With out reference to the outflows, Bitcoin’s trace has surged 16% this past week to interrupt above $46,000

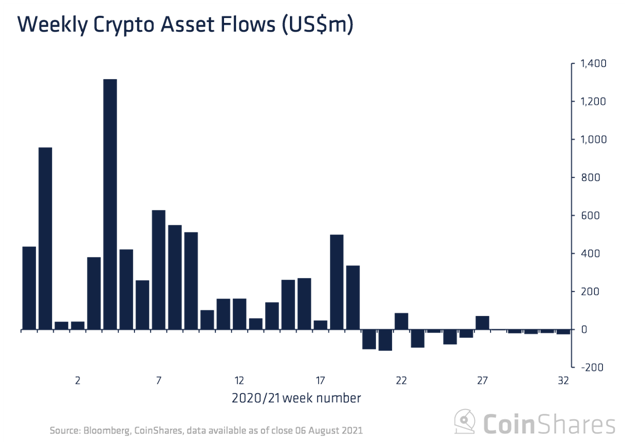

Crypto funding merchandise registered a fifth straight week of outflows for the week ending 6 August.

In step with files from CoinShares, weekly outflows from Bitcoin funding merchandise hit $33 million, up from $19.7 million registered over the old week.

The total digital asset funding product outflow for the week stood at about $26 million. Nonetheless, general withdrawals are vastly decrease compared with those recorded in Would maybe perchance well also and June, CoinShares added in the document.

Particularly, too, Bitcoin’s inflows are peaceable a wholesome $4.2 billion twelve months so a ways and total crypto funding belongings below administration (AUM) like increased to $50 billion.

Graph showing crypto outflows. Offer: CoinShares

Outflows in Bitcoin funds continued no topic the cease coin’s trace gaining at some level of the week, with CoinGecko files showing BTC is up about 16% in the past seven days.

Bitcoin trace is shopping and selling larger on the day, up by about 4.8% as consumers strive to rally to $46,000. At time of writing, the benchmark cryptocurrency is altering hands at round $45,878, which places BTC up 36% in opposition to the US greenback in the past 30 days.

With possible beneficial properties in the offing over the following couple of days, BTC trace will most likely test and even surpass its 11-week high of $46,433.43 reached on Monday 9 August.

Ethereum and other belongings map minor inflows

In contrast to Bitcoin, Ethereum and other digital asset funding merchandise recorded exiguous inflows. Ethereum inflows were $2.8 million, amid increased passion in the lead-up to the London toughen.

“Ethereum market share is again fast rising and now represents 26% of funding merchandise, compared to lawful 11% at the starting of 2021,” CoinShares’ James Butterfill wrote in the document.

The second-biggest cryptocurrency’s trace has soared larger than 20% over the last week, reaching a 7-day high of $3,181.83.

Meanwhile, Ripple (XRP) added $1.1 million as the value jumped 10% and Bitcoin Money inflows grew by $1.0 million in a week; its trace increased practically 8%.

Cardano also saw some institutional capital inflow, adding $800,000 as ADA trace jumped above $1.48 with over 12% weekly beneficial properties.