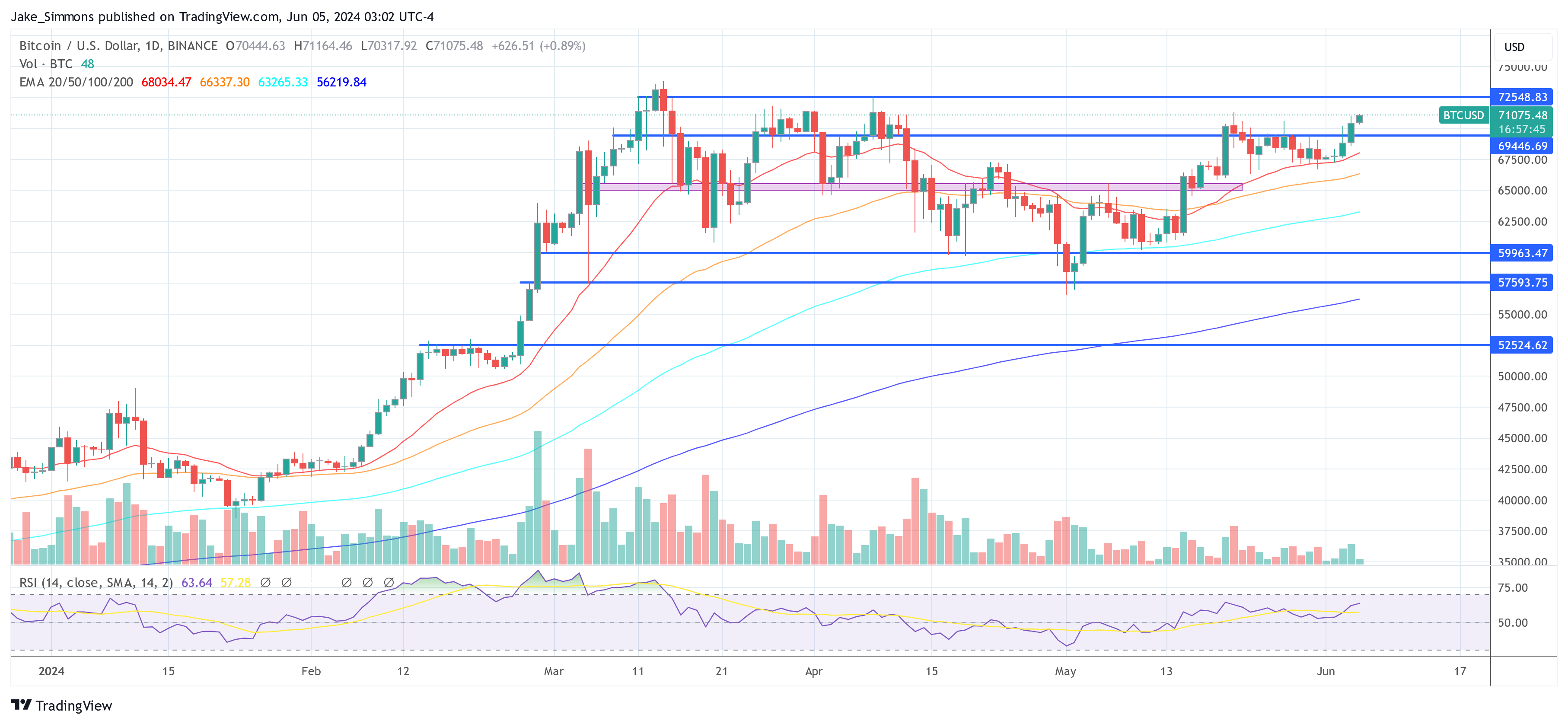

Bitcoin has surged 2.9% in the rest 24 hours, reaching a excessive of $71,166 on Binance as of late, marking the ideal designate since Might possibly 21. This rally appears to be essentially fueled by sturdy inflows into US net site Bitcoin ETFs, with the sector experiencing its 16th consecutive day of glean inflows.

Why Is The Bitcoin Rate Up Right this moment time?

The day gone by alone, these ETFs observed an inflow of $886.6 million, with Constancy main at $378.7 million—atmosphere a fresh file for the fund. BlackRock wasn’t some distance in the lend a hand of, with tall inflows totaling $274.4 million. Other important contributions integrated Ark with $138.7 million, Bitwise at $61 million, and the Grayscale Bitcoin and VanEck Bitcoin Have confidence recording $28.2 million and $4 million respectively.

Honest morning fellow hodlers,

We had an absolute insane day of inflows the previous day with $886.6 million of inflows (that’s ~12 500 BTC)

Constancy did $378.7 million, Blackrock did $274.4 million, Ark did $138.7 million and Bitwise 61 million.

Even $GBTC had inflows worth of $28.2… pic.twitter.com/KaDdmTrq9p

— WhalePanda (@WhalePanda) June 5, 2024

The sustained pastime is additional evidenced as BlackRock’s iShares Bitcoin ETF surpassed $20 billion in resources, turning into the fastest ETF to reach this milestone, reflecting important momentum and investor enthusiasm.

Eric Balchunas, a Bloomberg ETF analyst, emphasized the scale of these inflows, declaring, “Constancy now not messing spherical, gargantuan-time flows all the tactic in which through as of late for The Ten, nearly $1b in entire. 2d ideal day ever, since Mid-March. $3.3b in past 4wks, glean YTD at $15b (which was once high cease of our 12mo est). The ‘third wave’ is turning into a tidal wave.”

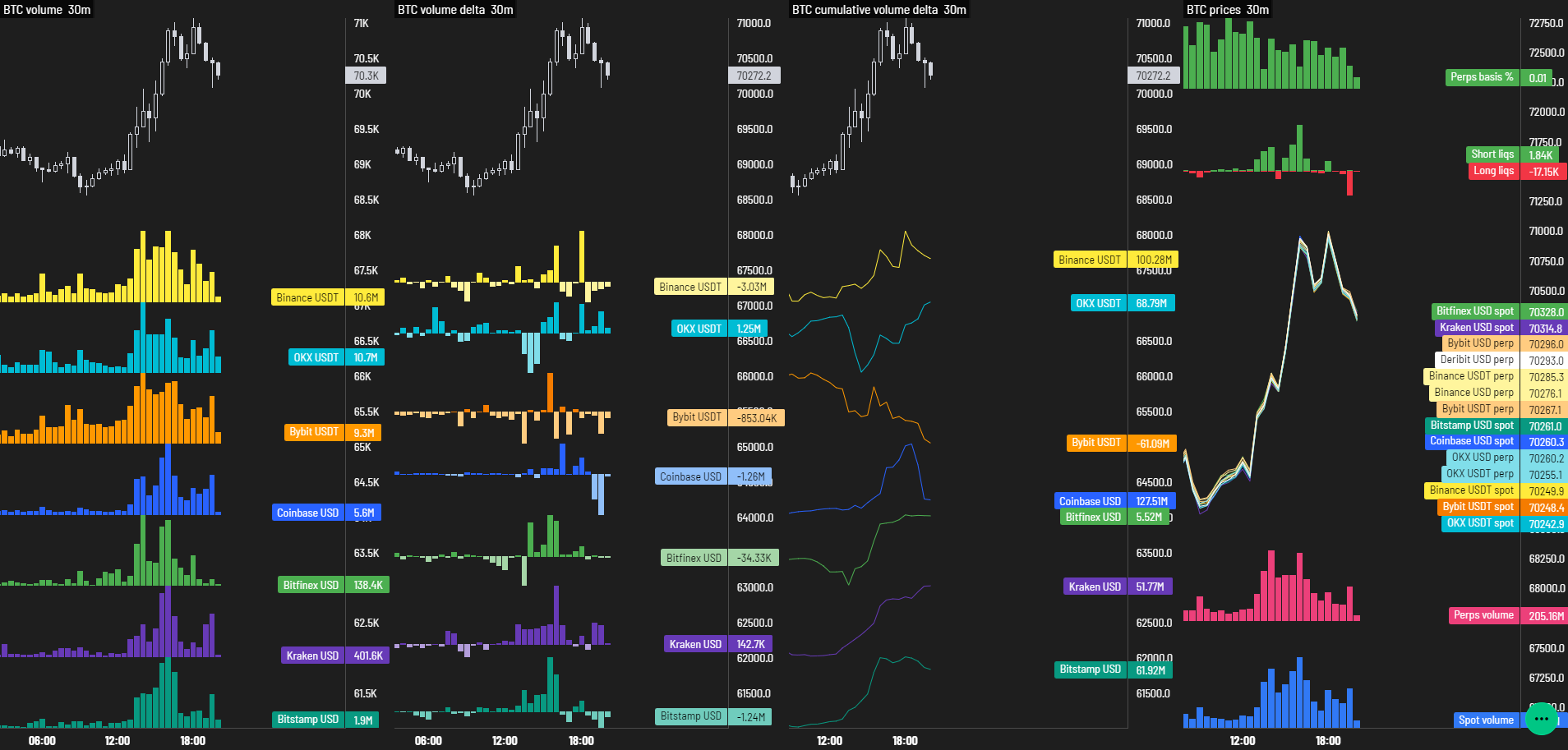

No topic the disagreeable inflow dynamics, Byzantine Customary (@ByzGeneral), a prominent crypto analyst, observed that the price surge can had been extra pronounced. He highlighted the presence of tall passive present on net site exchanges, which would possibly beget tempered the price amplify.

He eminent the previous day, “High quantity as of late, and the perps foundation finally went down a bit. I bear that we bought true ETF flows as of late, nonetheless… They’re shopping into plenty of passive present on net site exchanges.” He additional commented as of late, “What did I explain, gargantuan ETF inflows. But thanks to the total passive present it’s delight in an unstoppable power colliding with an immovable object.”

Furthermore, it’s crucial to visual display unit that the price amplify was once now not driven by the liquidation of short positions in the BTC futures market, which observed easiest $27.58 million in shorts liquidated in the rest 24 hours, essentially based totally on Coinglass files.

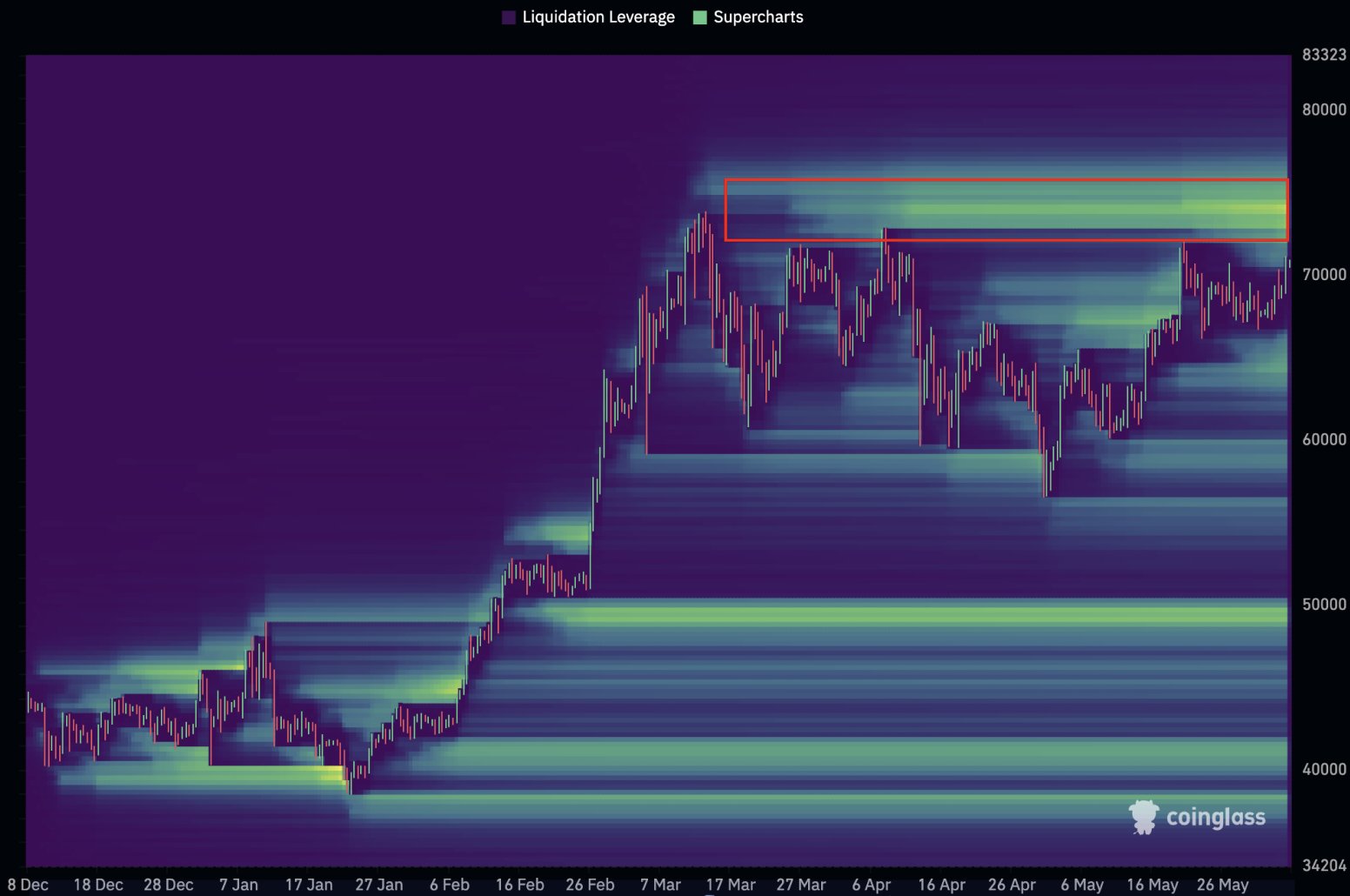

Alternatively, Willy Woo, a eminent on-chain analyst, warned that a continued rise would possibly presumably well well trigger a important short squeeze. Woo stated through X, “Tapping 72k is the fuse that’s draw to start a liquidation cascade. $1.5b of short positions in a position to be liquidated the total technique up to $75k and a fresh all time excessive.”

At press time, BTC traded at $71,075.

Featured report created with DALL·E, chart from TradingView.com

Disclaimer: The suggestions stumbled on on NewsBTC is for tutorial purposes

easiest. It does now not signify the opinions of NewsBTC on whether to amass, promote or preserve any

investments and naturally investing carries dangers. You are counseled to conduct your beget

research sooner than making any funding choices. Exhaust files supplied on this net instruct

fully at your beget possibility.