No matter the dilapidated stock market gape on 200-day transferring averages, a dip below it can perhaps presumably perhaps mean a sale tournament for Bitcoin.

No matter the dilapidated stock market gape on 200-day transferring averages, a dip below it can perhaps presumably perhaps mean a sale tournament for Bitcoin.

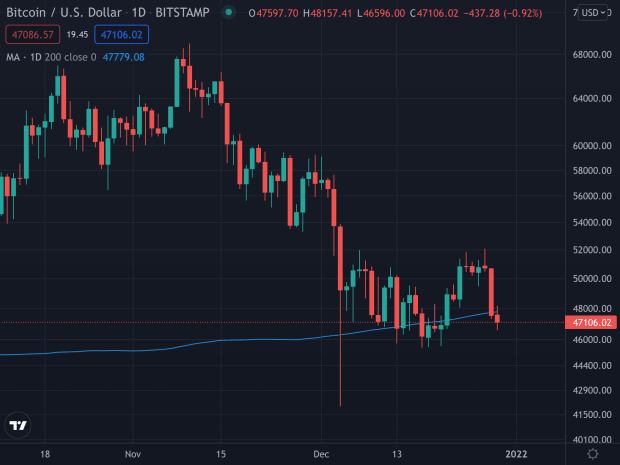

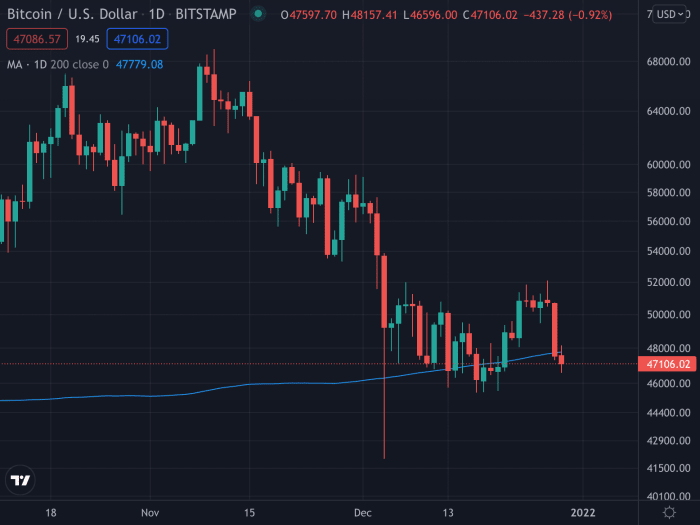

Bitcoin has been shopping and selling at sideways imprint action for hundreds of of December, struggling to protect above the 200-day transferring realistic.

After a solid October and an early November of current all-time highs, Bitcoin has encountered a blocking off avenue in December, having misplaced 13.60% since the origin of the month. This actuality stands in stark contrast to a popular belief that Bitcoin’s imprint would hit $100,000 by the stop of the three hundred and sixty five days.

On the time of writing, Bitcoin is shopping and selling at around $47,500 after having closed below its 200-day transferring realistic on Tuesday. The 200-day MA is steadily feeble to gauge an asset’s lengthy-term pattern in dilapidated capital markets. An asset is mostly thought of to be in an total uptrend for as lengthy because it holds above its 200-day MA.

In March 2020, Bitcoin violently broke below its 200-day MA as the pandemic outbreak unfold distress in the end of the sphere, alongside with capital markets. It took BTC about two months to safe befriend above the transferring realistic, triggering a stellar bull market that would extend past the stop of the three hundred and sixty five days. Bitcoin held above its 200-day MA for over a three hundred and sixty five days till China banned bitcoin mining, as soon as extra spreading distress to those ignorant of Bitcoin’s staunch functioning mechanics and triggering a handy ebook a rough winter for imprint over the summer months.

Bitcoin rose from $8,000 to $60,000 in lower than one three hundred and sixty five days sooner than correcting below its 200-day MA at around $40,000 in Could presumably presumably 2021. Provide: TradingView.

No matter the dilapidated stock market gape that an asset below its 200-day MA is also in a undergo market, for Bitcoin, it can perhaps presumably perhaps list a sale tournament. Given the search-to-search (P2P) currency’s solid, uncommon fundamentals and its history of crushing all other sources everywhere in the last 10 years, a dip below a technical indicator can relieve as a reduce rate indication, especially given Bitcoin’s volatility, which makes it tumble and fly extra without note than dilapidated sources.