After its third-greatest weekly plunge in over a one year, the Bitcoin (BTC) worth has within the kill started to rise. BTC’s worth has effectively rebounded from the essential back diploma of $37,500, despite an impending Federal Reserve rate hike.

Bitcoin Poised For 10% Jump

Diverse analysts, worship The Wolf of All Streets, Michael van de Poppe, and PlanB, are bullish on the bullish vogue, with the Bitcoin worth for the time being conserving above $39,000.

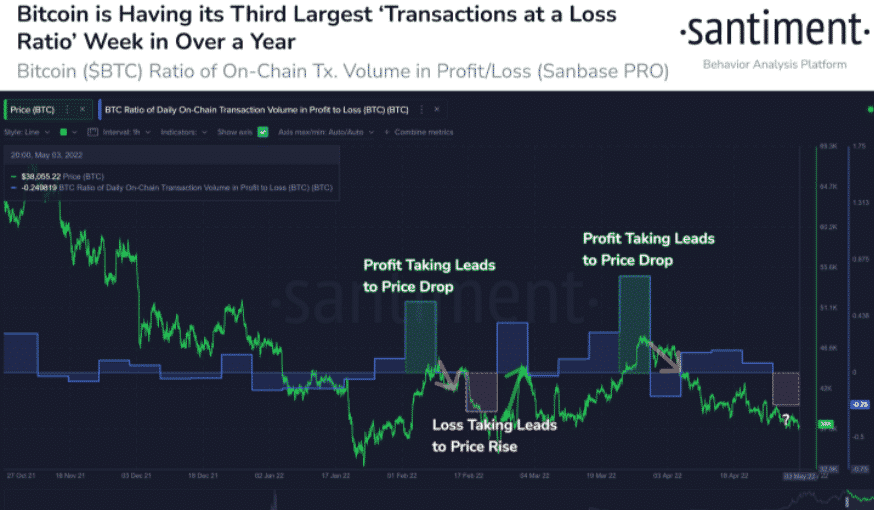

In a tweet on May perchance well perchance honest 4, on-chain records provider Santiment published historical records showing a 20% rally because of BTC transactions is negative at the identical levels between February 16 and 22. The week’s Bitcoin Ratio of On-Chain Transactions Quantity in Earnings/Loss statistic is the third greatest capitulation in a one year.

As technicals strengthen, several analysts and merchants forecast a worth amplify within the following days.

Michaal van de Poppe predicts that the worth of Bitcoin (BTC) will rise from recent levels. He acknowledged,

“Bitcoin starts to peep formula better at this stage. Odds that the match tonight is a ‘Promote the rumour, Desire the News’ match are rising.”

A illustrious crypto trader, The Wolf Of All Streets, predicted a rebound in Bitcoin worth as it breaks above the vogue line. A gargantuan rise can also be anticipated if the BTC worth stabilizes over $39,000.

Bitcoin On-Chain Transactions Quantity. Provide: Santiment

In accordance to PlanB, the customary $55K S2F model, which modified into launched in March 2019, appears to be like to be monitoring the Bitcoin worth vogue. He furthermore expects Bitcoin to rise in worth.

The worth of Bitcoin (BTC) has regained over 5% within the outdated 24 hours, stabilising shut to $39,000. Whales proceed to amass at dips, ensuing in a monumental amplify in procuring and selling quantity. Furthermore, the BTC has finished without a plunge below the severe back diploma. It suggests that a rally can also happen within the following several days.

Urged Discovering out | Bitcoin Temporarily Tops $40,000 As More Worldwide locations Undertake Crypto

BTC Trades Sideways

BTC has been procuring and selling sideways all the plot in which thru the final few days, with the worth losing below $40,000 on April 26. Though, after reaching the swing highs shut to $48,000, the worth has already begun to plunge. BTC retreated and lost 45 percent of its worth. BTC sellers, on different hand, are weary as the worth trades sideways in a slim differ since April 25.

B

BTC/USD trades sideways. Provide: TradingView

A day-to-day shut below the session’s low, on different hand, would disprove the bullish worth assumption. In that scenario, $36,000 incessantly is the lowest point on the device back.

BTC/USD is for the time being procuring and selling at $39,874, up 5.63 percent for the day as of publishing time. In accordance to CoinMarketCap, the predominant cryptocurrency by market capitalization has a 24-hour procuring and selling quantity of $35,528,442,016.

Urged Discovering out | Will Bitcoin Shoot Over $40,000 — Or Descend To $35,000?

Volatility Drops

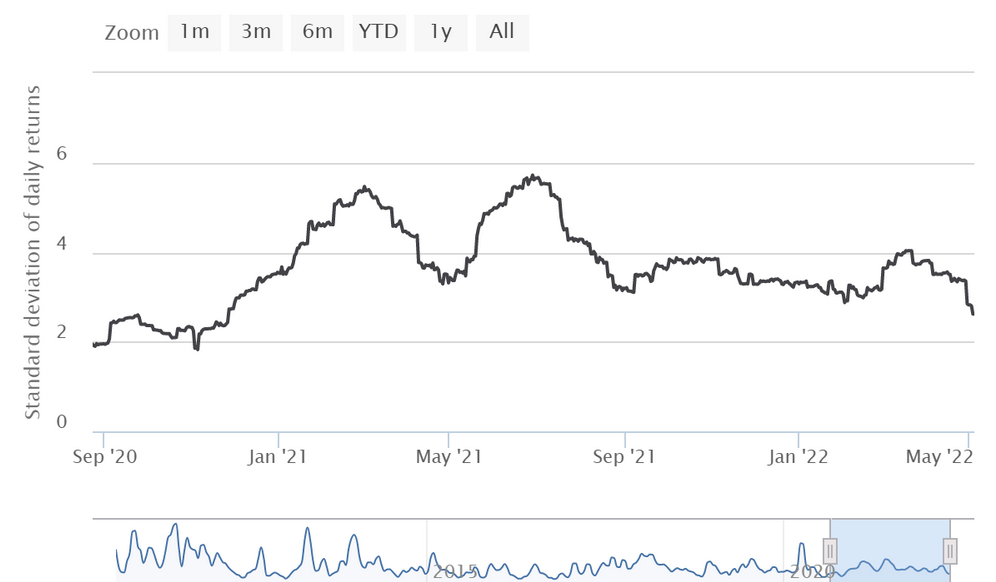

Bitcoin’s historical volatility is at 18-month lows, in step with statistics launched by the Desire Bitcoin Worldwide webpage. Its anticipated 60-day reasonable worth fell to 2.62%.

Bitcoin (BTC) volatility modified into final this low in November 2020, when the orange coin broke thru $10,000 for the predominant time in this bullish cycle.

Describe by Desire Bitcoin Worldwide

On April 27, 2022, thirty-day volatility reached a native low, but it is already showing signs of restoration.

The Bitcoin Volatility Index (BVOL), connected to the inventory market’s VIX, presentations how grand Bitcoin’s worth adjustments on a given day in the case of its outdated worth.

Essentially the most most up-to-date amplify in Bitcoin (BTC) volatility came about in July 2021, when the flagship cryptocurrency modified into twice as unstable over a 30-day period as it is now.

Featured checklist from Pixabay, chart from TradingView.com