Most, if now not all, folks are provisioned with zero monetary education and are now not given enough instruction in the first strategies of money, particularly because it relates to building wealth and setting up a gather foundation from which to characteristic so that they’ll also merely most optimally navigate the challenges of life.

Financial education is utterly dismissed in faculty rooms, college students are now not furnished with the compulsory colleges to successfully take care of the realities of existence and that is now not utterly restricted to monetary education both. Other important curricular deletions consist of an absence of efficient tutoring surrounding nutrition, bodily education, self-defense, efficient verbal change and negotiation skills, psychological resilience, and so on. To the more perspicacious amongst us, this has steadily been evident.

Indeed, many are aware that the opposite is in general the case: teenagers are impressed to settle on immense amounts of debt to gather a college education, condemning them to the Sisyphean trial of endeavoring to pay wait on their money owed whereas simultaneously facing minimal prospects of employment. Beyond this, many are impressed to assemble their credit ranking ranking by shouldering rising amounts of debt, taking up loss of life pledges (mortgages) and living life above their device — with this device of life being conception to be “fashioned” for most in the Western world and across the globe.

We are constantly being handed recommendation from those that create now not maintain any journey in building wealth. Fogeys, academics, mates and even media pundits, though reputedly successfully-intentioned, in point of fact live paycheck to paycheck and create now not maintain any concrete working out of the handling of money or lack the flexibility to competently allocate their capital in suppose to make sure its sanctity.

Sit down Down And Shut Up

The next non-public narrative illustrates this inform rather successfully.

As a boy, I became once once reprimanded by a college teacher when he elucidated the class about how the sector ”in actuality works,” extolling the alleged virtues of “getting a lawful education, working engaging, saving money” and proffering recommendation surrounding the merits of pursuing a profession. Having identified a novel evident hole in his arguments, I quipped: “Sir, why would I settle recommendation from any individual who has by no device left faculty?”

Pointless to thunder, I spent the next hour exterior the evaluate room in the hallway to “take into narrative what I had stated.” Indeed, to for the time being I easy take into narrative that interplay and the validity of the acknowledge looks to be to turn out to be an increasing number of apparent as time goes on. In my strategies, I became once merely employing the Socratic technique to greater model my teacher’s inadequacy to proliferate his recommendation to the class.

My teacher’s response is emblematic of the angle adopted by most folks in society on the present time, acceptance of the quandary quo and overreliance on out of date objects of working on this planet — which might possibly presumably be an increasing number of becoming an increasing number of anachronistic, particularly as they articulate to at least one’s rate range and future prospects. If the leisure challenges that lengthy-held assumption, it’s a ways snappy ridiculed or punished.

To be clear, endeavoring to attain a lawful education and working engaging are indeed virtuous, realistic pursuits, however the device in which for procuring these things or enacting them are multi-dimensional. The sector is by surprise altering and the digital universe is providing alternatives that by no device existed sooner than, serving to disrupt the monopoly that legacy systems maintain enjoyed for hundreds of years previous.

Religion in our existing institutions has all however evaporated, owed essentially to their lack of leadership and their cascade into corruption; with the scent of lies and deceit filling the halls of our establishments, their gross behavior is apparent to all. The existing paradigm serves to utterly usufruct and usurp our time, energy and value.

As such, this text addresses these matters and presents an rationalization as to why Bitcoin is the medication and lighthouse in the fog. It tiny print essentially the most frequent proclamations concerning bitcoin’s supposed instability and purported unsuitability as a viable and gather device for storing one’s wealth, along with presenting its virtues in three major domains which facilitate its explain as the safest space for one’s money — particularly how bitcoin satisfies the functions of safety, integrity and transportability.

- Integrity: Integrity refers to an asset’s anti-fragility and resiliency towards corruption of the protocol. The protocol being the safeguarding and fortification of your monetary energy.

- Security: Security refers to its resiliency to external adversarial attack vectors.

- Transportability: Relating to the flexibility with which one can physically transport one’s wealth across geopolitical domains along with the power with which one can readily transact with other market members with minimal impedance or friction, i.e., ease of transactability/liquidity.

Asking Questions

A treasured lesson became once learned after I requested my teacher that demand: the importance of hard authority figures and their biases, figuring out illogical fallacies in a single’s arguments and the importance of asking the “why” of things.

This ability that truth, sooner than we watch every particular side of bitcoin’s supremacy as the safest device for storing one’s wealth, we ought to commence by prefacing this matter with a temporary discussion surrounding the thought that of saving itself and its relevance to our lives.

Using a first strategies ability to money administration will permit us to greater model the necessity for properly allocating our capital in suppose to strengthen our monetary health and attain prosperity. This ability that truth, permit us to commence by employing a Socratic ability that will permit us to greater comprehend why it’s necessary to retailer our wealth in bitcoin.

Saving For A Wet Day

The thought of saving is time and any other time parroted by mainstream society and monetary “consultants” and has served to turn out to be axiomatic in the minds of many. “Effect your money for a rainy day” is a mantra that is embedded into the psyche from a younger age. Alternatively, we attain now not stop to seek records from two traditional questions in accordance to those assertions:

1) What’s it we’re “saving?”

2) The attach attain we “set up” it?

This ability that truth, permit us to analyze the matter.

In frequent parlance we direct that we’re “saving” or “building up our financial savings,” however what’s it that we’re surely saving or attempting to set up? Properly, our money pointless to direct, which naturally begs the previous demand of what precisely money is.

You change time and energy to generate value to the market whereby you are compensated with money which acts as a illustration of your stored time, value and energy in provider to that market. As a natural corollary to this, in day to day vernacular, we also direct that we “exercise” time; we exercise time with our mates and household, we exercise time in meditation, we exercise time doing our leisure pursuits, and so on. Time and money, then, can now not be disentangled — they are synonymous — money merely being a illustration of expended time.

Phenomenal deal — what does it matter? Properly, though this can also merely seem arbitrary, it unfortunately matters a immense deal , since most retailer their time in fiat currency, that will (and is) printed out of thin air, therefore devaluing the final existing stock. The more of something that exists the much less scarce it becomes and therefore the much less value it retains. With the thunder opposite policy producing the polar opposite end result: the scarcer the more treasured it becomes (assuming that question remains constant). The heart of the inform is that you just’re exchanging the scarcest thing you maintain — your time and energy — for something that has no shortage the least bit, a corrupt money in fiat currency.

Within the existing paradigm the excellent technique to wrestle this and insulate your procuring energy requires that the person generate a return on their money, and that return desires to be superior to the present inflation payment — that’s what the sport is de facto all about. Sooner than bitcoin regarded, the in style technique to attain this became once by discovering modern strategies to generate stated return by varied investment automobiles.

The used medication to this inform is participating in the monetary markets, that device that one has to recall some component of risk in suppose to gather their procuring energy into the future — a system whereby folks deserve to recall an increasing number of risk to take up with rising levels of inflation, begetting a comprised societal foundation.

Bitcoin ameliorates this inform since it once any other time permits the person to surely set up their money and now not deserve to recall the risk of investment when all they settle to attain is to maintain some insurance coverage towards the uncertainty of the future and develop their prospects of safety and stability of their lives, as we shall look.

Sound Money Versus Relaxed Money

This successfully comes all of the device in which down to the quantity of preserving your wealth in sound money or comfortable money. In suppose to articulate apart between the two, we can search for to the three pillars mentioned on the introduction of this text which protest the sanctity of our financial savings, these being its integrity, safety and transportability/liquidity.

Let us now assess those three pillars and distinction the usage of banks with the usage of bitcoin and the device in which successfully every satisfies these properties.

Financial institution

Integrity: Fiat money stored in a monetary institution benefits from zero integrity thanks to an absence of protection from inflation since the curiosity payment would not beat even the reliable inflation payment. In consequence, preserving your money for your checking narrative device that you just’re mathematically guaranteed to lose procuring energy.

Security: The protection side of banks is critically greater. It’s a ways engaging for any individual to enter a monetary institution and decide your money; the money is both stored in the wait on of four toes of steel in a vault or this display shroud day, stored digitally. Alternatively, though correct for shielding towards malicious external assaults, a person’s checking narrative is any other matter since the prospective of confiscation or deplatforming is steadily present. Counterparty risks steadily exist, as can also merely moreover be seen with contemporary occasions in Canada.

Transportability: Fiat paper money became once a life like invention which allowed folks the finest thing about transacting and transporting their wealth more without considerations across procedure. Alternatively, this profit handiest exists contained in the person’s respective geopolitical domain. It might possibly perhaps well display shroud problematic if one were required to leave their nation in the case of an emergency, as can also merely moreover be seen with the contemporary disaster in Ukraine.

There isn’t very any exhaust withdrawing cash and carrying it across borders since it’s a ways also both needless in a nation with a particular currency or the change payment would display shroud atrocious and thus now not optimally liquid, along with presenting a pronounced risk to at least one’s safety thanks to susceptibility to theft or coercion. Money therefore, is now not flawless in transporting one’s wealth across geopolitical domains.

This ability that truth, a monetary institution is handiest marginally greater than preserving cash below your mattress.

Bitcoin

Integrity: Bitcoin would not suffer from the corrosive outcomes of inflation due to the its completely mounted provide. It’s a ways de facto deflationary in nature with its integrity steadily guaranteed, since no person or entity can alter the provision cap owing to its decentralization. There isn’t very any requirement to recall counterparty risk.

Security: If a person takes corpulent custody of their bitcoin (which they are impressed to attain) no person or party can carry out procure entry to to those funds if the owner holds those keys.

Transportability: Referring wait on to the thought that of money being an insurance coverage policy towards the inherent uncertainty of the future and a strategy for optimizing pure optionality as a bulwark towards stated uncertainty, bitcoin permits a person to retailer their wealth in an asset that will perhaps well also merely moreover be moved across geopolitical domains in the confines of their very minds.

That you can additionally enter a brand new nation with all your wealth intact, take dangle of a sim card and exercise your bitcoin or advertise for the native currency to take dangle of meals and lodging. Most of us’s wealth is stored of their properties as equity, which is extremely illiquid, taking spherical six months to transact. The money of their monetary institution accounts can also merely moreover display shroud needless in a international nation the attach their monetary institution accounts can also merely now not be valid or the currency varied.

The hot disaster in Ukraine successfully highlights the importance of possessing transportable wealth. The stylish world is in a constant protest of flux and the growing necessity for folks to flee their inherited nation states grows by the month; bitcoin supplies an unparalleled opportunity for folks to reclaim their autonomy in a world attach on minimizing or altogether eviscerating it.

Central Financial institution Digital Currencies

A temporary point and warning ought to be made right here concerning the upcoming implementation of Central Financial institution Digital Currencies (CBDCs). CBDCs are programmable digital currencies that would possibly be manipulated by governments, central banks and employers.

Even supposing CBDC proponents advocate for its exhaust as device of protection towards fraud and money laundering, they with ease omit the immense energy imbued in its issuers. CBDCs will permit the issuer to attain corpulent adjust over its users’ money: customize curiosity rates, attach expiry dates and adjust particular uses are true likely the most probabilities that exist with this programmable money.

And what can also very successfully be the final end result of this if these CBDCs can also merely moreover be linked to a digital ID? In case your political stance is seen as atrocious to the establishment? What occurs ought to you can not take dangle of investments or you are given a detrimental curiosity payment because you are saving too noteworthy money and are thus incentivized to exercise and exhaust?

Having demonstrated that allocating your capital contained in the confines of a monetary institution is a prison responsibility, it’s a ways popping into an increasing number of apparent that entrusting your money to those institutions will now now not dwell utterly a prison responsibility. Fiat money and the banking system will commence to pose a necessary risk now not true to your monetary sovereignty, however also to your person free will. The implementation of CBDCs surely imperils a person’s staunch to self-resolution; it presents a in actuality clear and present hazard jeopardizing liberty, sovereignty and freedom.

Bitcoin and CBDCs are diametrically adverse. They’re polar opposites of their philosophies; one grants sovereignty, the different slavery; one supplies self-custody and the different, total adjust.

Bitcoin Is Better Than Banks

Bitcoin fortifies your money and restores the person’s skill to set up as a alternative of take dangle of speculative investments. Bitcoin has no CEO; Bitcoin has no shareholder conferences; Bitcoin true is.

Pointless to direct, an astute reader will model that bitcoin and banks are now not the final be aware choices when it involves allocating one’s capital. There are other investment choices equivalent to precious metals, staunch property, authorities and company bonds, honest art, wine, antiques and hundreds other choices that will perhaps well also very successfully be damaged-down as stores of value. Based mostly totally on Nassim Taleb, you might presumably presumably even exhaust olive oil.

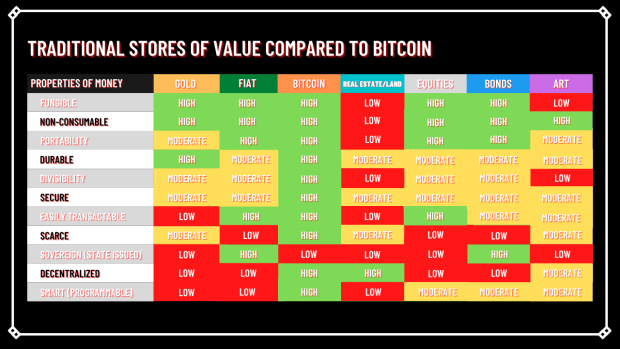

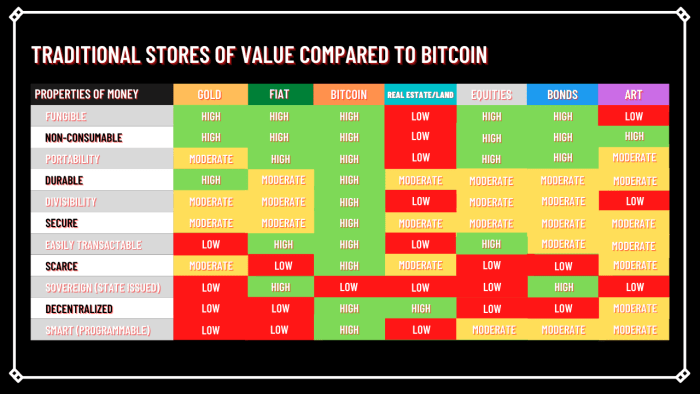

Alternatively, bitcoin remains supreme in its characteristic as the optimum retailer of value in accordance to it being ready to most successfully fulfill the core properties of money as demonstrated above. To extra compound this point, the next image presents a matrix illustrating a side-by-side comparison of each and every used retailer of value juxtaposed to bitcoin.

Sleek: The rising reputation of democratized finance, emergence of fractional possession and growing reputation of NFTs are attach to digitally dematerialize used stores of value. Alternatively, for the aim of this dialog, the above has centered on established, used stores of value and has forgone speculative ventures. As an illustration, a fraction by Basquiat or Van Gogh is what constitutes art in this instance, now not NFTs (which maintain yet to effect themselves). (Source)

Volatility

“Bitcoin is simply too volatile.”

This is a routine mantra that is persistently perpetrated by Bitcoin’s detractors as a aim of it now not being a protected wager. Personally, you can’t blame them since they are oftentimes merely regurgitating what’s expounded by the mainstream media in suppose now not to seem ignorant on the matter. It’s a ways an computerized response, derived from hysterical headlines. Allow us to dismantle it.

We maintain established that bitcoin is mainly the most gather asset accessible to market actors, possessing the finest integrity and safety along with providing the device for transportability. The attach does volatility maintain a characteristic to play?

Let us commence to ticket what volatility is and why bitcoin is now not volatile whatsoever. Let us proceed in our strategy of asking questions. What’s it that is volatile about bitcoin precisely? The model is volatile.

The model of bitcoin is indeed volatile ought to you are measuring the asset by fiat currency, however model would not steadily equate value or price. Because of this one can preach that an asset or object can both be conception to be undervalued or overrated; consideration is essentially essentially based upon what one subjectively believes the asset to be price.

Effect is merely the target present change payment for a narrate lawful or provider, i.e., what one is required to pay to receive its profit; however the model itself, though aim, is made up our minds by the subjectively perceived value of an asset’s price and value. All of us build value to varied things — some bag value in gathering baseball cards, others bag value in learning how to crochet, whereas there are others who bag zero value in both of those practices and so attain now not settle.

The more value something has, the elevated its price, that device that this can also merely expose the next model, since all of those components are interdependent. Since value is derived from question, shortage and perceived usefulness, which together fabricate the muse of bitcoin’s exhaust case, the volatility of the model of bitcoin can without considerations be reconciled since it has a mounted and diminishing provide: coupled with rising question, it ends in an ascendance in model.

You Can’t Lose Money With Bitcoin

A valorous explain.

When one stops to maintain in strategies the matter, they inevitably model that they’ll’t lose any money. Completely, the value of their bitcoin measured in fiat can also merely fluctuate however their holdings maintain now not gone anywhere. Seasoned veterans in the Bitcoin procedure create now not maintain any curiosity in the fluctuations in the fiat model of bitcoin; that metric is inconsequential to them and poses no relevance because they exhaust a particular device of size. They’ve begun to denominate things, now not in fiat terms however in bitcoin terms, which is why the meme “1 BTC=1 BTC” is so prevalent, since it successfully illustrates this point.

All the pieces is for the time being denominated in fiat in most of us’s minds, however when one begins to shift one’s mindset and begins denominating things in bitcoin terms, and come what might in satoshis, the image becomes noteworthy clearer. This ability that truth, whereas you commence this direction of and also you discard the conception to be trading your bitcoin for fiat, you as a alternative commence to be aware of of the value of things relative to bitcoin and what it will take dangle of you, equivalent to a rental, a automobile, groceries, and so on.

In fact, what’s volatile are fiat currencies. How many currencies maintain risen and fallen over the centuries? How persistently are they diluted and deprived of their fashioned value? How scarce are they? We ought to be impressed to commence asking these questions.

Time Preference

These questions are in point of fact reflected by one’s time preference: Whereas you occur to can maintain gotten a in actuality excessive time preference, then you positively space more emphasis on the present and strategy-term model motion. Whereas you occur to can maintain gotten a lower time preference, that device the next predisposition for patience and delayed gratification, then longer-term efficiency is more meaningful. Your time horizon will inevitably maintain an affect on your perception of occasions.

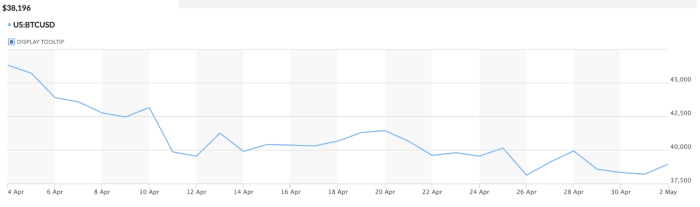

The next image shows bitcoin’s efficiency over a recent one-month time duration. The next image shows bitcoin’s total return since 2010. When seen on a lengthy ample time horizon, we can look that bitcoin doesn’t search for volatile the least bit. In fact, it looks to be to be somewhat consistent in its trajectory to the tip-staunch corner.

One-month return (source)

All-time return (source)

Conclusion: There Is Nowhere Else To Effect Your Money

The major emphasis of this text is to stimulate the reader’s strategies into asking questions, to ask the obvious “normalcy” of the existing paradigm and to undertake considerate inquisition into the prospective of a bigger, more humane association.

Bitcoin is founded on natural regulations; it’s a ways aim truth, ruled by the regulations of arithmetic and physics. It’s a ways engineered money. Distinction this with central banks who manipulate curiosity rates on a whim, which in general decline decade after decade. Now not handiest are you losing procuring energy, however you are actively being robbed.

Bitcoin now not handiest supplies safety, integrity and transportability, however also supplies simplicity to its users. Long previous are the times of stock-deciding on and head-scratching — bitcoin presents the choice of a easy and gather device for retaining your wealth into the future.

I inform the reader to bag a more gather, greater-performing retailer of value for his or her money. Bitcoin is the hurdle to beat and the device for securing your wealth across procedure and time. For of us who maintain the fortune of reading this text now and maintain courage to enter the new paradigm, they’re going to be rewarded with an explosion of their procure price since they are entering the market before every part of the S-curve, taking corpulent advantage of the adoption phase of a know-how, the attach they’ll sit down wait on and search for Metcalfe’s Law and the Lindy carry out play out beautifully.

Bitcoin is the opportunity of a millennium. It’s a ways the oasis in the desolate tract, the protected harbor in the storm, the defend towards the arrows. Reclaim your sovereign birthright, return to your future and fear now now not.

This is a visitor post by Beren Sutton-Cleaver. Opinions expressed are utterly their occupy and attain now not necessarily reflect those of BTC Inc. or Bitcoin Magazine.