On-chain details reveals Bitcoin holders beget been selling at trim losses on the stage of earlier bottoms, suggesting that the final capitulation for the cycle can also very properly be right here.

Bitcoin 7-Day MA aSOPR Has Sharply Long gone Down Now now not too prolonged previously

As pointed out by an analyst in a CryptoQuant put up, the BTC market people can also very properly be coming shut to surrendering.

The related indicator right here is the “Spent Output Profit Ratio” (SOPR), which tells us whether or no longer Bitcoin investors are selling their money at a profit or at a loss upright now.

When the value of this metric is greater than 1, it capacity the realistic holder is curious their money at a profit at blow their own horns.

On the more than a few hand, the indicator having values decrease than the brink suggests the market as a entire is realizing some amount of loss for the time being.

Naturally, the SOPR having values precisely equal to 1 implies the investors are upright breaking-even on their selling.

The “Adjusted SOPR” (aSOPR) is a modified version of this metric that doesn’t eradicate into epic circulate of all those money that had been offered within an hour of being sold. This helps eradicate away noise from the records that acquired’t beget any important impacts on the market.

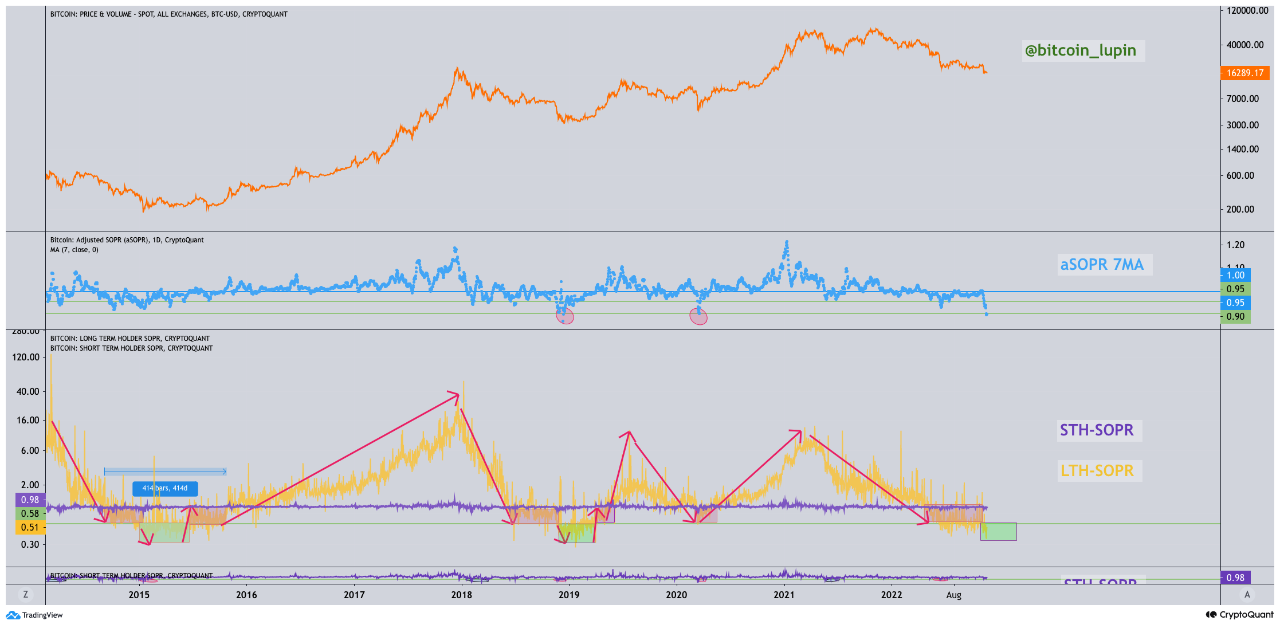

Now, right here is a chart that reveals the trend in the 7-day curious realistic Bitcoin aSOPR over the closing several years:

Looks like the 7-day MA value of the metric has declined in recent days | Source: CryptoQuant

As you might perhaps perhaps per chance per chance perhaps also compare in the above graph, the 7-day MA Bitcoin aSOPR has taken a deep dive below the 1 keep recently. This means that investors are now selling at some wide losses.

The contemporary ranges of the indicator are the same as those noticed succor for the duration of the 2018-19 undergo market bottom, besides for the duration of the COVID smash.

The motive such deep capitulations beget generally coincided with vital bottoms in the value of the crypto is that they signify an exhaustion of marketing and marketing stress because the old holders stop and dump their holdings at a loss.

Stronger arms then decide these money up and fetch at cheap costs, leading to a more certain at some point soon.

If the contemporary capitulation in actual fact is the final one, then a bottom can also very properly be in peep for Bitcoin. Nonetheless, bullish trend wouldn’t straight observe the coin; the instant term is at risk of aloof be bearish.

BTC Label

On the time of writing, Bitcoin’s keep floats round $16.1k, down 5% in the closing week.

The value of the crypto seems to have gone down during the past day | Source: BTCUSD on TradingView

Featured image from 愚木混株 cdd20 on Unsplash.com, charts from TradingView.com, CryptoQuant.com

Hououin Kyouma

Loves to write, focused on cryptocurrency. For the time being finding out Physics at college.