Bitcoin prolonged losses to achieve ranges last seen in January 2021 on Wednesday amid a broader market promote-off.

The depend on-to-depend on digital currency struggled to preserve the $30,000 level all the best plan thru the day as U.S. inflation ranges had been reported above market expectations and a macroeconomic distress-off motion keeps gaining traction globally.

U.S. inflation reached 8.3% in the 12 months ending in April 2022, the U.S. Division of Labor Statistics reported Wednesday morning.

The market had pinned user prices index (CPI) expectations at 8.1% and the extra serious-than-anticipated results ensued a overwhelmingly crimson day for equity markets in the nation.

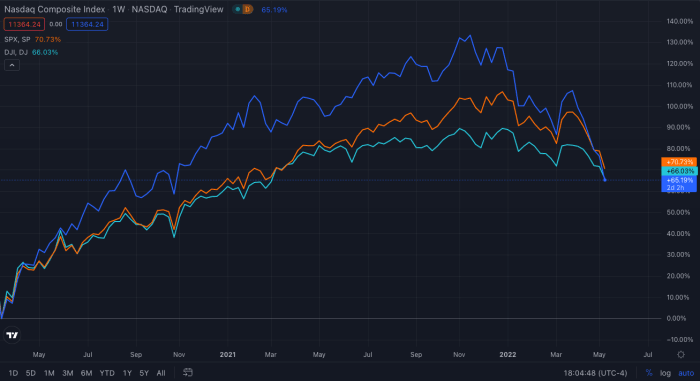

The Nasdaq dropped by extra than 3% on Wednesday to ranges now not seen since November 2020. The Dow Jones and the S&P 500 furthermore failed to damage out the carnage. The two indexes plunged to ranges every hadn’t revisited since March 2021. The Dow denoted a 1% loss whereas the S&P 500 slid by 1.65% as of late.

Markets have largely turned south ever since the U.S. Federal Reserve Board walked away from its overly accommodative insurance policies that started on the outset of the COVID-19 pandemic.

Turning on a extra hawkish tone, the Fed started diminishing its asset purchases just a few months previously, nonetheless it wasn’t till March that the central bank’s Federal Open Markets Committee (FOMC) raised charges for the main time in three years. The conservative 0.25% elevate would space a precedent for increased hikes to be aware.

Earlier this month, the FOMC launched that the Fed’s benchmark ardour rate would rise by 0.5% – double the construct higher of the old meeting. The committee’s hike in Would possibly well per chance per chance denoted the most interesting construct higher in ardour charges in over two a long time.

Furthermore, the FOMC launched it could per chance per chance begin up shrinking its steadiness sheet, meaning it could per chance per chance now not be a holder of assets like bonds and mortgages, utilizing bond yields and mortgage charges up and inserting extra stress on equities.

Bitcoin’s correlation with equity markets could even be partly explained by the larger involvement of real traders and institutions, which can per chance per chance well be sensitive to the provision of capital and therefore ardour charges, Morgan Stanley reportedly acknowledged.

To boot to a hawkish U.S. central bank, global factors just like the Russian battle in Ukraine and China’s ongoing lockdowns have wired provide chains worldwide, extra pressuring markets all the best plan down to erase phase of the positive aspects made since behind 2020 – Bitcoin included.