Key Takeaways

- Bitcoin’s market price dropped almost 14% in September.

- Market sentiment has grew to was pessimistic due to the the tip crypto’s depressed designate efficiency.

- On-chain info shows no significant indicators of accumulation but.

Bitcoin is about to terminate September at a double-digit loss relative to August. As market sentiment continues to deteriorate, the tip cryptocurrency needs to protect onto a crucial make stronger stage to retain far from a serious correction.

Bitcoin in Threat

Bitcoin is consolidating spherical the $19,000 make stronger stage. Market participants contain taken existing of the tip crypto’s used designate motion over contemporary weeks.

The market sentiment toward Bitcoin remains unfavorable. Social info from Santiment shows a weighted sentiment ranking of -0.69, whereas talk of Bitcoin on social media sits below 20%, indicating that passion has waned.

Brian Quinlivan, Director of Advertising at Santiment, worthy the pattern in a September 30 recap story, declaring that “the world remains in an awfully fragile location, and traders aren’t trusting grand of one thing to upward thrust any time soon.” Crypto has suffered alongside hundreds of risk-on resources all the map via this yr amid hovering inflation rates, passion rate hikes, a world energy disaster, and market exhaustion off the support of the 2021 bull market.

The declining passion in Bitcoin will even be considered from an on-chain perspective. In keeping with Glassnode info, the different of addresses keeping no longer much less than 1,000 BTC has remained regular at spherical 2,117 addresses over the previous three days, following a engaging 26.75% decline. This market behavior means that prominent patrons contain misplaced passion in gathering extra cash.

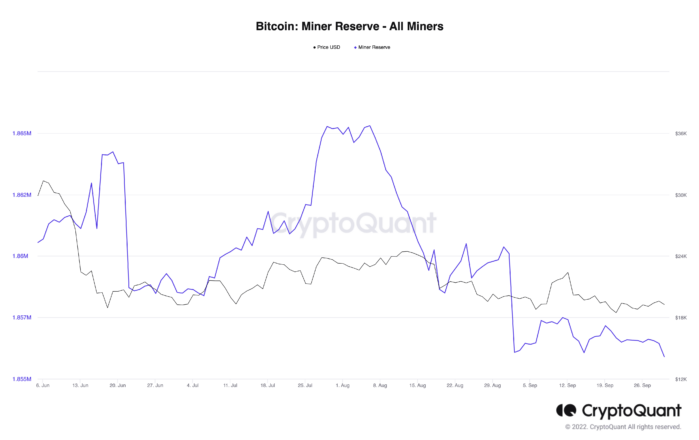

A identical pattern is taking part in out with miners. In keeping with CryptoQuant info, Bitcoin miners’ reserves contain plateaued at 1.86 million tokens, keeping spherical this stage for fair about a month. The inactiveness among miners follows a serious selloff in August.

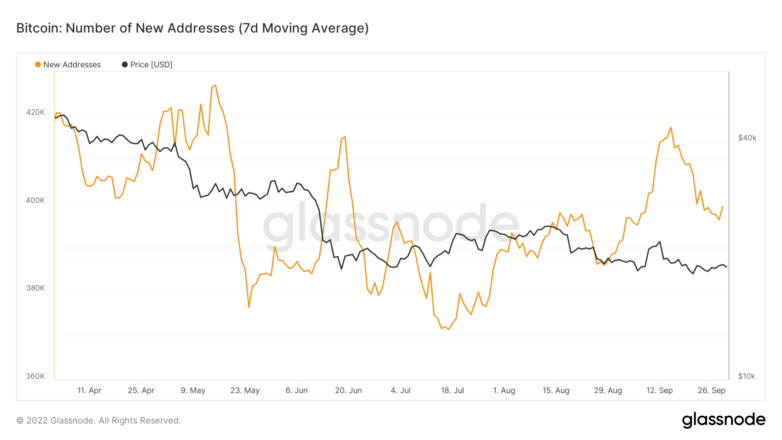

Despite the suggestions displaying a bleak outlook for the #1 crypto, the different of new day by day addresses created on the network hints that the tip crypto can even post a turnaround. The Bitcoin network is expanding, displaying an uptick in retail passion since mid-July. The bullish divergence between network divulge and the asset’s designate aspects to a seemingly enchancment in momentum in the fracture.

If network divulge hits a higher excessive at a seven-day realistic of larger than 417,000 addresses, the bullish memoir could perhaps well be validated.

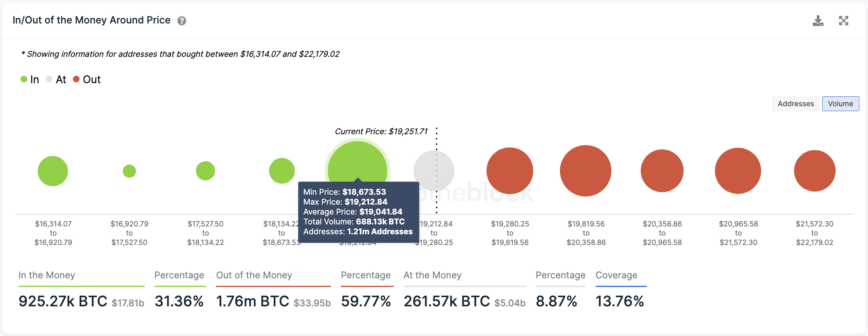

Transaction historical previous shows that BTC established a serious make stronger stage at $19,000, the save 1.21 million addresses purchased over 688,000 BTC. This keep a matter to wall have to protect to forestall a steep correction. If it fails to protect this stage, a selloff can even ensue, doubtlessly sending BTC to $16,000 or decrease.

IntoTheBlock’s IOMAP model shows that Bitcoin faces extra than one areas of resistance ahead. The most truly intensive one sits at $20,000, the save 895,000 addresses protect almost 470,000 BTC.

It’s been a rough yr for markets, and crypto hasn’t been spared in the fallout. Whereas Bitcoin is now almost a yr into a brutal endure market, several indicators point out that the anxiousness can even fair no longer be over. At the same time as new entrants join the tip crypto’s network, the worldwide macro image, declining sentiment and miner passion, and contemporary designate motion designate that there’s no optimistic save off of the Bitcoin memoir to flip bullish anytime soon.

Disclosure: At the time of writing, the author of this part owned BTC and ETH. The suggestions contained on this part is for academic applications handiest and will not be any longer funding advice.

For additional key market trends, subscribe to our YouTube channel and salvage weekly updates from our lead bitcoin analyst Nathan Batchelor.

The suggestions about or accessed via this internet location is got from honest sources we deem to be accurate and official, but Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any info on or accessed via this internet location. Decentral Media, Inc. will not be any longer an funding consultant. We develop no longer give personalized funding advice or hundreds of monetary advice. The suggestions about this internet location is field to change with out look. Some or all of the suggestions on this internet location can even fair was outdated-long-established, or it’ll even be or was incomplete or wrong. We can even fair, but are no longer obligated to, update any outdated-long-established, incomplete, or wrong info.

You’ll want to never get an funding determination on an ICO, IEO, or hundreds of funding per the suggestions on this internet location, and likewise you should never clarify or otherwise depend on any of the suggestions on this internet location as funding advice. We strongly point out that you simply consult an authorized funding consultant or hundreds of qualified monetary unswerving even as you’re seeking funding advice on an ICO, IEO, or hundreds of funding. We develop no longer bring together compensation in any kind for examining or reporting on any ICO, IEO, cryptocurrency, foreign money, tokenized gross sales, securities, or commodities.

Bitcoin, Ethereum Network Process Reveals Foremost Design back Threat

Volatility has struck the cryptocurrency market, main to higher than $160 million in liquidations over the previous 24 hours. Bitcoin and Ethereum in the in the intervening time are sitting on top of used make stronger,…

Perform Kwon Moved LFG’s Bitcoin After Court Popular Arrest, Prosecutors…

Despite the with out warning intensifying drama surrounding Kwon, the famously outspoken blockchain entrepreneur surfaced on Twitter Monday to train that he used to be “making zero effort to conceal” from authorities. Kwon Allegedly…

The Dollar Is at a 20-365 days High. That’s Putrid News for Bitcoin

Bitcoin and the broader crypto market are struggling to protect above their June lows because of renewed energy from the dollar. BTC Down as DXY Rallies Bitcoin is combating against…