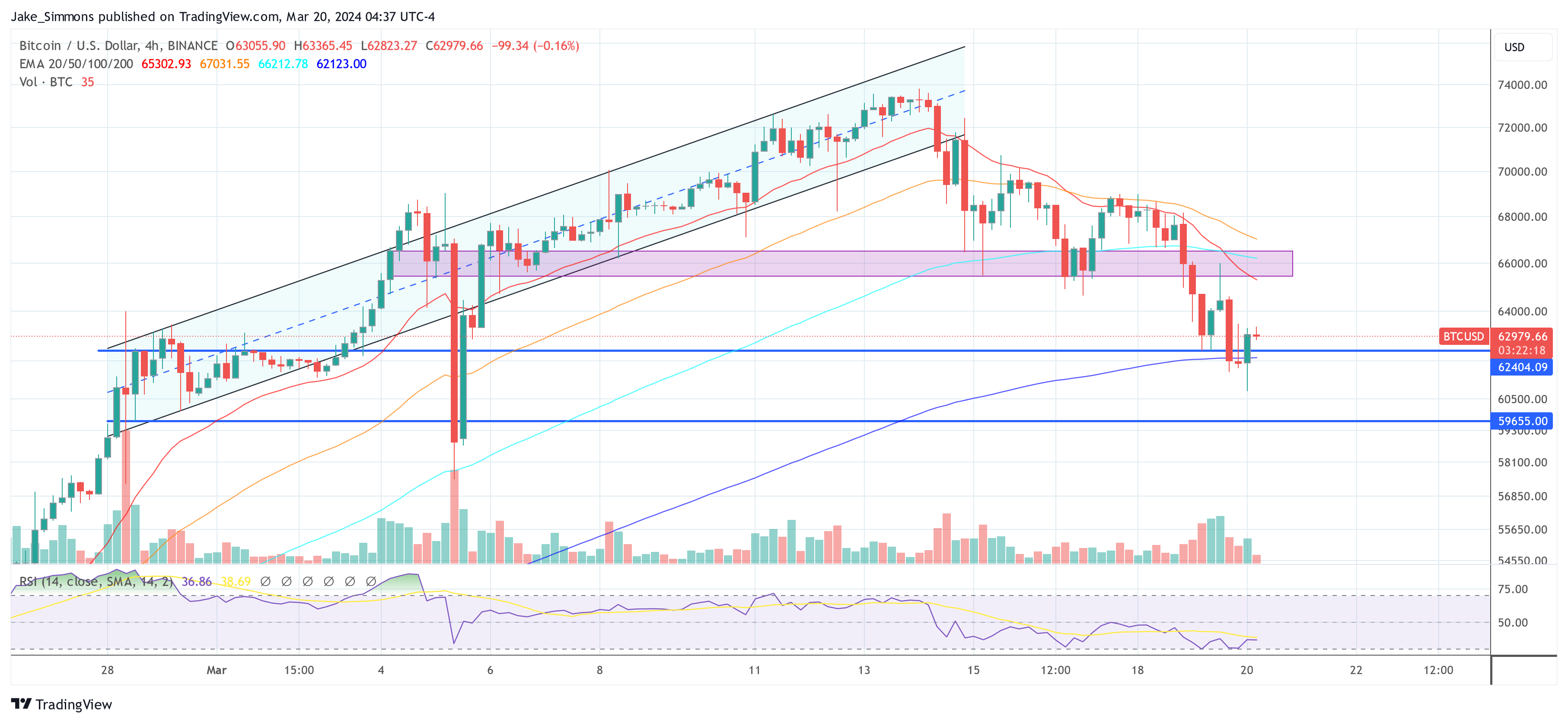

Bitcoin has experienced a engaging decline from its March 14 high of over $73,600 to this day’s low of underneath $60,800, translating to a -17% loss in cost. This major plunge has triggered a flurry of exercise on social media platforms, significantly X (beforehand Twitter), the put apart crypto experts have been fervently discussing the capacity reasons within the again of this downturn and speculating on what the future holds for the enviornment’s main cryptocurrency.

Unpacking The Bitcoin Shatter: Knowledgeable Opinions

Alex Krüger, a revered prefer in each macroeconomics and crypto, grow to be quick to name the principle factors contributing to Bitcoin’s designate crumple. Essentially based entirely on Krüger, the atomize could even be attributed to just a few key factors: vulgar leverage within the market, Ethereum’s unfavourable affect on overall market sentiment as a result of ETF speculations, a significant decrease in Bitcoin ETF inflows, and the irrational exuberance surrounding Solana memecoins, which he refers to disparagingly as “shitcoin mania.”

Reasons for the atomize, in reveal of importance

(for those that want them)

#1 Too unprecedented leverage (funding matters)

#2 ETH riding market south (market made up our minds ETF no longer passing)

#3 Negative BTC ETF inflows (careful, files is T+1)

#4 Solana shitcoin mania (it went too a ways)— Alex Krüger (@krugermacro) March 20, 2024

WhalePanda, yet any other influential scream within the crypto discipline, identified the alarming rate of ETF outflows, with a file $326 million leaving the market yesterday. This circulate has been significantly detrimental to GBTC, which seen outflows of $443.5 million.

In distinction, Blackrock’s inflows stood at a mere $75.2 million, marking its 2d lowest as much as now. Additionally, Fidelity seen excellent $39.6 million in inflows. “No longer unprecedented to scream, that is awful for the value and we’ll doubtlessly be taught about decrease now this potential that news impacts the sentiment to boot. Let’s be taught about what the flows are the following day. Obvious thing is that we’re roughly 30 days from halving, and GBTC is getting rekt,” he remarked.

Yesterdays ETF flows by @FarsideUK.

We had $326 million in outflows. Biggest outflow as much as now.

Blackrock did no longer put us from $GBTC, which form of grow to be obvious with the value action.$GBTC had $443.5 million outflows, Blackrock had $75.2 million inflows, their 2nd lowest to… pic.twitter.com/hIingoYMly

— WhalePanda (@WhalePanda) March 20, 2024

Charles Edwards, founding father of crypto hedge fund Capriole Investments, supplied a historical standpoint on Bitcoin’s most up-to-date designate stagger, suggesting that a 20% to 30% pullback is within the norm for Bitcoin bull runs.

“A identical previous Bitcoin bullrun pullback is 30%. Abet in December, we have been already within the longest worthwhile scamper in Bitcoin’s history. A 20% pullback right here takes us to $59K. A 30% pullback would be $51K. These are all ranges we also can simply quiet be ecstatic waiting for as possibilities,” he acknowledged.

Rekt Capital supplied an prognosis of Bitcoin’s designate retracements for the reason that 2022 beget market backside, noting that the present pullback is handiest the fifth essential retrace, with all previous ones exceeding a -20% depth and lasting from 14 to 63 days. In sum, there are two key takeaways about this present retracement

The nearer Bitcoin will get to a -20% retrace, the higher the different becomes.

Retraces want time to fully feeble (no longer decrease than 2-3 weeks, at most 2-months).

For the reason that November 2022 Endure Market Bottom…

Bitcoin has experienced the following retraces:

• -23% (February 2023) lasting 21 days

• -21% (April/May perhaps well well additionally simply 2023) lasting 63 days

• -22% (July/September 2023) lasting 63 days

• -21% (January 2023) lasting 14 days

This… pic.twitter.com/cQyQOLA5Zv

— Rekt Capital (@rektcapital) March 19, 2024

Alex Thorn, head of overview at crypto huge Galaxy Digital had beforehand warned of the possibility of serious corrections in some unspecified time in the future of bull markets, suggesting that the present retrace is comparatively identical previous. “Two weeks ago i warned that huge corrections aren’t excellent that you presumably can mediate of nonetheless *most likely* in Bitcoin bull markets. At -15%, this within reason identical previous historically. Bull markets climb a wall of awe.”

Macro analyst Ted (@tedtalksmacro) focused particularly on the implications of the upcoming Federal Originate Market Committee (FOMC) assembly. He highlighted the huge outflows from discipline BTC ETFs, attributing them to merchants’ cautious stance prior to the FOMC resolution and the capacity impact of tax season within the US.

On the opposite hand, following the plunge to $60,800, Ted urged that the market can have fully priced within the worst-case scenario, hinting at a doable bullish reversal if the FOMC’s choices align with market expectations for pastime rate cuts by the tip of the yr. He acknowledged:

Time to utter. FOMC hedging carried out, worst case priced. Entirely thing that happens from right here is that those protective positions unwind into or on the match this day. Bulls also can simply quiet step up right here soon. […] The market has fully priced in yet any other defend from the Fed at this day’s assembly, and is pricing 3 rate cuts from them by the tip of the yr. Anything else that strays a ways off from this from this day’s new financial projection / dot intention discipline fabric will impact the market stagger sharply.

At press time, BTC traded at $62,979.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for academic capabilities handiest. It doesn’t represent the opinions of NewsBTC on whether to purchase, promote or defend any investments and naturally investing carries dangers. You need to perhaps well presumably also very well be commended to behavior your maintain overview sooner than making any funding choices. Exhaust files supplied on this web page utterly at your maintain possibility.