Correct 19 days within the past, Bitcoin became once procuring and selling round $98,000. This day, it shattered expectations by hitting a brand fresh all time excessive of $118,820, underscoring the accelerating shift towards viewing Bitcoin as every a retailer of price and a strategic asset.

BlackRock’s iShares Bitcoin Belief (IBIT) broke its ETF records final night by surpassing $80 billion in sources under management, doing so in truthful 374 days. That’s practically 5 times quicker than the previous document held by the Leading edge S&P 500 ETF (VOO), which took 1,814 days to reach the equivalent label.

As of nowadays, IBIT sits at $83 billion and holds over 706,000 BTC, making it the Twenty first good ETF within the US market. Two days within the past, IBIT furthermore closed at a brand fresh all time excessive of $63.58, reflecting a gigantic seek data from for Bitcoin.

The exchange of hours the moderate American wants to work to comprise the funds for one Bitcoin. In accordance to basically the most fresh chart by Anil Patel, it now takes 3,766 hours, practically two plump years of labor at the moderate US wage, to bear truthful 1 Bitcoin.

In accordance to a brand fresh document from Bank of The usa World Learn, Bitcoin is the tip performing forex of 2025, beating out 19 fiat currencies with an 18.2% achieve versus the US dollar one year-to-date. This places Bitcoin sooner than venerable accurate performers love the Swedish krona, Swiss franc, and Euro. The records underscores Bitcoin’s rising energy no longer truthful as a digital asset, but as a world monetary unit.

Bitcoin has furthermore reclaimed its sigh amongst the sector’s most treasured sources, surpassing Amazon to become the Fifth good by market capitalization. With a complete market cap of $2.36 trillion and a label of $118,820, bitcoin now ranks truthful gradual tech giants love Apple, Microsoft, and NVIDIA.

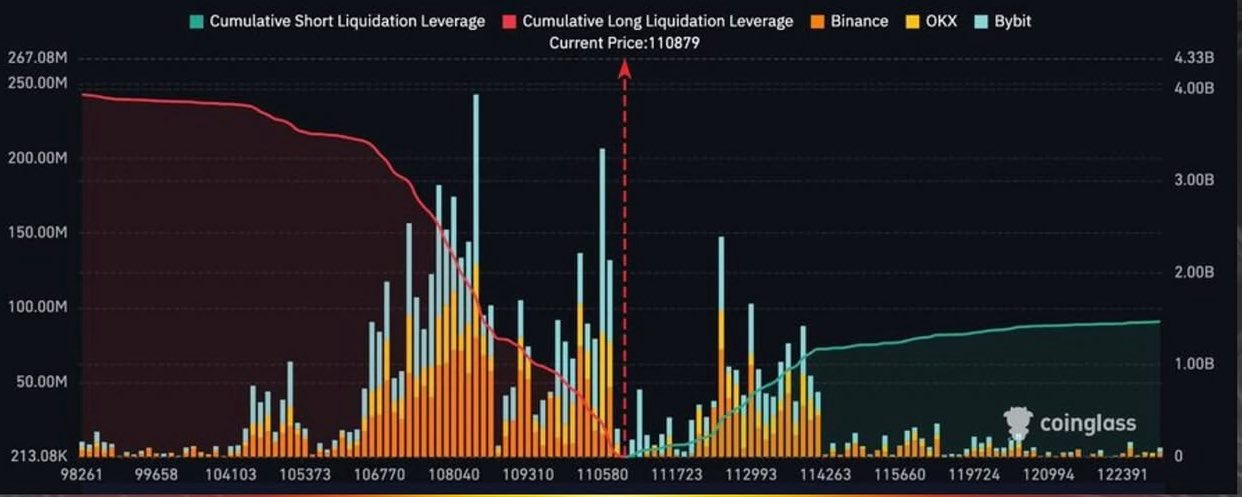

Over the final few days, more than $463 million in Bitcoin brief positions were liquidated, as label features obtain even higher. In accordance to data from Coinglass, an additional $1.5 billion briefly positions are on the verge of liquidation if Bitcoin hits $120,000.