Records from several on-chain indicators suggests examine from retail patrons has at final returned following the most recent Bitcoin rally.

Bitcoin Retail Passion Has Returned In Explosive Vogue

Bitcoin has witnessed a gigantic surge just now no longer too prolonged within the past and has come nearer to the $100,000 dream target than many had expected. Investor curiosity within the asset had cooled off within the future of the cryptocurrency’s never-ending consolidation, but with a rally take care of this, it has naturally made a return.

Within the context of the unusual dialogue, the investor focus segment is retail, which contains the smallest of the holders. The first metric that might per chance presumably hint at a return of these patrons within the market is the Unique Addresses, which keeps track of the entire amount of BTC addresses coming online for the main time.

As the market intelligence platform IntoTheBlock has pointed out in an X put up, the Bitcoin Unique Addresses bask in witnessed a pointy prolong just now no longer too prolonged within the past, suggesting a clean amount of tackle advent.

The Unique Addresses can register an uptick when unusual patrons be a part of the network or when worn ones who had equipped earlier come help to the asset. The metric also goes up when original customers develop multiple wallets for privacy.

On the other hand, when a surge occurs at a scale take care of the unusual one, the extinct is more susceptible to be the motive. Thus, the most recent development within the indicator might per chance presumably per chance presumably imply a excessive amount of unusual adoption for the cryptocurrency.

As is considered within the above graph, the Bitcoin Unique Addresses just now no longer too prolonged within the past hit a excessive of 442,000, the perfect day-to-day designate since March of this twelve months. Expansive patrons are also likely becoming a member of the network upright now, but their number absolutely wouldn’t be too excessive, so this adoption must come from retail patrons.

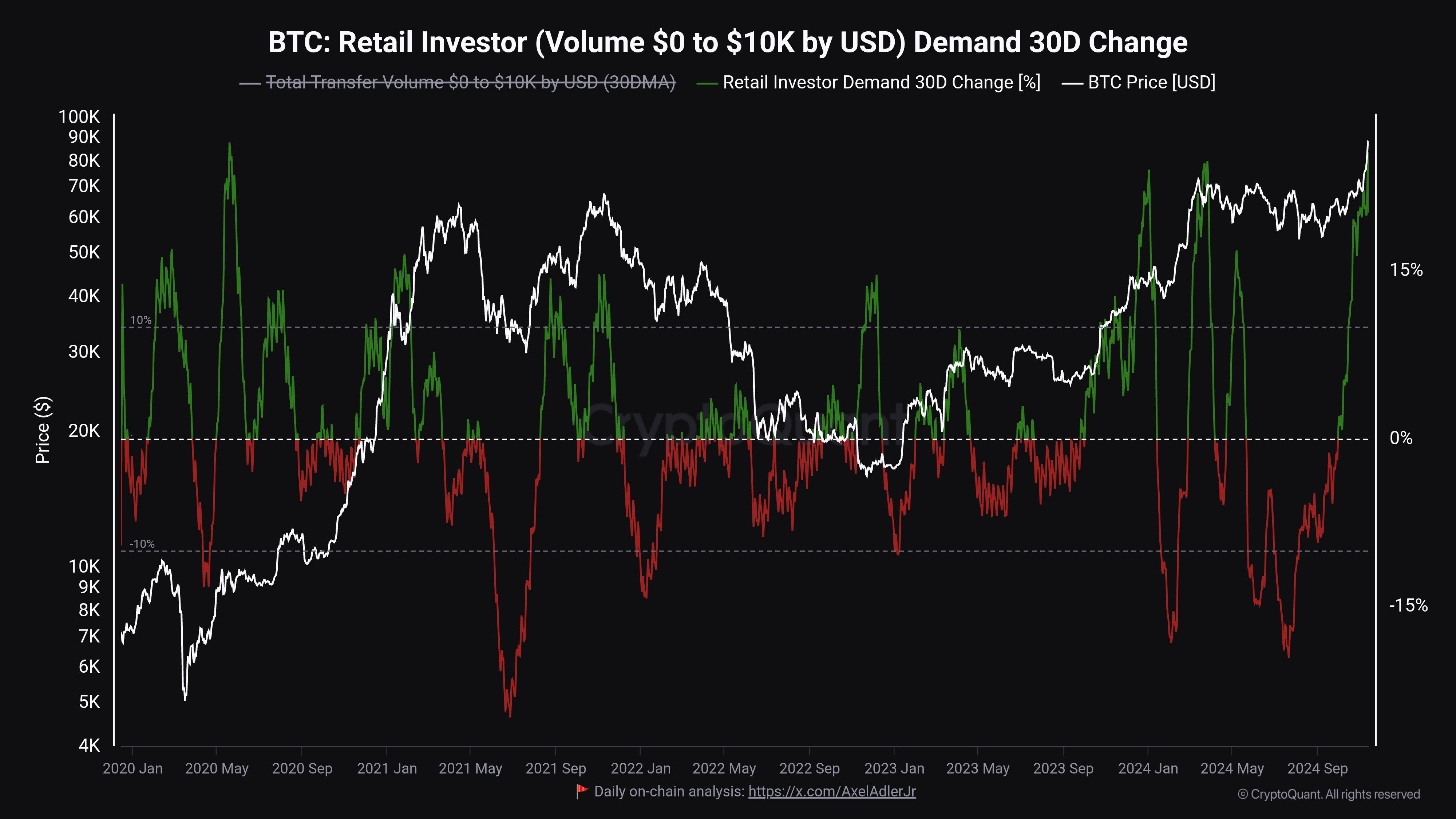

One more indicator, the Retail Investor Set a question to 30D Exchange, presents us with files relating to the process of original and newcomer retail patrons upright now. As CryptoQuant community analyst Maartunn has explained in an X put up, this indicator has also just now no longer too prolonged within the past shot up.

This metric tracks retail investor examine through transaction volume. For the reason that members of this cohort elevate steadiness amounts that aren’t too important, their transfers are susceptible to involve little values as well. As such, their volume might per chance presumably per chance presumably also be measured by only inviting files of the transfers valued at decrease than $10,000.

From the chart, it’s obvious that the 30-day commerce within the volume of retail patrons has just now no longer too prolonged within the past considered a clean definite spike to ranges now no longer considered in more than four years.

“It’s now no longer likely to brush aside that retail trading is fully help, with Dogecoin surging, excessive funding rates, and a spike in Google searches for Bitcoin,” notes the analyst.

BTC Build

Bitcoin has considered a little a setback within the past day as its designate has now dropped to the $88,300 stage.

Featured image from Dall-E, IntoTheBlock.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The files found on NewsBTC is for instructional functions

only. It does now no longer list the opinions of NewsBTC on whether or now to no longer rep, sell or preserve any

investments and naturally investing carries dangers. You are suggested to habits your maintain

learn sooner than making any investment decisions. Expend files equipped on this internet situation

fully at your maintain risk.