The under is an excerpt from a most original model of Bitcoin Journal Reliable, Bitcoin Journal’s top price markets newsletter. To be among the many first to receive these insights and assorted on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

New Hash Price All-Time High

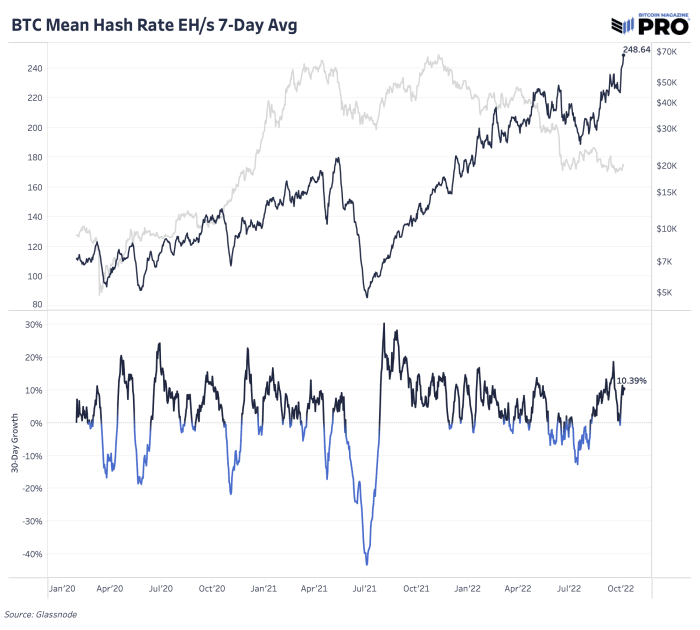

Dazzling two months within the past, the 2022 growth in Bitcoin hash price was once having a glimpse bleak. The bitcoin be aware had plummeted, miner margins had been getting compressed, gigantic public miners had been shedding bitcoin holdings and it was once a ripe time to revisit the affirm of miner capitulation out there. Like a flash forward to presently: be aware has come down from a huge personal market rally to $25,000 whereas hash price coming online has exploded to a original all-time of on the arena of 250 EH/s. The cleave and differ and rallies in bitcoin be aware haven’t impacted the hash price from ripping greater this 365 days. Hash price hasn’t if truth be told declined on a 30-day growth basis since July.

That’s among the finest public records readily accessible to chalk up why bitcoin hash price has exploded so principal. It’s public miners executing on growth plans. But that doesn’t imply gigantic scale mining corporations haven’t confronted extra pressures. Compute North, for sure among the largest records heart operators and bitcoin mining hosting companies and products, filed for Chapter 11 bankruptcy stunning weeks within the past. They housed miners for corporations adore Marathon Digital, Compass Mining and Bit Digital across 84 assorted mining entities. A fundamental public sale on the bulk of Compute North existing sources will happen on November 1, 2022 including mining containers, machines and plump records centers.

Within the Celsius crumple, Celsius Mining additionally filed for bankruptcy reduction in July. That mentioned, it’s optimistic from essentially the most original Compute North’s bankruptcy that the stress is aloof on gigantic-scale miners. They aren’t out of the woods but and we’ve been hesitant to name for an end of miner capitulation this cycle as be aware has stagnated and hash be aware (miner earnings divided by hash price) continues to face some stable headwinds with this stage of hash price growth taking part in out.

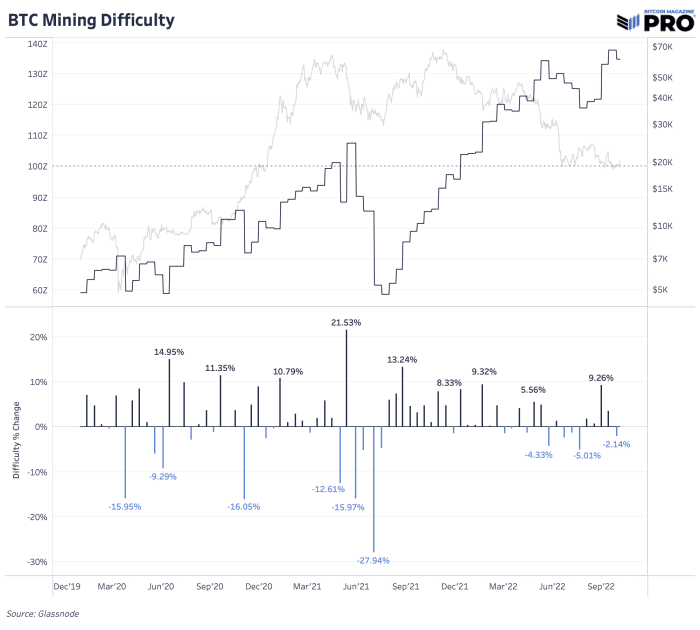

After making a original all-time excessive, mining arena saw a first price sized negative adjustment of 2.14% correct sooner than this explosion in hash price over the closing week. But that appears to be all momentary reduction because of the as of now, the next projected arena adjustment is having a glimpse adore a vicious 13.5% obvious adjustment on the time of writing. We haven’t viewed that stage of adjustment since correct after the Chinese language mining ban. That kind of adjustment would be disagreeable records for existing miner profitability as hash be aware would come underneath further stress.

It takes inconceivable operational excellence to proceed to excel within the bitcoin mining trade over a total lot of cycles.

Here’s why bitcoin mining-associated fairness investing might perchance also be both extremely profitable (whenever you elect for sure among the winners) or downright disastrous.

In our December 21 fragment closing winter, we mentioned the following,

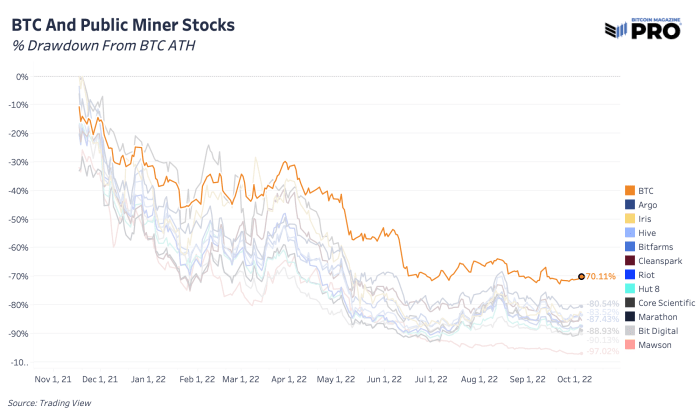

“What you would aloof accumulate from evaluating the performance of publicly-traded miners against bitcoin itself is that ensuing from the capital constructing of their enterprise and the valuations most original in fairness markets, miners can and sure will outperform bitcoin over periods when hash be aware rises very a lot.

“Nonetheless, over the very long time length the earnings in bitcoin phrases for every mining company is assured to diminish in bitcoin phrases, and ensuing from the excessively gigantic earnings multiples that corporations within the meanwhile trade with in equities markets in a nil price of interest world, even bitcoin mining equities style to zero over time in bitcoin phrases (over again, ensuing from the fairness multiples assigned in a nil price of interest fiat-denominated world).”

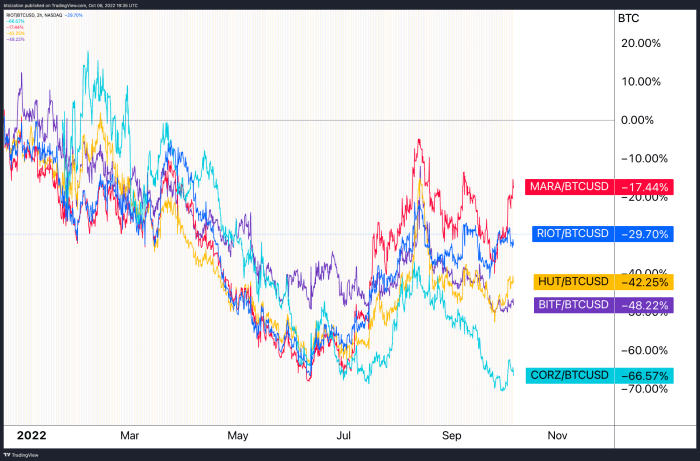

Since that point, the fragment costs of publicly traded mining corporations are all down very a lot when measured against bitcoin itself.

This might perchance perchance aloof come as no shock. Miner margins are getting relentlessly squeezed as earnings decrease, in both bitcoin and greenback phrases.

Since the all-time excessive within the bitcoin be aware, every publicly traded mining company has underperformed the asset itself, bar none.

While mining-associated equities can completely adore from their most original beaten down valuations, the style of mining machines and the industrial incentives of mining all but form obvious that hash price continues to form bigger farther from here.

To quote a outdated direct of ours,

“Nonetheless, the dynamics eager with evaluating publicly traded bitcoin miners is simply a small assorted. Unlike assorted “commodity” producers, bitcoin miners generally attempt and preserve as principal bitcoin on their steadiness sheet as that you just would be in a position to accept as true with. Relatedly, the long scurry provide issuance of bitcoin is famous into the long scurry with shut to 100% certainty.

“With this records, if an investor values these equities in bitcoin phrases, fundamental outperformance against bitcoin itself is achievable if investors allocate in some unspecified time in the future of the ultimate time in some unspecified time in the future of the market cycle the utilization of an records-pushed ability.”

Within the long scurry, mining-associated equities as well as ASICs will over again be primed for gigantic outperformance against bitcoin itself. We don’t whisper that time has arrived stunning but.

Relevant Past Articles