Bitcoin has seen a pullback down to the $58,000 stage within the course of the past day. Here’s what frequently is the reason at the motivate of it, per on-chain records.

Exchanges Bear Considered A Enormous Amount Of Tether Withdrawals Now now not too long within the past

Per records from the market intelligence platform IntoTheBlock, centralized exchanges salvage just now not too long within the past seen a Tether (USDT) outflow spree exceeding $1 billion.

Investors in general preserve their cash in exchanges as soon as they have to replace them within the shut to future, so them making the gallop to withdraw their tokens doubtlessly implies that they’re attracted to keeping into the long-period of time.

For unstable sources love Bitcoin, replace outflows can naturally be a bullish set apart this is why. Within the context of the unique topic, although, the asset being withdrawn is a stablecoin, so the implication for the market is moderately a host of.

In general, patrons store their capital within the design of fiat-tied tokens love Tether as soon as they have to get away the volatility connected to cash love BTC. Such holders attain at closing thought to mission motivate into the quite loads of aspect of the market and additionally they will furthermore just employ exchanges for doing so.

When holders aquire into sources love Bitcoin utilizing their stablecoin, they naturally surrender up boosting their costs. As such, replace inflows of stables in general is a bullish set apart for the sector.

Withdrawals of USDT and others into self-custody as a replace, on the quite loads of hand, in general is a bearish set apart for the market, as it exhibits the patrons don’t imagine they would be making a swap into the unstable aspect within the shut to future.

The most fashionable Tether withdrawals would possibly maybe furthermore just, therefore, be why the Bitcoin designate has tumbled. This USDT exiting exchanges would possibly maybe furthermore even salvage represented recent BTC sells, as many patrons decide on to gallop into self-custody as quickly as they’ve swapped between sources.

As IntoTheBlock has identified within the chart, the closing two huge USDT replace outflows also had a bearish surrender on BTC.

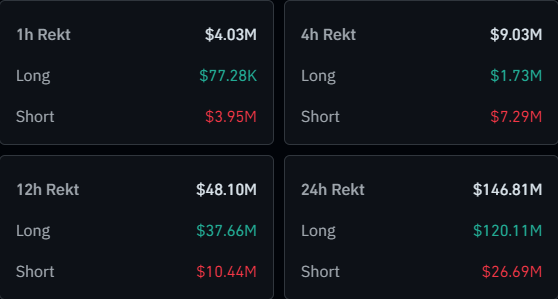

In one more files, the cryptocurrency derivatives market as a entire has seen a huge quantity of liquidations since the volatility that Bitcoin and other cash salvage displayed within the course of the past day.

Under is a table from CoinGlass that sums up the liquidations that salvage took place within the most fashionable unstable market section.

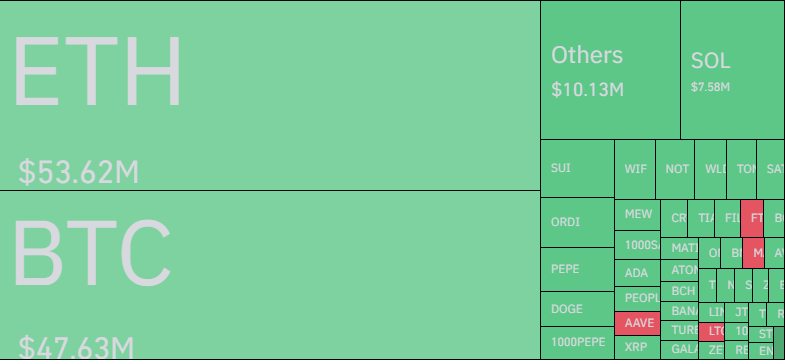

As is seen above, around $146 million in cryptocurrency liquidations salvage took place over the past day, with $120 million coming from the long contracts by myself, representing extra than 80% of the total.

Curiously, Ethereum (ETH) is the mark that has contributed the most in the direction of this derivatives flush and never Bitcoin love is in general the case. That mentioned, ETH has easiest $6 million extra liquidations than BTC.

BTC Designate

At the time of writing, Bitcoin is shopping and selling around $58,800, down 4% over the closing 24 hours.

Featured image from Dall-E, IntoTheBlock.com, chart from TradingView.com

Disclaimer: The records found on NewsBTC is for academic capabilities

easiest. It does now not characterize the opinions of NewsBTC on whether to aquire, sell or preserve any

investments and naturally investing carries dangers. You are urged to habits your maintain

analysis before making any funding decisions. Use records equipped on this web web site

fully at your maintain possibility.