The label of Bitcoin looks to absorb returned to a uneven market condition, quashing any hopes of a breakout to new highs rapidly. On the more than a couple of hand, the lawful news is that the present bull cycle will also silent now not be over, despite the indisputable truth that it is taking some time for the premier cryptocurrency to resume its upward momentum.

Particularly, the most up-to-date on-chain statement presentations that Bitcoin has been going via a “euphoria wave” over the last few months. Here’s the implication of this fragment on the present bull trail.

How Frail Is The Contemporary Bitcoin ‘Euphoria Wave’?

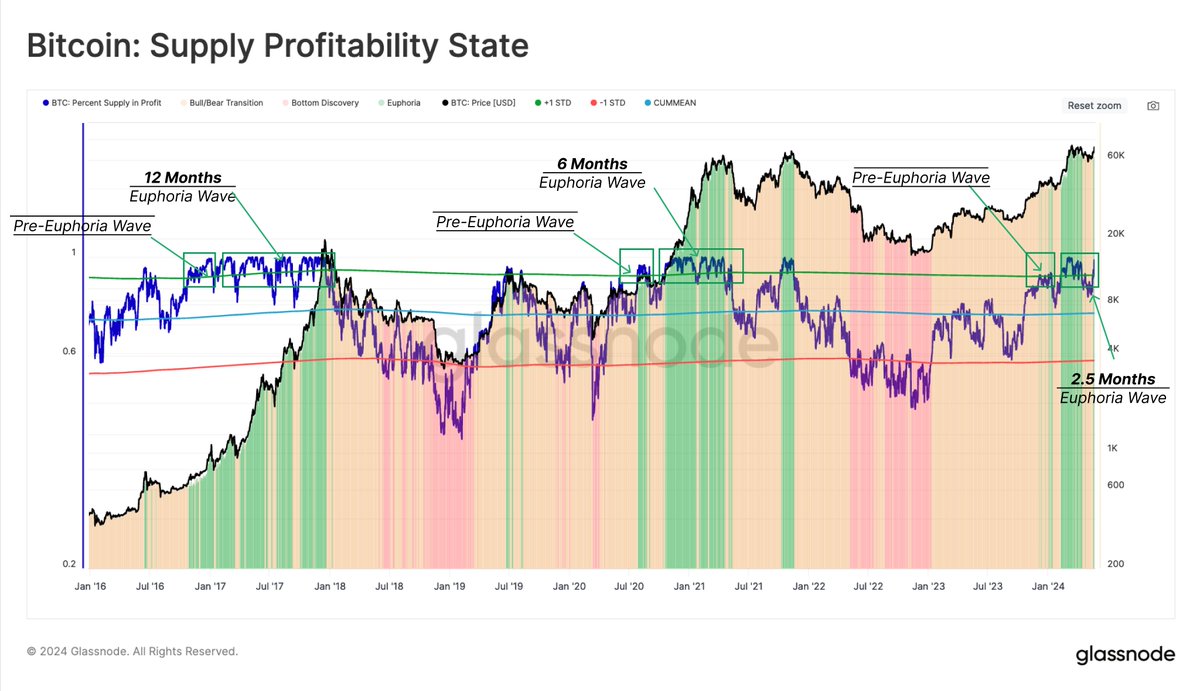

Blockchain intelligence agency Glassnode published by strategy of a post on the X platform that Bitcoin has entered the euphoria fragment of the market cycle. This on-chain statement is in accordance with the “P.c Provide in Profit” metric, which measures the percentage of the total circulating Bitcoin provide that’s on the second in profit.

In line with Glassnode, the “Euphoria Wave” is identified as a period right via which the provision in profit in most cases fluctuates around the 90% stage. This fragment in most cases lasts between 6 to 12 months and is characterised by increased investor sentiment and heightened market speculation.

Glassnode’s files presentations that 93.4% of the circulating Bitcoin provide is on the second within the green and that the Euphoria Wave is “reasonably young”. The on-chain analytics platform notorious that the euphoria fragment has handiest been energetic for about two and a half of months.

As with every fragment within the market cycle, the Euphoria Wave will in the end come to an cease in some unspecified time in the future. Historically, the euphoria fragment can signal tops and is continuously followed by a cooling-off period, which is marked by a downturn within the label of Bitcoin.

If the last cycle – with a 6-month Euphoria Wave – is anything to head by, then there could silent be about three to four months within the present bull trail. Finally, the present profitability of the premier cryptocurrency will also veil pivotal within the period of its bull cycle and overall future trajectory.

Upward push Of BTC Accumulation Addresses Continued In Can also: Analyst

One in every of the show-memoir indicators of the bullish sentiment round Bitcoin is the continuous upward thrust in accumulation addresses. In line with an on-chain analyst on CryptoQuant’s platform, there turned into a well-known make bigger within the resolution of most up-to-date BTC accumulation addresses.

The analyst identified the continuity of this distinct pattern despite BTC’s reasonably slack label action in Can also. Within the intervening time, the natty Bitcoin holders absorb also persevered to load their baggage, with main purchases recorded over the last month.

As of this writing, Bitcoin is valued at $67,744, reflecting a mere 0.4% make bigger within the last 24 hours. In line with files from CoinGecko, the pioneer cryptocurrency is up by about 15% within the previous month.

Featured image from iStock, chart from TradingView

Disclaimer: The records realized on NewsBTC is for tutorial functions

handiest. It does now not signify the opinions of NewsBTC on whether to aquire, sell or relieve any

investments and naturally investing carries dangers. It is most likely you’ll maybe be advised to behavior your absorb

analysis sooner than making any investment choices. Utilize files equipped on this internet region

fully at your absorb menace.