While bitcoin prices plummeted this week, the network’s hashrate has also dropped considerably since tapping a excessive on Would possibly possibly 9. Since then, the hashrate has viewed swings between 10-15% as a result of crypto market downturn, alleged factors with energy outages in Sichuan, China, and the upcoming challenge alternate.

Comparable to the Label, Bitcoin Hashrate Sees Wild Fluctuations

Bitcoin’s hashrate has been fluctuating in latest days after the price of BTC dropped tremendously in price one day of the last week. After some recovery, bitcoin (BTC) market knowledge displays that seven-day stats point to a weekly loss of 15% on Thursday afternoon (EST).

The network’s hashrate or processing energy has also adopted the downward jog. There are many factors that demonstrate why the hashrate has slumped, as bitcoin’s be conscious drop is correct one in all the causes.

On Would possibly possibly 16, the Bitcoin hashrate of all the network plummeted, with Antpool -16%, F2pool -11%, Binancepool -14%, and Huobipool -23%. Other folks in the Sichuan industry identified that it is going to ought to be a non everlasting phenomenon. pic.twitter.com/s3fb37t2mK

— Wu Blockchain (@WuBlockchain) Would possibly possibly 16, 2021

Yet every other residing off of the hashrate fluctuations stems from reports in China. In accordance to the reporter Colin Wu or “Wu Blockchain” on Would possibly possibly 16, “the Bitcoin hashrate of all the network plummeted.” Wu mentioned that Antpool, F2pool, Binance Pool, and Huobi Pool all observed hashrate share losses.

“Other folks in the Sichuan industry identified that it is going to ought to be a non everlasting phenomenon,” Wu remarked. If truth be told, the hashrate started mountain climbing northbound again after Wu’s Twitter statements. Wu mentioned, however, that the skill consumption in China is in heavy ask in the intervening time. Wu extra pressured out:

The most vital reason is that the local weather is hot and the commercial energy consumption is super, nonetheless the water drift of hydropower is insufficient, which is 30% lower than in rainy years. The flexibility company made up our minds to originate a non everlasting blackout of the mine at 2 pm on the 16th.

With a Field Spike Expected in 9 Days, Miners Would possibly possibly successfully be Laying Low

Grid factors in China have continuously plagued miners correct thru the years, namely one day of the moist season in Sichuan. The moist season helps the drift of hydropower, nonetheless the pure parts would possibly furthermore residing off flooding and energy outages as successfully.

China’s mining dominance is now not the finest reason the hashrate dip has been in play. Yet every other the reason why the hashrate is losing lower would possibly be as a result of anticipated challenge spike coming up in nine days.

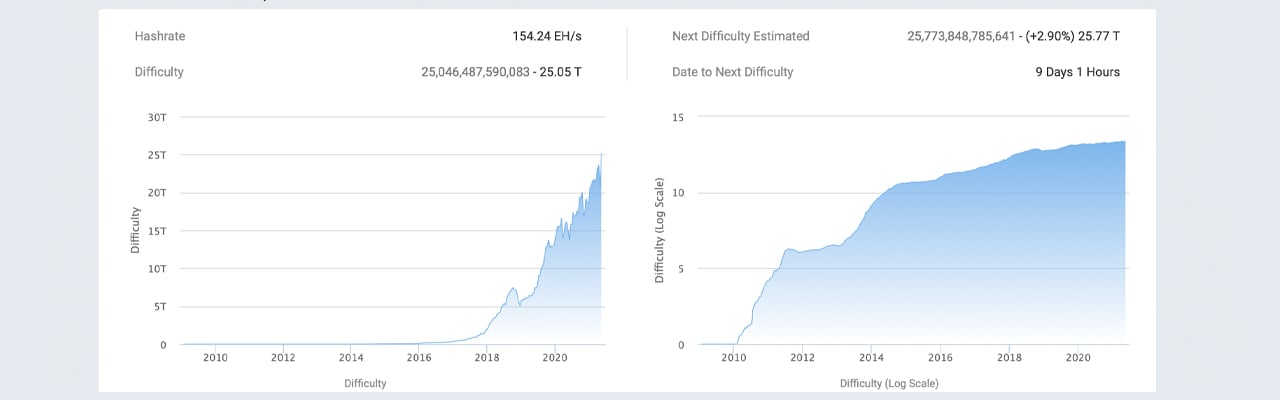

Bitcoin mining challenge on Would possibly possibly 20, 2021.

Bitcoin mining challenge on Would possibly possibly 20, 2021.Bitcoin’s mining challenge tapped a lifetime excessive as Bitcoin.com News reported last week, and on the time of the fable, the challenge alternate used to be an estimated 13 days away. BTC miners would possibly be ‘gaming the network’ in direct to drop the challenge to a lower metric.

If BTC miners let the hashrate bound excessive above the 180 to 200 exahash per 2d (EH/s) differ to in the intervening time, then the challenge would have jumped to an estimated 30.30 trillion. At the time of writing, BTC’s mining challenge is 25.0 trillion and as a change of leaping to 30.30T, latest estimates demonstrate a smaller 2.90% spike to 25.77T.