Key Takeaways

- Bitcoin plummeted 9% Wednesday, reaching a low of $62,820.

- The downswing resulted in extra than $700 million in liquidations.

- BTC could presumably per chance excellent again sooner than advancing further.

Bitcoin has rebounded following a flash fracture on Nov. 10. Whereas traders appear to be re-coming into the market, the leading cryptocurrency could presumably per chance retest the most up-to-date lows sooner than resuming its uptrend.

Bitcoin Sure for Any other Downswing

Bitcoin shall be going by an impending dip.

The tip cryptocurrency suffered a dip shortly after breaching a new all-time excessive at $69,000. The surge got here Wednesday as traders rushed to hedge against the fastest 12-month inflation amble the U.S. has ever recorded since 1990. However, the cryptocurrency market moreover seemed overheated.

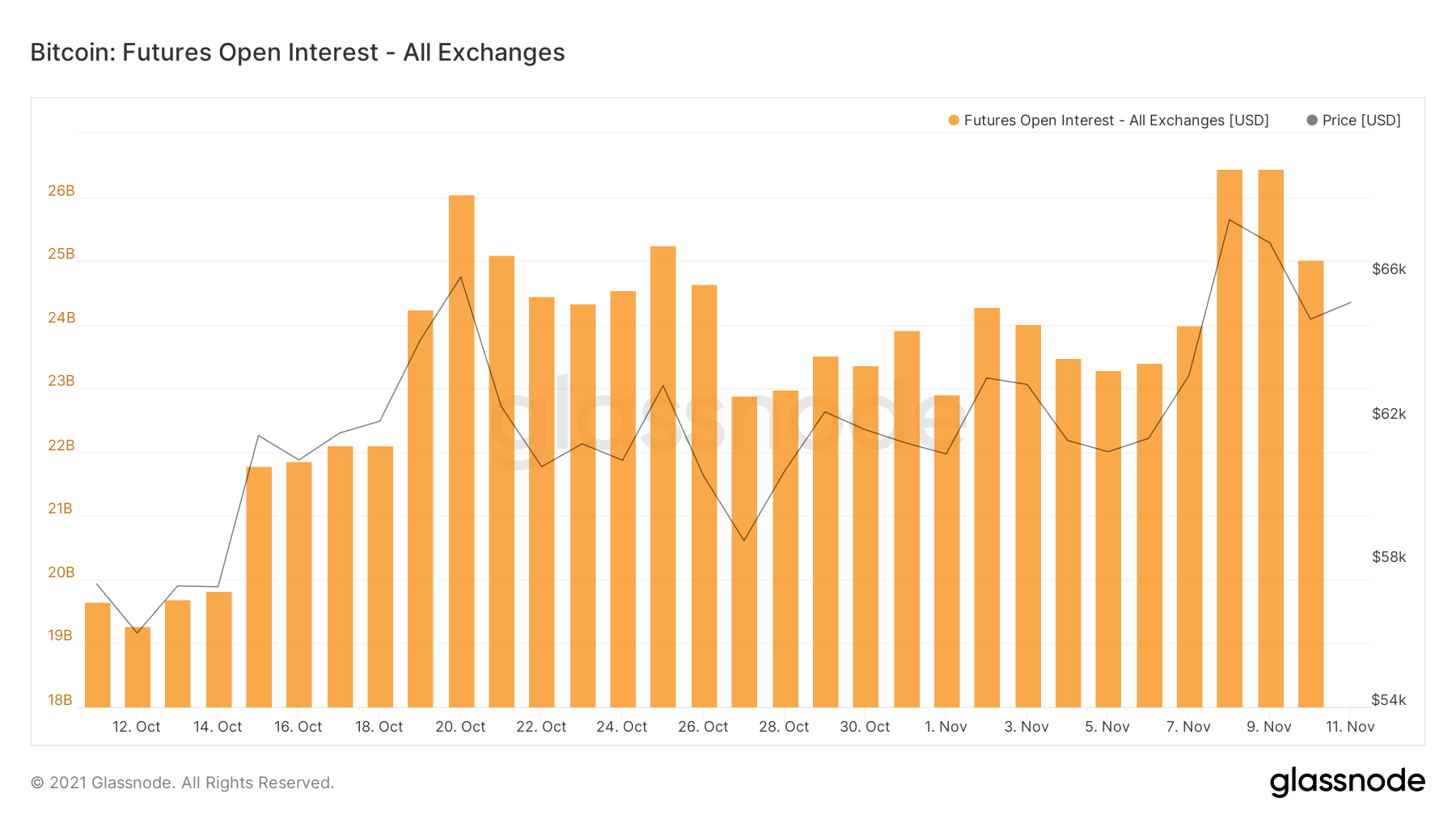

Inaugurate curiosity in Bitcoin and Ethereum futures has soared this week, growing the supreme conditions for a long squeeze. Hours after Bitcoin reached a new all-time excessive, it noticed a 9% correction that resulted within the asset’s market price shedding virtually 6,000 suggestions inside just a few hours.

As the flagship cryptocurrency crashed below $63,000, most different belongings within the market adopted, generating extra than $700 million in liquidations price of long and brief positions.

Despite the indispensable losses incurred, open curiosity in Bitcoin futures stays above $25 billion. The rather a lot of amount of funds allocated in open futures contracts is a unfavorable label for the continuation of the uptrend.

The excessive open curiosity price could presumably per chance level to that traders who bought shaken out of the market within the flash fracture are hoping to avenge their losses. The elevate in snatch orders shall be contributing to the price rebound viewed within the last few hours. Serene, Bitcoin could presumably per chance dip further to alleviate just among the stress and stabilize the futures open curiosity.

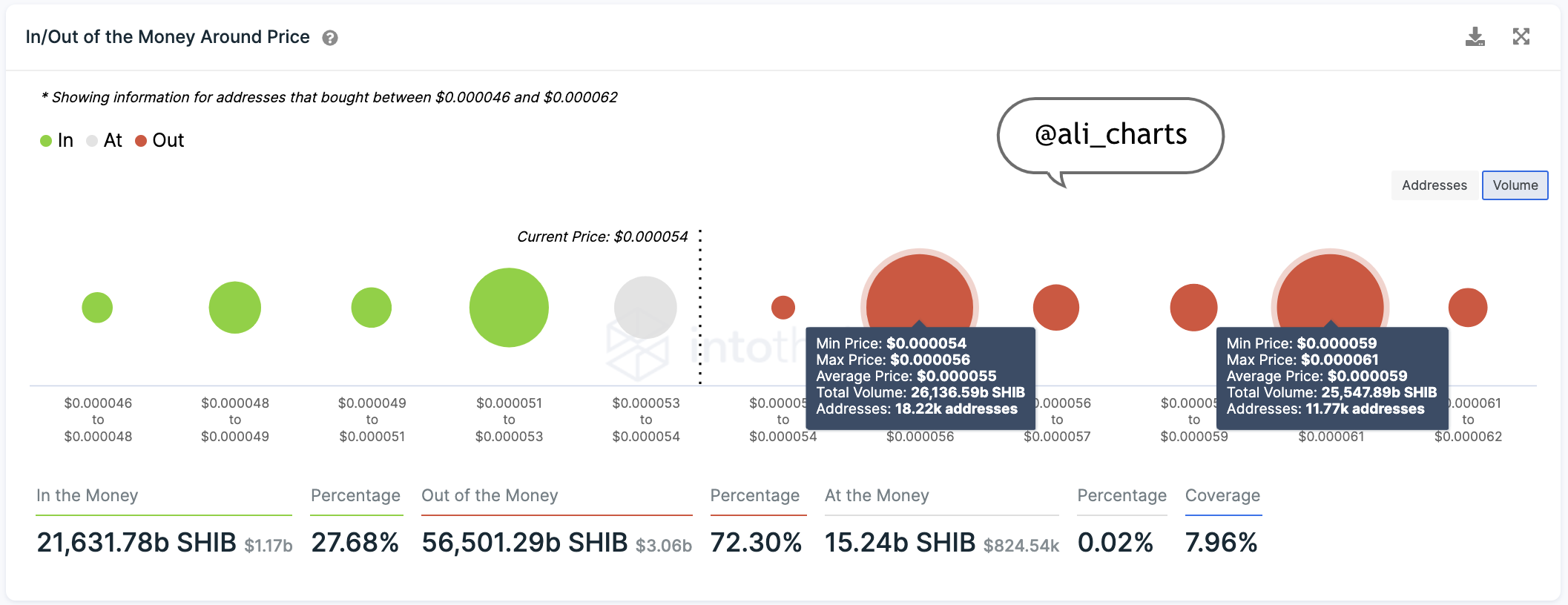

In accordance with IntoTheBlock’s In/Out of the Money Spherical Tag (IOMAP) model, one other downswing shall be capped between $61,350 and $63,300. Transaction history reveals that roughly 1.31 million addresses non-public beforehand bought over 650,000 BTC around this heed stage.

This kind of large quiz wall could presumably per chance non-public the skill to absorb any promoting stress as holders inside this heed pocket could presumably per chance strive to help their positions “In the Money.”

A downswing to the $61,350 and $63,300 heed vary could presumably per chance moreover help sidelined traders to rep motivate into the market. In this eventuality, the elevate in shopping stress shall be ready to lend a hand Bitcoin hit new all-time highs as the IOMAP reveals no indispensable present obstacles ahead.