Over the previous few weeks, Bitcoin markets dangle had to accommodate a swarm of wicked news coming out of China.

It started with rumors that miners in Sichuan had long gone offline after the province cramped vitality-intensive industrial activities, corresponding to Bitcoin mining.

Then got here a joint enlighten by three of China’s prime financial self-regulatory organizations reminding the general public of the nation’s 2017 ban on crypto resources. Then it became reported that for the first time, the Chinese Reveal Council, headed by President Xi Jinping’s prime financial consultant, became cracking down on mining.

To prime things off, closing Sunday the Chinese disclose-elope news company Xinhua published a negative article on crypto resources, denouncing their dangers relative to identical old funding instruments.

Whereas there had been a pair of things contributing to this promote-off, one element is undeniable: there is one thing brewing in China. No matter it’s far, this assortment of events has led market participants to terror for Bitcoin’s future, especially because it relates to mining.

To resolve this, let’s follow the cash.

The colossal element about Bitcoin’s financial transparency is that it enables us to dangle how miners are responding to all of this, in realtime. But earlier than we delve into the exact mining data, it’s basic to make a rapid recap of how miners dangle interaction with Bitcoin and the map we can measure that.

One amongst the largest misconceptions about Bitcoin mining is that it’s far, to quote Elon Musk, “highly centralized, with supermajority controlled by handful of vast mining (aka hashing) companies.” Right here’s objectively wrong. Actually, what we call mining this demonstrate day is a highly layered exercise.

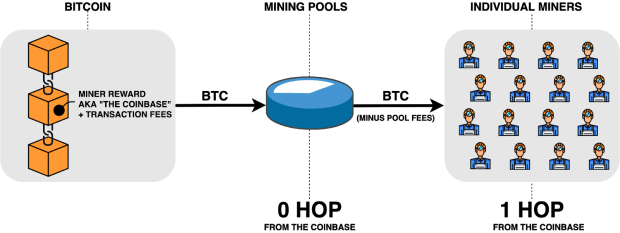

In sing to fabricate greater their odds of success, miners collectively make a contribution their sources to so-known as mining swimming pools. Swimming pools describe desirable groups of individual miners that work collectively mining the very identical block. When a pool efficiently mines a block, it’s far awarded 6.25 newly issued BTC plus all charges paid by users to dangle their transactions integrated in that block. After collecting a carrier charge, the pool then distributes the proceeds to individual miners.

Monitoring what happens to newly issued bitcoin can yield meaningful insights into the collective behavior of both mining swimming pools and the individual miners running within them. In sing to discern these two very varied actors, Coin Metrics has produced a house of aggregate metrics that abet as proxies.

As a proxy for mining pool behavior, we aggregate data from all “coinbase” transactions: the first transaction of every Bitcoin block (now to now not be at a loss for phrases with the switch). As a proxy for individual miner behavior, we aggregate data one hop from that transaction, i.e., all transactions that got funds from the coinbase.

At a runt degree, when you notice what happens after one hop, the notion that Bitcoin mining is centralized is shattered. Genuinely, there are hundreds transactions previous one hop which dangle dozens of recipients, which would maybe maybe maybe be indicative of layered constructions even on the individual miner degree. One notion is that several mining operations are joint ventures the attach apart partners might need complex payout constructions. As such, measuring one thing over one hop becomes extra tough and subjective.

Now that we have got lined how aggregate miner behavior will also be measured on-chain, let’s consume a ogle on the info.

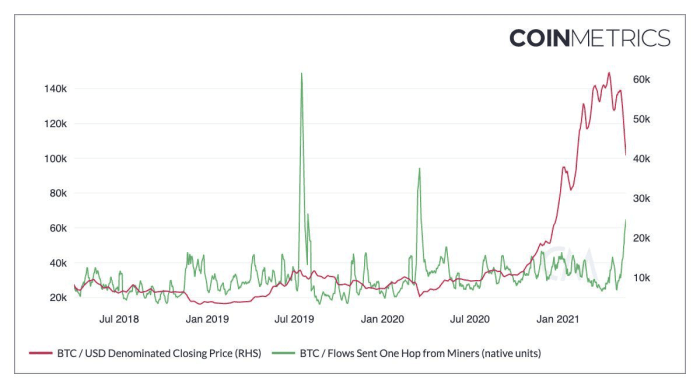

What’s the on-chain data telling us? Before individual miners can effectively promote their cash, they ought to make a transaction that sends funds to an switch, an over-the-counter desk, and even today to the consumer albeit in uncommon conditions. In any of those eventualities, we would gaze an manufacture greater in the waft of funds being despatched from individual miners (one hop) to other addresses.

The chart below shows precisely that. Aggregate flows despatched by miners are on the best stages since March 2020, when markets crashed on the onset of the COVID-19 pandemic. This helps the hypothesis that essentially the most as a lot as date promote-off became by Chinese miners which dangle provided share of their holdings in sing to flee essentially the most as a lot as date wave of enforcement actions by the Chinese Communist Celebration.

Even though what they receive on a every single day basis is minute in comparison to global BTC quantity, the info showcased above suggests that as soon as miners are doubtless promoting (an manufacture greater of “flows despatched”), markets respond negatively.

Non-public in solutions that miners are also speculators. Even though what they receive in miner rewards is minute in USD phrases relative to the quantity of global BTC markets, they make succor BTC on their balance sheets. In times of uncertainty, when they ask to desire cash, their collective actions dangle an impact available in the market on the market.

Now keep yourself in the sneakers of a Chinese miner that can decide to switch to a undeniable nation. No matter the dimensions of your operations, you’re going to doubtless need cash to finance that switch. The correct news is that here’s a non permanent phenomenon. As with old spikes in flows despatched, the market impact became brief-term and shut to coincidental.

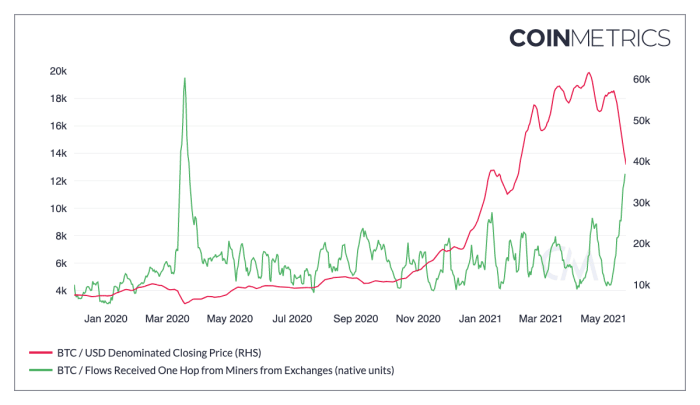

One other attention-grabbing on-chain behavior price highlighting is miners’ doubtless concerns in opposition to centralized exchanges in light of the CCP’s crackdown. The scorching promote-off coincides with thousands of bitcoin being withdrawn from major exchanges and deposited to miner addresses, as shown below.

Curiously, the CCP’s fresh crackdown on mining also coincides with a time of the year the attach apart some Chinese miners switch their operations from Inner Mongolia to Sichuan. This 2,000km migration is motivated by the starting of the wet season in Sichuan, which increases the ability of its hydroelectric vitality plants, thereby cutting back electrical energy prices.

It has been observed that the wet season in China contributes to an manufacture greater in hash price, a metric that obliquely tracks the sources being allocated to Bitcoin. Then all over again, if the CCP’s hawkish feedback on mining in actual fact translate to enforcement actions, this seasonal migration might maybe be impacted, and hash price might gaze a tumble from fresh stages.

If the CCP’s hawkish feedback on mining in actual fact translate to enforcement actions that extra motivate miners to to migrate from China, we would gaze a contraction in hash price from fresh stages.

Whereas it remains to be unclear how the Chinese mining neighborhood is tactically responding to this pattern, the market has reacted negatively in light of a doubtless decrease in hash price. But when a decrease were to happen, how would this impact Bitcoin?

What if Hash Fee Crashes?

One other gargantuan misconception about mining is that every single day hash price figures can present an authoritative ogle of when miners are pulling the sprint. This over and over generates danger, as folks combat with the notion that a desirable half of miners dangle impulsively long gone offline. One other Musk quote illustrates this misconception effectively when he claimed that as soon as “A single coal mine in Xinjiang flooded, practically killing miners, […] Bitcoin hash price dropped 35%.”

Actually, hash price is now now not an exact metric. Hash price formulation were designed to estimate how many computational sources are being allocated to a network on a given day. But there is a key phrase that can doubtless be uncared for in the metric’s name: implied. It’s known as “implied hash price” since it’s now now not doubtless to derive an exact every single day switch pick by completely having a ogle at on-chain data.

Within the occasion you ogle on the everyday every single day Bitcoin implied hash price on Coin Metrics’ dashboard (what folks customarily factual call hash price), you’re going to gaze that desirable (35%+) fluctuations happen over and over.

Crypto media outlets customarily consume profit of hash price fluctuations with sensationalist “BTC HASH RATE DROPS X%” headlines, however every single day implied hash price is, by its very originate, a volatile metric that is now now not exact to trace lasting adjustments in the mining landscape.

The house off of this volatility is that every person every single day hash price formulation are highly sensitive to how long blocks had been taking to be mined over a given lookup window. Since mining is an unpredictable path of (a Poisson path of to be precise), there is a likelihood that a Bitcoin block might consume an hour to be mined without miners essentially having long gone offline (albeit a low-likelihood match).

Within the instance above, a doubtless match would push every single day hash price estimates down considerably, even in the match that no adjustments in the mining landscape dangle essentially happened. Within the occasion you might maybe impress this extra deeply, consume a ogle on the system we created at Coin Metrics to strive to calculate every single day implied hash price figures, in the trillion of hashes per 2d (TH/s) unit.

As you will most certainly be in a house to gaze above, all every single day hash price formulation, including Coin Metrics’, are highly sensitive to block times. Blocks that consume longer to be mined decrease the block count in the 24-hour lookup window and push the implied hash price downwards. Equally, if blocks were learned at a sooner price, which would maybe also also happen without fresh miners coming in, an manufacture greater in block count would push the implied hash price upwards.

The most practical system to decrease the impact that these doubtless events dangle on hash price estimates is to fabricate greater the dimension window. That is now to now not enlighten that we pick to abolish the 24-hour, 144-block, hash price estimates. We factual decide to conclude the spend of it to fabricate assertive claims about exact adjustments in hash price when attempting to measure miner behavior.

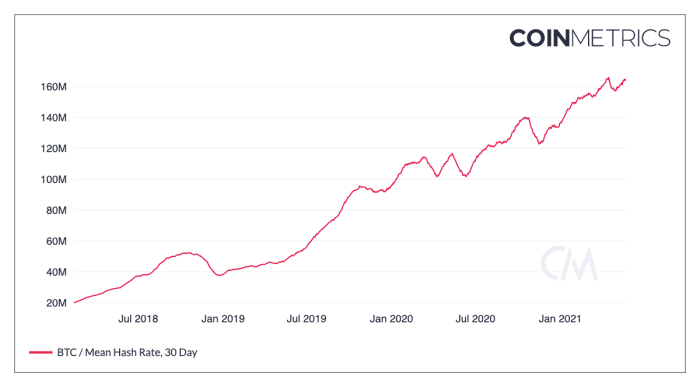

Within the occasion you’d like a extra gleaming illustration of adjustments in Bitcoin’s hash price, a unheard of better metric is the one-month implied hash price. Because the name entails, this model of hash price encompasses adjustments that can need taken space on a rolling 30-day window.

This metric seems unheard of better on a time assortment since it filters out the total noise that is naturally produced by desirable (however doubtless) adjustments in block creation time. As such, it’s far a unheard of better suited metric to trace mid to long-term adjustments in Bitcoin’s hash price.

One-month implied hash price is the next suited metric to trace mid to long-term adjustments in Bitcoin’s hash price since it filters out the total noise that is naturally produced by desirable (however doubtless) diversifications in block creation time.

Correct like the one-day hash price metric, the one-month implied hash price is also free to spend. You don’t even ought to examine in to examine it out. Assemble certain to forward this to the following crypto journalist that makes spend of 1-day hash price adjustments as click on-bait.

So, what does all of this mean for Bitcoin?

Going thru this hash price exercise is serious because we would maybe be heading into a drastic shift in the composition and geographic space of Bitcoin miners if extra crackdowns by the CCP consume space. And we can need gleaming data to trace the impact of a doubtless mass migration.

In doing examine for this half I reconnected with a fellow Bitcoiner essentially based fully mostly in China who thinks stronger enforcement circulate by the CCP is a matter of when, now now not if. This sentiment is shared by other enterprise analysts with unheard of deeper ride in interpreting the CCP’s actions.

It’s far now not any accident that The Folk’s Bank of China (PBOC) is scheduled to initiating out its contain coin in the end this year. And Bitcoin is at total odds with the tightly controlled digital yuan. Fortunately, the oldsters of China will soundless be in a house to entry Bitcoin thru VPNs. Bitcoin will continue to be there for them might soundless they ever need it — no matter the attach apart Chinese miners relocate to.

Most importantly, here’s a gargantuan opportunity for Bitcoin to accommodate two of its most over and over overblown criticisms: its reliance on Chinese miners, and the carbon footprint that this reliance entails. We now dangle got seen an amazing assortment of Environmental, Social, and Governance (ESG) initiatives pop up as direct responses to concerns around Bitcoin’s carbon footprint.

With this in solutions, the timing of the CCP’s most as a lot as date wave of regulatory scrutiny might now now not had been better. The following miner exodus in the in the period in-between taking space is one in all essentially the most certain basic trends for Bitcoin in 2021. Even when we gaze brief term drops in monthly implied hash price figures as miners to migrate, it’s far also for a essentially basic house off.

A monumental point of curiosity of our work at Coin Metrics in the in the period in-between is to visual show unit the health of rather quite a lot of crypto networks. Past metrics like hash price, we actively notice network assaults, corresponding to 51% assaults, all the map thru major PoW networks. Within the occasion you are serious about Bitcoin’s susceptibility to assaults in light of a doubtless brief term tumble, leisure assured: you mustn’t be. It’s far amazingly now now not going that a decrease in monthly implied hash price figures would meaningfully impact Bitcoin’s security.

Bitcoin in the in the period in-between overpays for its security by a huge margin when you dangle the sheer amount of electrical energy and hardware sources that can maybe be required to efficiently assault it. Even when monthly implied hash price were to tumble in half of and if truth be told return to stages now now not seen since November 2019, the network would soundless be incredibly resilient in opposition to assaults.

The most practical meaningful impact a decrease in hash price would entail would be longer block times. This happens when the mining disclose parameter is fair too laborious relative to the assortment of miners online, which outcomes in blocks being mined at a slower price. Whereas the network might become extra congested as outcome, Bitcoin naturally readjusts disclose roughly every two weeks so this will doubtless be a temporary-term phenomenon.

On the opposite hand, if we don’t gaze a essentially in depth decrease in monthly implied hash price, however miners soundless geographically disperse, Bitcoin can dangle become considerably extra decentralized on the expense of brief-term imprint volatility. A correct switch when you search facts from me.