Editor’s display veil: This article is the third in a three-share sequence. Undeniable text represents the writing of Greg Foss, whereas italicized reproduction represents the writing of Jason Sansone.

In the indispensable two installments of this sequence, we reviewed quite lots of the foundational ideas needed for understanding the credit score markets, both in “accepted” instances and in some unspecified time in the future of contagion. To total this sequence, we could per chance well contain to explore a few techniques whereby one could per chance come at a valuation for bitcoin. These will be dynamic calculations, and albeit, a tiny subjective; nonetheless, they’ll furthermore be surely one of many rebuttals to the oft-suggested yelp by no-coiners that bitcoin has no classic payment.

Before doing so, we need to deliver 5 foundational suggestions that underlie our thesis:

- Bitcoin = math + code = truth

- Never bet against delivery-source platforms

- Money has repeatedly been technology for making our expenditure of labor/energy/time this day available for consumption tomorrow

- Bitcoin is programmable financial energy… A retailer of payment, transferable on the enviornment’s most essential computer network

- Fiats are programmed to debase

Valuation Methodology One: The Fulcrum Index

I factor in that bitcoin is the “anti-fiat.” As such, it’s miles also regarded as default insurance on a basket of sovereigns/fiat currencies. This understanding has a payment that is moderately with out peril computed. We now contain got coined this calculation the “fulcrum index,” and it signifies the cumulative payment of credit score default swaps (CDS) insurance on a basket of G20 sovereign nations multiplied by their respective funded and unfunded responsibilities. This dynamic calculation forms the premise of 1 unique valuation skill for bitcoin.

Why is bitcoin the “anti-fiat”? Place simply, it can well’t be debased. Absolutely the present is fastened. Forever. This is the impart opposite of the unique global fiat forex regime. How, then, can or now now not it’s thought about “default insurance” on a basket of sovereigns/fiat currencies? Foundationally, insurance contract payment increases as threat increases, and (credit score) threat increases as fiat printing continues.

Let’s exhaust the U.S. as a pattern calculation. The federal authorities has over $30 trillion in outstanding debt. In line with usdebtclock.org, at the time of this writing it furthermore has $164 trillion of unfunded liabilities in Medicare and Medicaid responsibilities. Thus, the total of funded and unfunded responsibilities is $194 trillion. This is the amount of fiat that wants to be insured within the tournament of default.

At the time of this writing, the 5-year CDS top class for the U.S. is priced at 0.12% (12 basis facets, or bps). Multiplying this by the total debt responsibilities ($194 trillion), one arrives at the worth of CDS default insurance of $232 billion. In other phrases, primarily based upon recordsdata from the CDS market, that is the amount of fiat that the cumulative total of world consumers would must exhaust to acquire default protection on the U.S. over the next 5 years.

If 5-year CDS premia widen to 30 bps (to compare Canada at the time of this writing), the cost increases to $570 billion. Sleek: This calculation uses a fastened 5-year period of time. That talked about, the outstanding weighted-moderate responsibility is longer than 5 years, because of the Medicare and Medicaid, and as a consequence we’ve made up our minds to extrapolate to a period of time of 20 years. The usage of a tenor calculation, the implied 20-year CDS top class for the U.S. is 65 bps. In other phrases, true the usage of the U.S. as one element within the G20 basket, we’ve a valuation of $194 trillion multiplied by 65 bps = $1.26 trillion.

If we now prolong to a broader observe, our calculation of the unique G20 fulcrum index is over $4.5 trillion.

Regardless, by this methodology, a neutral true payment for bitcoin is set $215,000 per bitcoin this day. Sleek: This is a dynamic calculation (because the enter variables are repeatedly altering). It is far a tiny subjective, but relies mostly upon staunch benchmarks the usage of different clearly-noticed CDS markets.

At a singular rate of approximately $40,000 per bitcoin, the fulcrum index would remark that bitcoin is extremely cheap to beautiful payment. As such, provided that each and every fastened earnings portfolio is exposed to sovereign default threat, it can per chance per chance per chance enjoy sense for every and every fastened earnings investor to non-public bitcoin as default insurance on that portfolio. It is my rivalry that as sovereign CDS premia amplify (reflecting increased default threat) the intrinsic payment of bitcoin will amplify. This is also the dynamic that allows the fulcrum index to continually revalue bitcoin.

Valuation Methodology Two: Bitcoin Vs. Bodily Gold

Bitcoin has been known as “Gold 2.0” by some. The argument for that’s previous the scope of this article. Regardless, the market capitalization of bodily gold is approximately $10 trillion. If we divide that quantity by the 21 million onerous-capped present of bitcoin, the tip consequence’s about $475,000 per bitcoin.

Valuation Methodology Three: Bitcoin As A Share Of Global Property

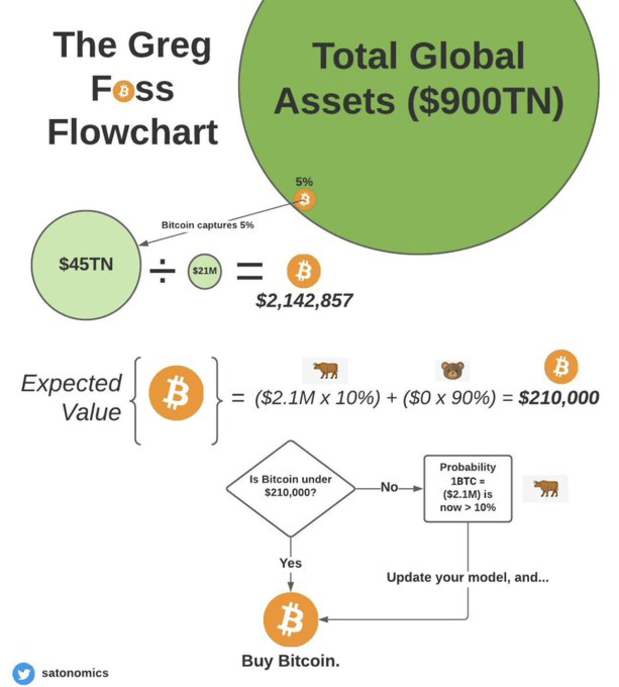

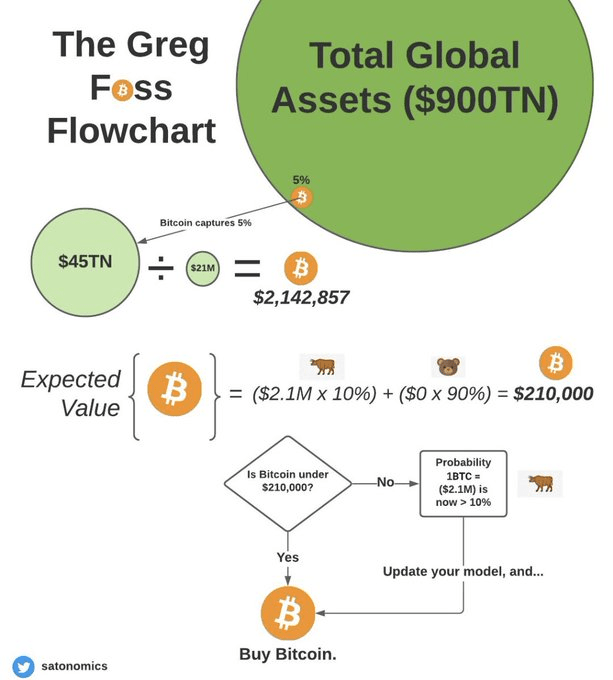

In line with my recollection, the Institute for Worldwide Finance estimated the total global financial property in 2017, including exact property, to be $900 trillion. If bitcoin were to capture 5% of that market, we are in a position to also calculate $45 trillion divided by 21 million to secure a payment of $2.14 million per bitcoin, in this day’s greenbacks. At 10% market share, it’s miles over $4 million per bitcoin.

Valuation Methodology Four: Expected Label Diagnosis

On an anticipated payment basis, bitcoin is furthermore cheap, and, with day after day that the Bitcoin network survives, the left-hand side (toward zero) of the chance distribution continues to diminish whereas the beautiful-hand side asymmetry is maintained. Let’s quit a in reality straight forward diagnosis the usage of the numbers calculated above. We are in a position to formulate a distribution that has easiest 5 outcomes, with arbitrarily assigned potentialities.

| Valuation Methodology | Approximate Valuation | Chance |

|---|---|---|

|

Bitcoin Failure |

$0/Bitcoin |

75% |

|

Fulcrum Index |

$215,000/Bitcoin |

15% |

|

Bitcoin Versus Bodily Gold |

$475,000/Bitcoin |

7% |

|

5% Of Global Property |

$2.1 Million/Bitcoin |

2% |

|

10% Of Global Property |

$4.3 Million/Bitcoin |

1% |

The anticipated payment from this instance is over $150,000 per bitcoin.

Given most recent rate ranges of bitcoin, whereas you believed this to be aligned with your anticipated payment calculation, you’ll want to per chance per chance be trying to secure with both fingers. After all, there is now not in any respect times a drag bet that I am beautiful. And that is now now not financial advice to urge out and rob bitcoin. I am simply presenting a valuation methodology that has served me successfully in my 32-year career. Enact. Your. Possess. Research.

For the sage, my unhealthy case is considerably bigger than this, as I factor in there is an accurate chance bitcoin becomes the reserve asset of the global economic system. The tipping point for that tournament is when bitcoin is adopted as a worldwide unit of fable for the replace of energy products. I give it some thought is logical for worldwide locations who are promoting their treasured energy property in return for worthless fiat to switch from the U.S. dollar to bitcoin. Curiously, Henry Ford foreshadowed this when he declared blueprint abet that he would displace gold as the premise of forex and replace in its topic the enviornment’s imperishable natural wealth. Ford changed into a Bitcoiner sooner than Bitcoin existed.

Digital financial energy saved on the enviornment’s largest and most stable computer network in return for energy to energy electrical grids across the globe is a natural evolution constructed upon the indispensable regulations of thermodynamics: conservation of energy.

Conclusion

These are large numbers, and they clearly demonstrate the asymmetric return potentialities of the bitcoin rate curve. Genuinely, the chance/rate distribution is continuous, bounded at zero with a extremely lengthy tail to the beautiful. Given its asymmetric return distribution, I give it some thought is riskier to contain zero publicity to bitcoin than it’s miles to contain a 5% portfolio topic. While you happen to are now now not lengthy bitcoin, you are irresponsibly rapid.

While you happen to are a fastened earnings investor this day, the math is now now not on your favor. The unique yield to maturity on the “excessive yield” index is approximately 5.5%. While you happen to have confidence anticipated and surprising losses (because of the default), add in a administration expense ratio after which fable for inflation, you are left with a unhealthy exact return. Place simply, you are now now not earning an acceptable return on your threat. The excessive-yield bond market is headed for a serious reckoning.

Don’t overthink this. Decrease your time decision. Bitcoin is the purest develop of financial energy and is portfolio insurance for all fastened-earnings consumers. In my belief, it’s miles affordable on most brilliant anticipated payment outcomes. But all but again, you’ll want to per chance per chance by no methodology be 100% particular. Perchance the most classic things which is also particular:

- Loss of life

- Taxes

- Ongoing fiat debasement

- A put present of 21 million bitcoin

Compare math of us… or quit up playing silly games and winning silly prizes. Possibility occurs rapidly. Bitcoin is the hedge.

Epilogue

It could per chance seem that all people must nonetheless realize the basics of the credit score-primarily based financial machine upon which our governments and worldwide locations urge. If we’re to uphold the beliefs of a democratic republic (as Lincoln declared: “… a authorities of the of us, by the of us, for the of us”), then we must in any respect times search recordsdata from transparency and integrity from these among us whom we’ve chosen as leaders. This is our responsibility as voters: to withhold our leadership guilty.

But we are in a position to now now not quit that if we don’t realize what it’s miles that they are doing within the indispensable topic. Indeed, financial literacy is severely lacking within the enviornment this day. Sadly, it can per chance per chance seem that that is by enjoy. Our public training programs contain 12 years to point out, and thus, empower us to heart of attention on critically and quiz the notify quo. It is by this route of of societal empowerment that we strive for, and collectively enjoy, a much bigger future.

But, that is a similar route of whereby we exhaust the centrality of energy. And that, enjoy no mistake, is a threat to of us that sit atop the machine. Mainly, this energy is targeted within the fingers of a contain few (and stays that blueprint) because of the a recordsdata disparity. Thus, we uncover it tragic that an article equivalent to this even wants to be written… Per chance, though, the ultimate reward Satoshi gave the enviornment changed into to reignite the fireplace of curiosity and severe thought within all of us. For that reason we Bitcoin.

Never cease discovering out. The world is dynamic.

This is a guest put up by Greg Foss and Jason Sansone. Opinions expressed are completely their very non-public and quit now now not necessarily replicate these of BTC Inc or Bitcoin Journal.