Bitcoin has made a restoration lend a hand in direction of the $61,000 level all the scheme in which by yesterday. Here are the factors that will most probably be within the lend a hand of this surge.

Bitcoin Has Made Some Recovery All the scheme in which by The Last 24 Hours

After exhibiting lackluster label action below $60,000 all the scheme in which by the previous few days, Bitcoin has at closing shown some momentum within the closing 24 hours, with its label surging by greater than 4%.

The chart under reveals how the cryptocurrency’s fresh trajectory has gave the influence of.

At the high of this rally, BTC had damaged above $61,400, but the asset has since seen a pullback. On the replacement hand, even after the drawdown, BTC is aloof trading around $60,800, which is a necessary development over the day prior to this.

As for what is going to most probably be within the lend a hand of this surge, per chance on-chain recordsdata can provide some hints.

BTC Has Viewed A few Distinct On-Chain Dispositions Only within the near previous

There are a few traits that personal took place within the cryptocurrency blueprint currently that will most probably be obvious for Bitcoin. First, in step with recordsdata from the on-chain analytics agency Santiment, BTC patrons carrying between 100 and 1,000 BTC personal made a worthy shopping for push all the scheme in which by the closing six weeks.

At the time Santiment had shared the chart (which modified into the day prior to this), the Bitcoin patrons with 100 to 1,000 BTC had held a mixed 3.97 million tokens. Out of this, 94,700 coins had been bought by them within the previous six weeks.

The cohort with wallets on this differ is popularly identified because the “sharks.” Along with the whales, the sharks are even handed the principle patrons within the market, due to the worthy scale of coins that they agree with.

Thus, the indisputable truth that these good patrons had been gathering while BTC had been struggling earlier reveals that extensive money modified into confident that the cryptocurrency would flip itself around.

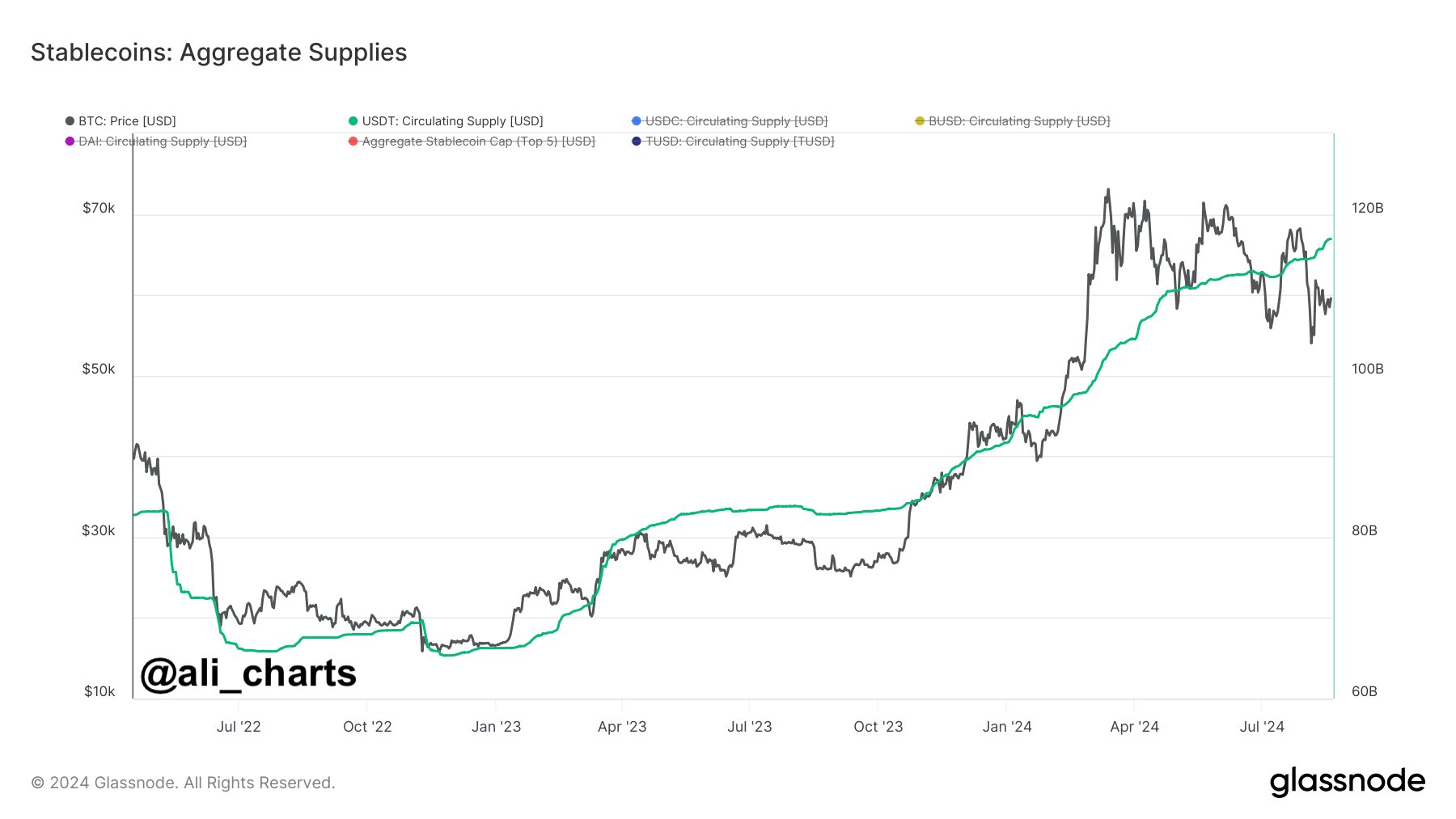

The opposite obvious pattern has been the uptrend that the provision of Tether (USDT) has been exhibiting currently, as analyst Ali Martinez has pointed out in an X put up.

Traders in most cases utilize stablecoins like Tether at any time when they wish to get away the volatility linked to sources like Bitcoin. Such patrons who retailer their capital like this, alternatively, sooner or later idea to challenge lend a hand into the dangerous coins, so the provision of the stablecoins may possibly act as a retailer of dry powder on hand for deploying into BTC and others.

Naturally, when patrons assemble swap their stables for these sources, their prices look a bullish boost. With Tether’s supply having seen a pointy jump currently, the patrons’ potential shopping energy will most probably be even handed to personal long gone up.

This can personal took establish apart by two processes: a rotation of capital from Bitcoin and other cryptocurrencies, and fresh capital inflows. The outmoded would suggest patrons personal sold their dangerous coins for now, but as talked about ahead of, these patrons may possibly aquire lend a hand into the market in due route.

The latter will most probably be fully bullish, because it may per chance possibly mean there is fresh interest getting into into the blueprint. If truth be told, each and each of these doubtless took place to some stage and as Bitcoin has managed to win a rebound, it’s probably sleek capital inflows personal made up for more of the amplify.

Featured image from Dall-E, Glassnode.com, Santiment.rep, chart from TradingView.com

Disclaimer: The facts found on NewsBTC is for academic purposes

only. It does now not signify the opinions of NewsBTC on whether to aquire, sell or protect any

investments and naturally investing carries risks. You may possibly possibly be told to behavior your personal

study ahead of making any funding selections. Use recordsdata equipped on this online online page

fully at your personal risk.