC has been extra stable than these resources for a file length already this Twelve months. The “volatility” is an indicator that measures the deviation of on a standard basis returns from the usual for Bitcoin.

When the charge of this metric is excessive, it reach the crypto has been registering a bigger amount of returns when put next to the mean, suggesting that the coin has concerned a bigger trading threat currently. On the opposite hand, low values indicate there haven’t been any valuable fluctuations within the charge in latest days, exhibiting that the market has been traditional.

Now, right here’s a chart that reveals the vogue within the 30-day volatility for Bitcoin over the route of its entire historical past:

The value of the metric seems to have plunged in recent days | Source: Arcane Research's Ahead of the Curve - January 10

As shown within the above graph, the Bitcoin 30-day volatility is at very low ranges on the 2nd because the charge has been trading largely sideways in latest weeks. The present values of the indicator are the lowest since 2020, however they are mute bigger than one of the most valuable lows during old undergo markets.

One consequence of this latest flat movement has been that BTC has turn into extra stable than resources like gold, DXY, Nasdaq, and S&P 500. To evaluate these resources’ volatilities in opposition to every other, the file has made bid of the 5-day volatility (and no longer the 30-day or 7-day one).

The below table highlights the sessions in BTC’s lifetime when the crypto’s 5-day volatility has been simultaneously decrease than all these former resources.

Looks like such occurrences have been a very rare event | Source: Arcane Research's Ahead of the Curve - January 10

As the table shows, there private most effective ever been a handful of cases the build the Bitcoin 5-day volatility has been decrease than that of gold, DXY, Nasdaq, and S&P 500 on the identical time. The file labels such occurrences as “relative volatility compression” sessions.

It appears to be like like, earlier than the latest plug, the ideal length of this vogue became gorgeous 2 consecutive days. This implies that the present relative volatility compression length is already the longest ever within the coin’s historical past.

But every other attention-grabbing truth within the table is the total returns in Bitcoin that had been noticed within the 30-day length following the critical date of the volatility compression in every of these cases. Apart from one prevalence (September 29, 2022), all other volatility compression sessions had been succeeded by the charge turning into highly volatile and registering huge returns.

It now remains to be seen whether a identical pattern will apply this time as successfully, with Bitcoin experiencing a wild subsequent 30 days after this significantly flat charge action.

BTC Label

At the time of writing, Bitcoin is trading around $17,400, up 3% within the closing week.

BTC has surged in the last few days | Source: BTCUSD on TradingView

Featured image from Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, Arcane Learn