On-chain data displays the Bitcoin miner selling vitality has plunged no longer too long ago, a trace that can be clear for the crypto’s establish.

Bitcoin Miner Selling Energy Has Plummeted In Recent Days

As identified by an analyst in a CryptoQuant post, there used to be much less selling power from the miners no longer too long ago. There are two relevant indicators right here, the miner provide and the miner outflow. The first of those, the miner provide, is purely a measure of the total quantity of Bitcoin for the time being sitting in the wallets of miners.

The different one, the miner outflow, is a metric that retains discover of the total different of coins that miners are transferring out of their provide for the time being. Now, the “miner selling vitality” is defined as this miner outflow divided by the miner provide (30-day interesting average, log-scaled).

When the price of this indicator is excessive, it come miners are transferring out expansive amounts when put next with their complete provide correct now. Since miners most ceaselessly rob out their BTC for dumping purposes, this pattern could well moreover be bearish for the price of the crypto. On the opposite hand, low values counsel miners are spending moderately dinky amounts for the time being.

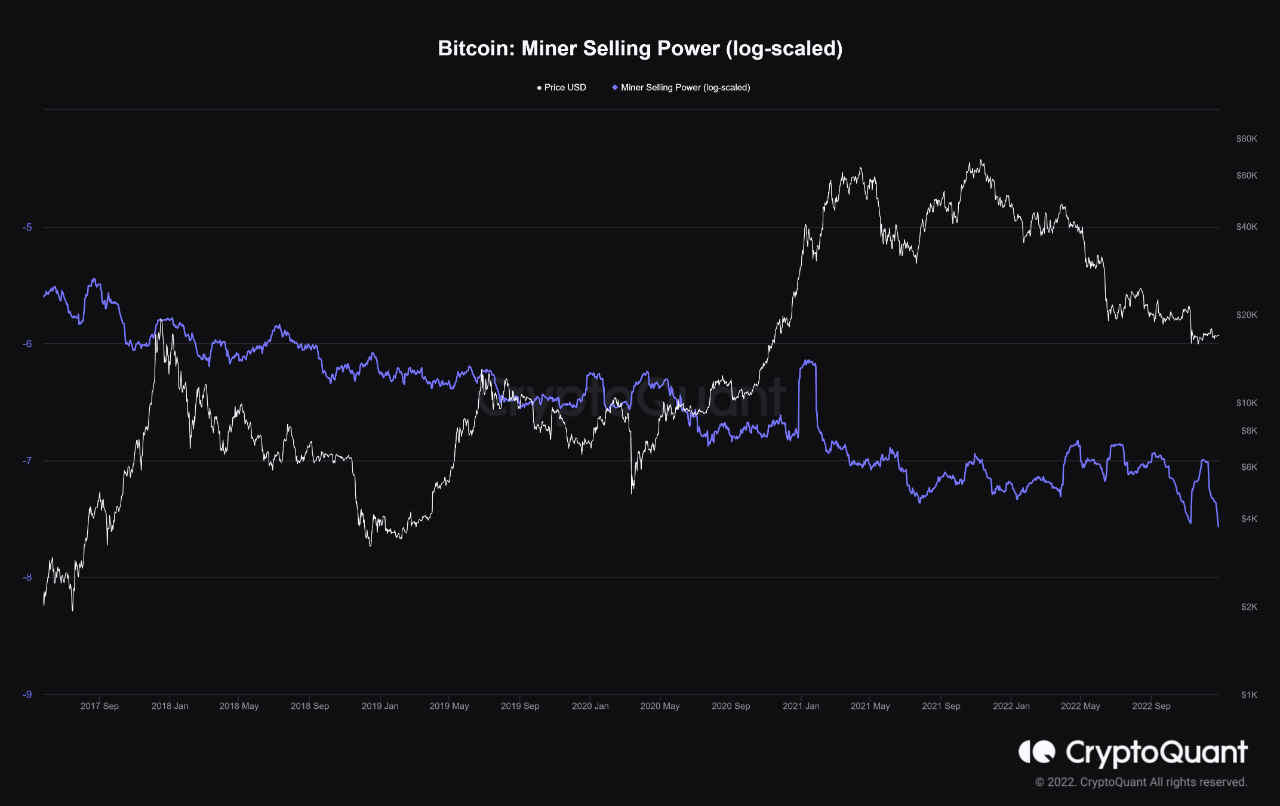

The beneath chart displays the pattern in the Bitcoin miner selling vitality over the previous few years:

The value of the metric seems to have taken a plunge in recent days | Source: CryptoQuant

Because the above graph displays, whenever the Bitcoin miner selling vitality has reached excessive values and map a local peak, the price of the crypto has considered some downtrend. This pattern makes sense as highs in the metric counsel elevated selling power from these chain validators.

Now not too long ago, the indicator over again showed this form of formation, and BTC reacted with a decline this time to boot, as its establish went from bigger than $18,000 to the original $16,000 stage. Nonetheless, since this contemporary peak, the miner selling vitality has been suddenly going down and has now map a original low.

This muted selling power from miners also can no longer necessarily be bullish by itself, however it does mean that if Bitcoin displays any bullish momentum now, miners wouldn’t provide any impedance to it in the mean time.

A charming long-timeframe pattern to glimpse in the miner selling vitality chart is that the metric has been on an total downtrend in the closing five years or so. This implies that over time, miners cling been selling lesser and lesser BTC when put next with their reserves, suggesting that they cling been amassing and rising their provide as an alternative.

BTC Trace

At the time of writing, Bitcoin’s establish floats around $16,800, up 1% in the closing week.

BTC continues to display boring price action | Source: BTCUSD on TradingView

Featured divulge from Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, CryptoQuant.com